As a seasoned researcher with over a decade of experience in financial markets and digital currencies, I have witnessed firsthand the rollercoaster ride that Bitcoin represents. Having closely observed the crypto landscape since its inception, I have come to appreciate both the exhilarating highs and nerve-wracking lows of this revolutionary asset class.

The price of Bitcoin recently hit an unprecedented peak at $90,243, thanks to a continuous surge in value over the past week. After several days filled with excitement and rapid increases, the market is now experiencing a period of stabilization, allowing for a well-timed pause.

As a crypto investor, I’ve been keeping an eye on the trends, and recent insights from CryptoQuant suggest that there could be a buildup of selling pressure. This might indicate a temporary dip or a period of stabilization, possibly pushing the price below the $90,000 level. It’s important to stay informed and adapt my investment strategy accordingly.

As an analyst, I find this week to be crucial in predicting Bitcoin’s future trajectory. The focus lies on whether Bitcoin can sustain its position near the $90,000 resistance level or if it will pull back to retest support around $80,000. Given the robust market fundamentals and sustained bullish sentiment among investors, there’s a significant possibility that we might witness another rally.

Instead of a brief consolidation period potentially providing a more robust foundation for Bitcoin’s long-term growth, the focus lies on whether Bitcoin can maintain its present height or if this temporary reduction in activity will provide an opportunity for buyers to rejoin at lower demand points, paving the way for the next significant price shift.

Bitcoin Selling Pressure Still Far From Peak Levels

The price of Bitcoin has hit a new peak, which could mean a short break in its current price increase. Experts and investors are keeping an eye on it because Bitcoin tends to make big moves once it starts rising. However, even with this upward trend, many people are being careful, thinking that Bitcoin may need some time to stabilize before going up further.

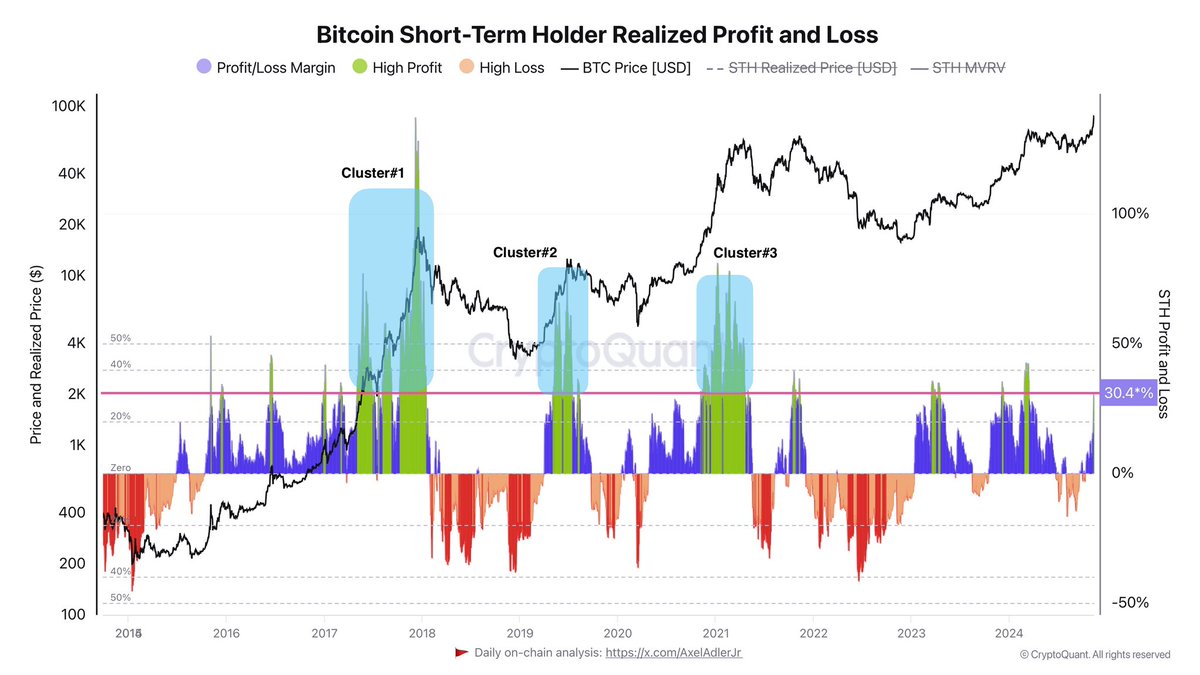

Based on my analysis as an analyst looking at CryptoQuant’s key data, I’ve noticed a period of moderate selling activity in the market right now. This could indicate a potential consolidation phase, as short-term investors seem to be cashing out their profits. By scrutinizing the short-term holder realized profit and loss figures, it appears that the current selling pressure is relatively subdued compared to past peak selling instances.

According to Adler’s perspective, the moderate level of pressure indicates that Bitcoin’s recent surge might not be coming to an end soon. He points out notable spikes of heavy selling in past highs, which he labels as Clusters #1, #2, and #3 on his graph, demonstrating a much higher degree of selling pressure compared to the current situation. This suggests that although some investors are cashing out, it’s not nearly at the intense levels observed during previous market peaks.

As Bitcoin moves towards stabilization, a reduced selling activity might pave the way for a steadier surge. Investors are carefully watching this phase to determine if Bitcoin will regain momentum for its next rise or if it will persist in cooling down, creating a strong foundation around its current price point before another possible upswing.

BTC Testing New Supply Levels (Again)

Bitcoin has now moved into an eagerly awaited stage of price determination, reaching a brand-new record high of $90,243 before. At present, it’s being traded near $87,500, having undergone several days with significant buying activity and unprecedented peaks. Yet, the market might experience a spell of consolidation below the $90,000 ceiling as traders evaluate fresh demand zones, possibly around the $80,000 mark.

The upcoming days will be crucial in deciding Bitcoin’s short-term direction. If Bitcoin manages to maintain its value above $85,000, this would demonstrate strength and probably stimulate an increase toward higher supply areas as bullish sentiment intensifies. Conversely, if Bitcoin falls below this level, it may experience a pullback towards the demand zone of around $82,000, providing a more solid base before another attempt at a rally.

Experts see this period of consolidation as important following Bitcoin’s rapid rise, as it gives the market an opportunity to set up reliable support levels. Maintaining within the current range indicates resilience, implying that Bitcoin is poised for additional growth. Investors are now keeping a close eye, trying to determine if Bitcoin will retain its recent gains or need a temporary adjustment before pushing towards new records.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-11-13 21:40