As a seasoned crypto investor with memories of the 2017 bull run still fresh in my mind, I can’t help but feel a sense of deja vu when I see the Bitcoin LTH/STH SOPR Ratio crossing above its 90-day MA. History has shown us that this pattern is often a bullish indicator for Bitcoin’s price, and given where we are in the current cycle, it’s hard not to get excited.

The data indicates a specific relationship between two key Bitcoin network indicators has just repeated a historical pattern, which typically signals an increase in the asset’s value.

Bitcoin LTH/STH SOPR Ratio Has Crossed Above Its 90-Day MA Recently

In his latest article for X, CryptoQuant’s Axel Adler Jr delves into the current pattern observed in the Bitcoin SOPR Index. The “Spent Output Profit Ratio” (SOPR) serves to inform us whether overall Bitcoin investors are realizing gains or losses when selling their assets.

If the value of this metric surpasses 1, it signifies that the typical Bitcoin user is generally conducting transactions with a net gain. Conversely, when it falls below this threshold, it suggests that more transactions are occurring at a net loss within the network.

The SOPR Ratio, the actual metric of interest here, keeps track of the ratio between the version of the SOPR specifically for short-term holders and that for long-term holders.

In essence, Bitcoin users are categorized into two primary groups: short-term and long-term investors, based on the duration they hold their Bitcoins. A Bitcoin holder is considered a long-term investor if they’ve held onto their coins for more than 155 days, while those who hold for less time fall under the category of short-term investors. After holding their coins for over 155 days, the short-term investors move into the long-term group.

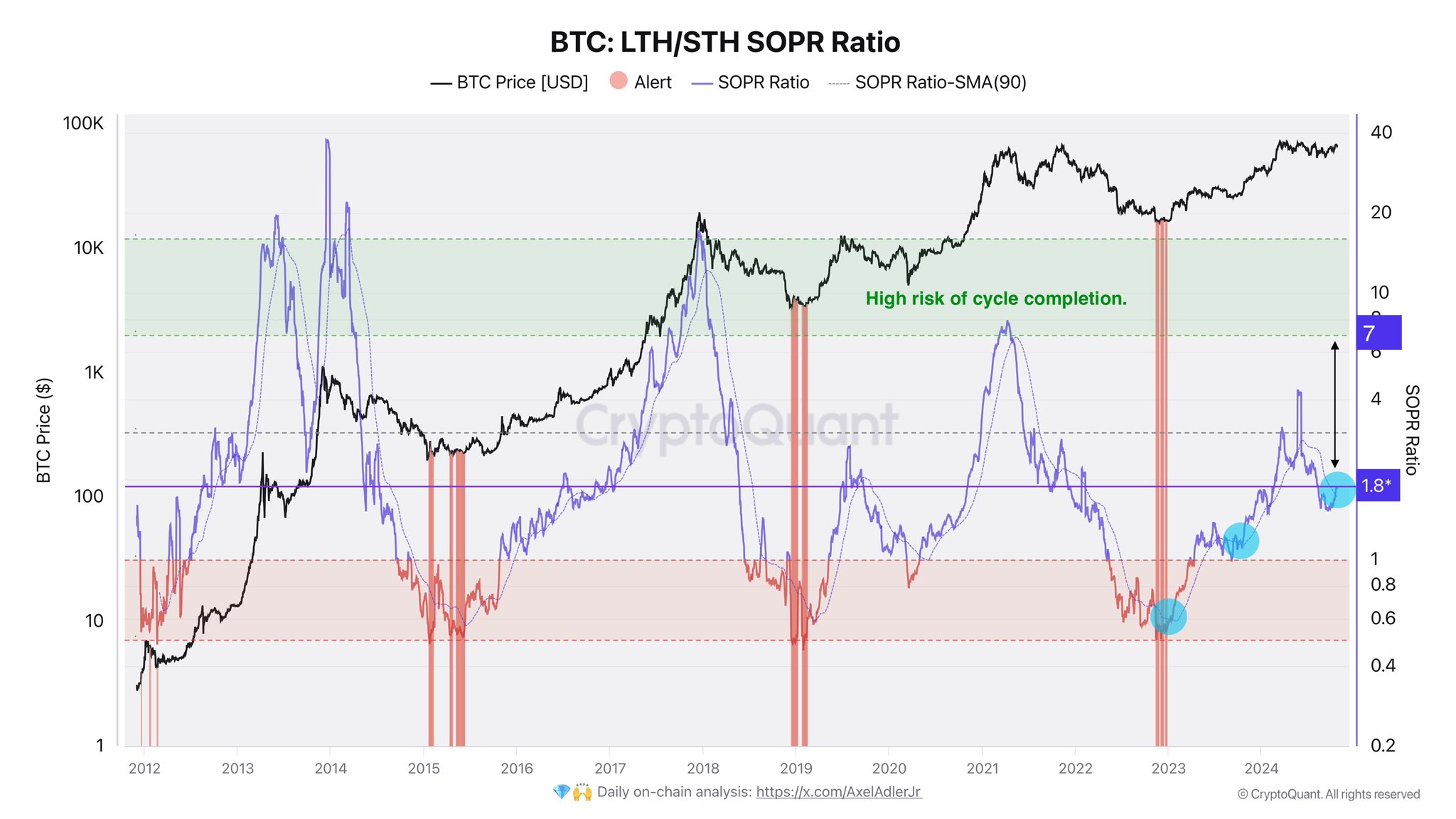

Presently, I’d like to bring your attention to the chart that our analyst has provided. This chart illustrates the evolution of the Bitcoin SOPR Ratio in conjunction with its 90-day moving average throughout the lifespan of this digital currency.

Based on the graph, it’s clear that the Bitcoin SOPR Ratio has experienced a notable increase lately, indicating an uptick in long-term holders (LTHs) selling their profits at a faster pace than short-term holders (STHs).

Historically, this trend tends to occur during bullish market phases, as Long-Term Holders (LTHs) are persistent entities that often accumulate substantial profits when a full-blown bull rally takes place.

In simpler terms, the Short-Term Holders (STHs) are those who purchased Bitcoin within the last five months. Consequently, their purchase price falls roughly within the range of Bitcoin’s trading prices during this timeframe.

In other words, these profits for them (regular investors) are typically smaller compared to Long-Term Holders (LTHs), who often buy assets when prices are at their lowest during a bear market. Consequently, during bullish market conditions, the ratio tends to become significantly larger in favor of the LTHs.

The SOPR Ratio, recently, has climbed up to 1.8 and exceeded its 90-day moving average, as shown on the chart. In previous cases, as pointed out by CryptoQuant’s author, this crossover has often been a bullish sign for Bitcoin.

It’s important to note that the profits from Long-Term Holdings (LTHs) might raise some concerns, but based on the chart, it seems that the market cycle typically nears its peak only when the ratio exceeds a value of 7. This indicates that caution is advisable when this level is breached.

In simpler terms, there’s a possibility that Bitcoin could continue rising, as demand might offset the selling by long-term holders (LTH) until we reach similar high points as before, mirroring previous market cycles.

BTC Price

Currently, Bitcoin’s price hovers approximately at $68,200, experiencing a rise of over 1% within the past 24 hours.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- All Elemental Progenitors in Warframe

- What Happened to Kyle Pitts? NFL Injury Update

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

2024-10-26 13:16