As a seasoned analyst with over two decades of market experience under my belt, I find myself increasingly intrigued by Bitcoin’s current trajectory. The recent price fluctuations have been reminiscent of the tech boom I witnessed in the late ’90s – a rollercoaster ride that ultimately led to unprecedented growth.

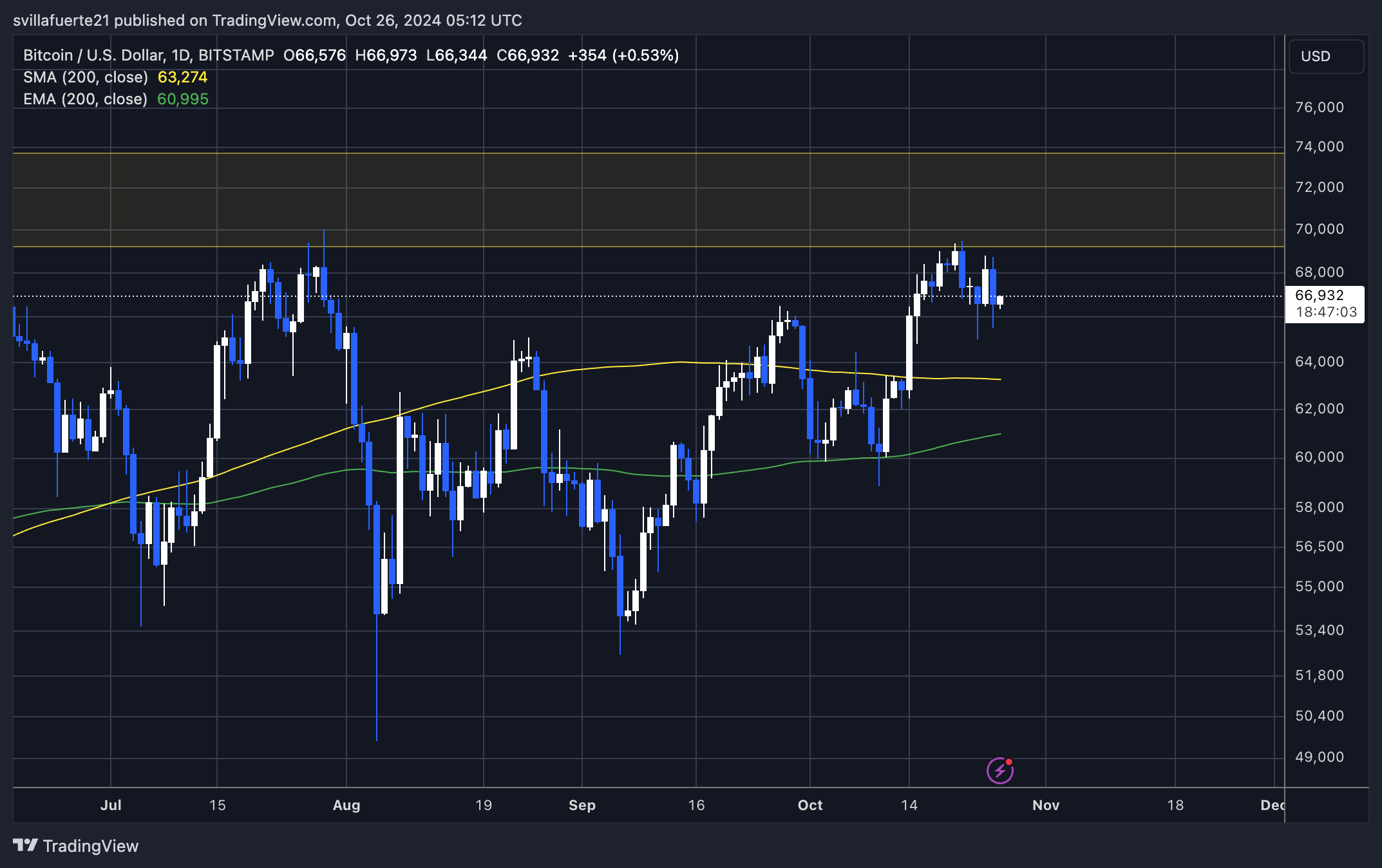

Over the past week, Bitcoin‘s price has shown considerable volatility, ranging from a peak of around $69,500 to a low of $65,000. After a series of bullish weeks, the market has recently calmed down, and Bitcoin is currently holding steady slightly below the important $70,000 mark. If Bitcoin can surpass this critical level, it could lead to increased buying activity.

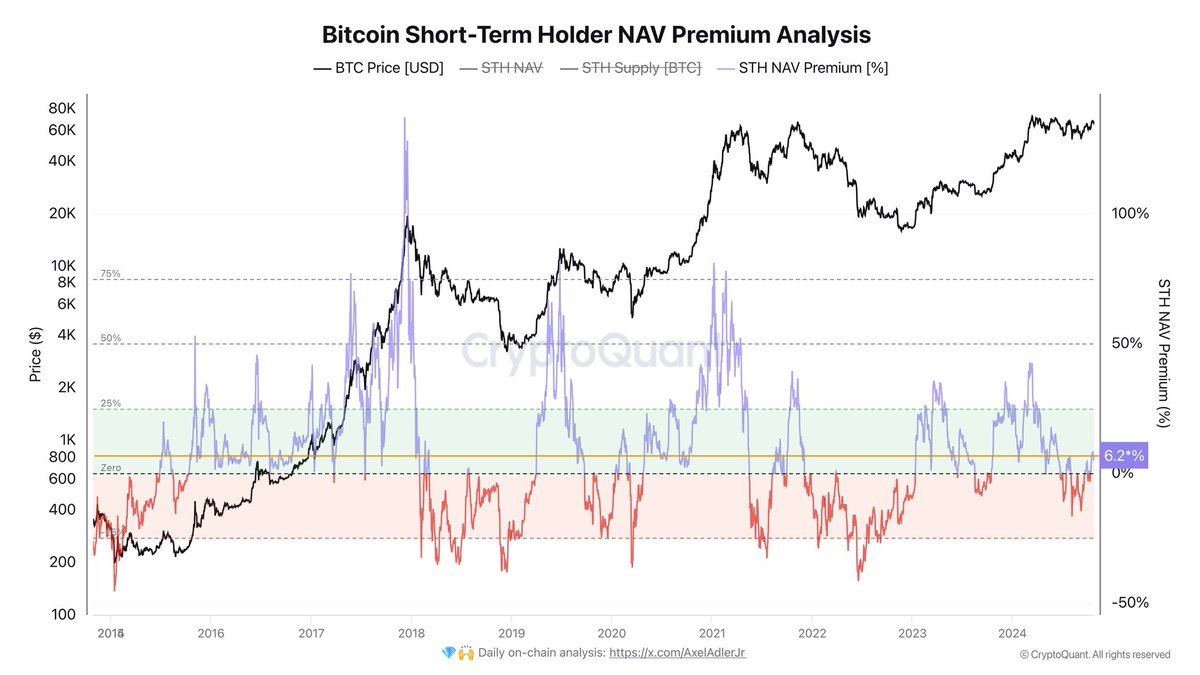

Based on information from CryptoQuant, it seems there’s potential for more growth since short-term holder (STH) coins are currently trading at a 6.2% higher value compared to their net asset value (NAV). This higher value is often seen as an indicator of market sentiment, showing the enthusiasm of short-term investors who are ready to pay above the current market price for Bitcoin. Typically, a larger NAV premium indicates that investors anticipate further price increases and are preparing for future profits.

In its current price range, many are keeping a close watch on $70,000 as a possible threshold for a new surge in Bitcoin’s price. With optimistic market feelings and backing evidence, Bitcoin’s forecast for the upcoming weeks looks promising, driven by both technical indications and robust buyer demand.

Retail Buying Bitcoin (Again)

Currently, Bitcoin is seeing an increase in interest from short-term investors as its price hovers near significant supply thresholds, not far off from record highs. Analyst Axler Adler recently disclosed some intriguing findings on this topic, indicating that the value of Bitcoin held by short-term investors (Net Asset Value or NAV) has risen to a 6.2% premium compared to longer-term holders.

The 6.2% higher price of Bitcoin compared to its average purchase price by short-term investors suggests they view Bitcoin as being worth more than its usual cost. This premium implies that these investors are hopeful about Bitcoin’s future growth prospects.

As an analyst, I’ve come to understand that Adler suggests this specific metric serves as a positive indicator, signaling potential for further price expansion. In the realm of Nav Premium, when it surpasses 25%, it often indicates a market running hot. This suggests that while demand is substantial, it hasn’t yet escalated to unhealthy levels, offering us an opportunity to closely monitor and anticipate market trends.

Based on Adler’s assessment, the Nav Premium serves as a crucial indicator of market sentiment. A premium of around 6.2% indicates robust demand from short-term investors, suggesting an accumulation period rather than a peak. This observation is particularly significant given that Bitcoin’s price is currently consolidating under strong resistance levels, which could pave the way for a potential breakout.

As a researcher studying the cryptocurrency market, I find myself observing an intriguing trend with Bitcoin (BTC). Currently, Bitcoin’s consolidation beneath its crucial supply levels, coupled with increasing demand among short-term holders, presents a promising landscape for potential price escalations. If this momentum in short-term holder demand persists, it could serve as the catalyst propelling BTC towards unprecedented highs.

The balance between premium demand and manageable NAV levels could signal sustained upward momentum. There is a potential rally on the horizon if buying pressure strengthens at current levels.

Technical Level To Watch

The price of Bitcoin has risen to $66,900 following strong backing at around $65,000. This steady support indicates robustness as it hovers above this critical threshold. The support around $65,000 represents a key turning point since maintaining it suggests underlying power and bolsters investor confidence. Nevertheless, to sustain its bullish trend, Bitcoin must break through the $70,000 barrier to verify the upward trend continuation.

If Bitcoin falls below the $65,000 mark, analysts anticipate a potential drop towards its 200-day moving average at around $63,274. This point is significant because it could act as a long-term base for the currency. A decline to this region might entice new investors, making it an important support level if tested.

Investors consider the 200-day Moving Average (MA) as a significant benchmark in Bitcoin’s bullish pattern. If Bitcoin can maintain its position above $65,000 and then surpass $70,000, it suggests that the current bullish trend is ongoing. However, if Bitcoin were to fall below these levels, attention would shift towards the 200-day MA. Maintaining an upward trajectory above this moving average is essential to avoid a bearish turn in the market.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-27 01:16