As a seasoned researcher with years of experience in the cryptocurrency market, I have seen Bitcoin’s volatile nature firsthand. While it is heartening to see the world’s most valuable coin steady at $63,500 and up 30% from August lows, the current situation warrants caution.

At the moment, Bitcoin is holding strong with its value exceeding $63,500. As per CoinMarketCap’s records, this leading cryptocurrency has been traded above that figure for the day, maintaining its position from yesterday and experiencing a notable 7% increase over the past trading week. From a technical standpoint, the upward trend continues if prices stay above support levels around $58,000 and $60,000.

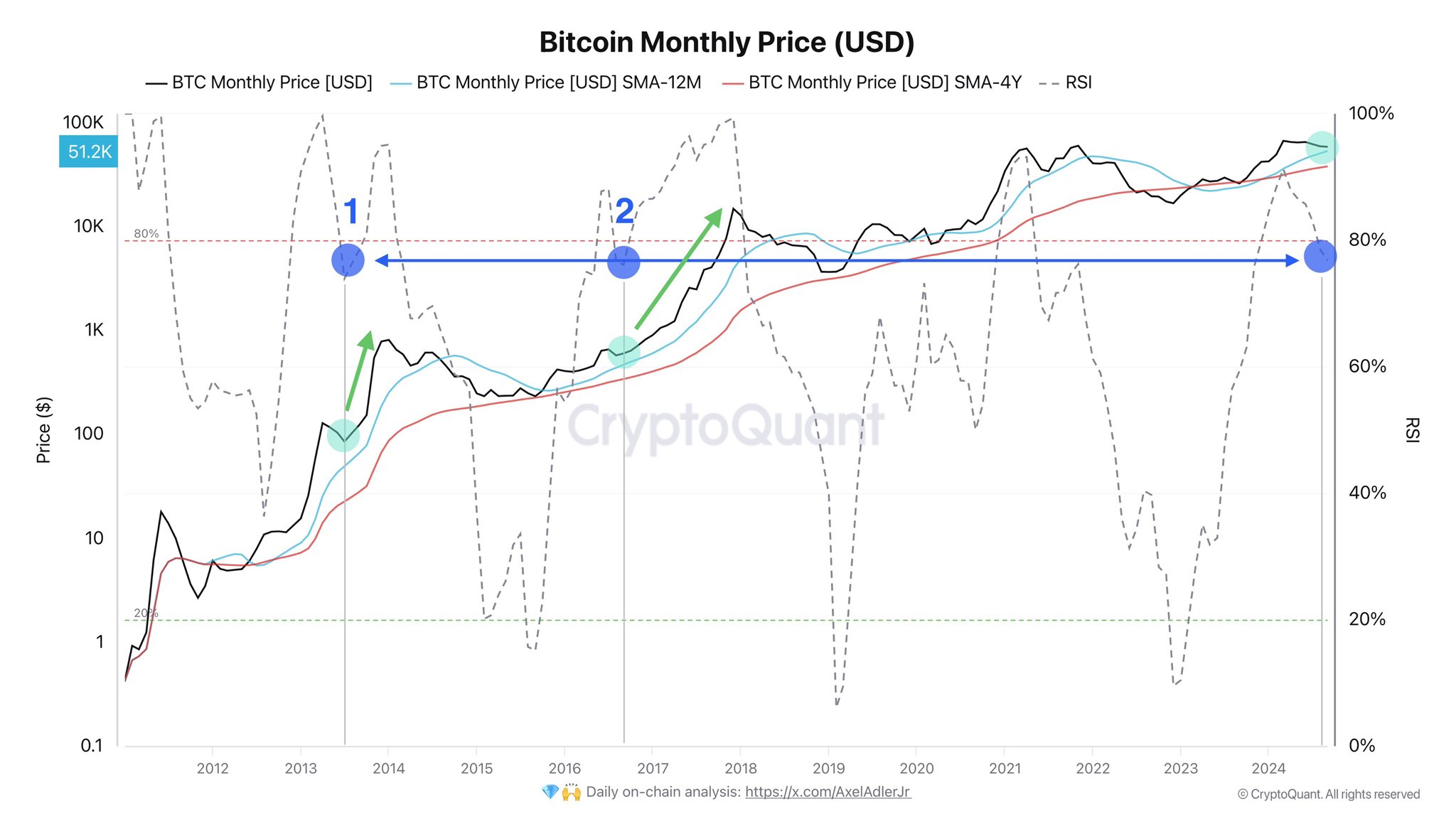

Bitcoin Up 30% From August Lows, RSI Dips Below 80% Level In The Monthly Chart

Currently, traders are feeling hopeful and positive, setting the stage potentially for further growth. Since its dip in early August, Bitcoin has risen by 30% and is approaching its August high of around $65,000. Analysts anticipate that buyers could drive prices beyond this level, indicating a new phase for bullish investors. It’s important to pay attention to the recent trend in the monthly chart as well.

Discussing with X, it’s observed that despite bulls making an attempt to surge beyond $65,000 for a new two-month peak, the upward push appears to be weakening. At this moment, the Relative Strength Index (RSI) on the monthly graph is declining and has just dipped below 80%.

As a researcher, when I examine an oscillator’s zone, I often notice that the area between 80% and 100% serves as a warning sign. This indicates that the coin in question might be overvalued or sitting in the overbought territory. When the Relative Strength Index (RSI) starts to decrease from this range, it suggests a weakening of the upward momentum. For bulls, this is generally unfavorable news.

On a monthly basis, such indications might bring significant impacts on shorter periods like daily or lower ones. This could suggest potential weaknesses emerging, as sellers seem ready to drive prices down further. If buyers are unable to surpass the $65,000 mark, this could be even more likely.

There Is Hope, BTC Will Likely Spike Once Prices Race Above $73,000

Although it might seem pessimistic, there’s still optimism to be found. The analyst notes that while the Relative Strength Index (RSI) currently sits below the 80% threshold, this isn’t an unprecedented situation. In fact, Bitcoin has shown a tendency to rebound when the RSI reaches these low levels. However, it’s important to remember that this doesn’t happen every time.

In light of recent developments, it’s crucial for traders to keep a keen eye on the market trends over the next few days. If the price trend heads towards $60,000, it could dampen the current upward surge, potentially marking the beginning of a correction period.

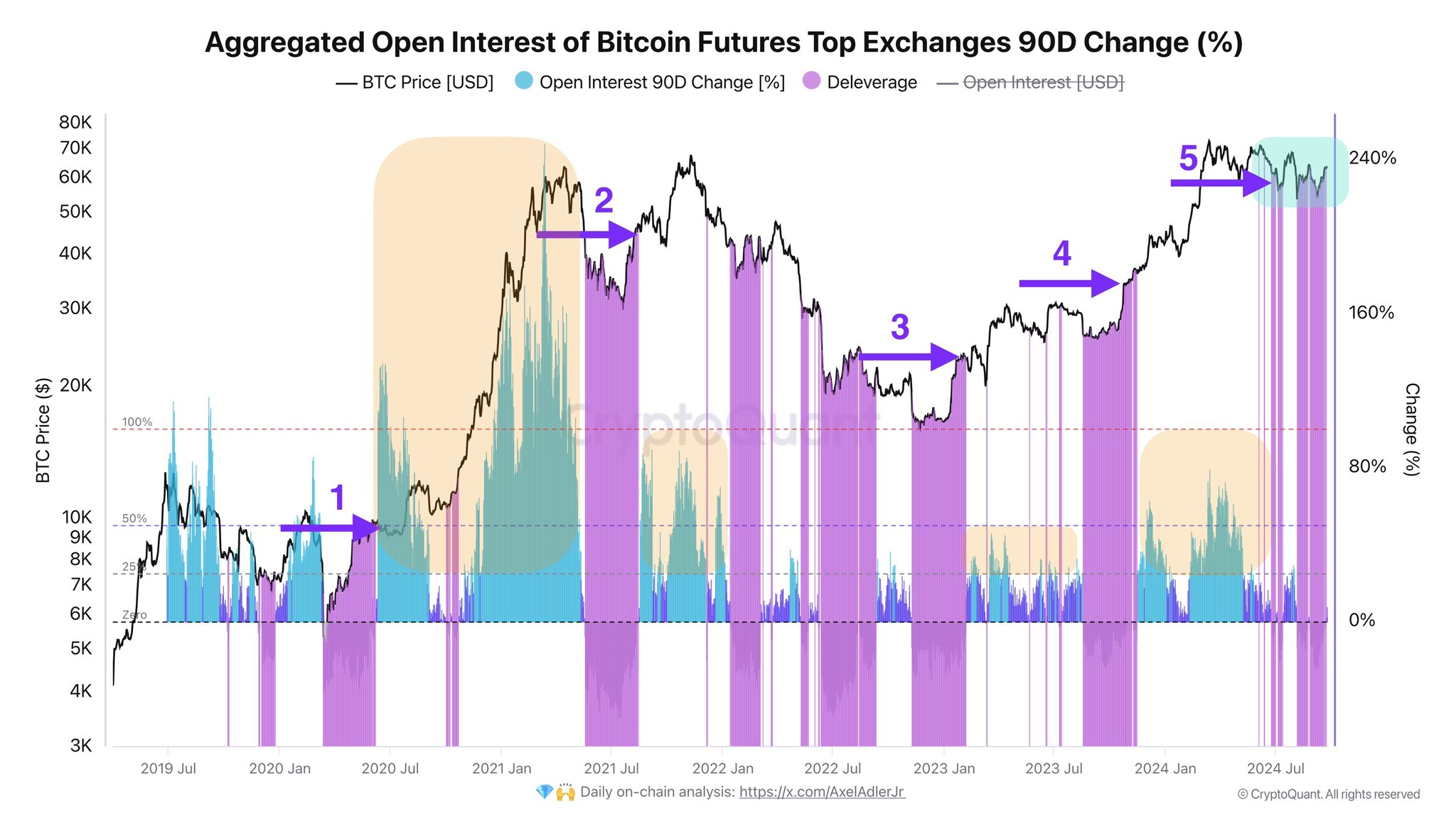

Despite the current viewpoint, the analyst remains optimistic about the future performance of Bitcoin. In another discussion, the analyst suggested that if Bitcoin manages to overcome its current instability and move towards $73,000, it could potentially experience a significant surge. This upward trend is expected to attract a substantial amount of new investment capital, particularly in the futures market.

If the influx continues, it might propel Bitcoin prices to unprecedented heights, potentially surpassing previous peak values. However, before that can occur, Bitcoin must build up some strength. This surge is likely if there’s a clear break above the $65,000 barrier, acting as resistance.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-09-25 23:46