As a seasoned researcher who has witnessed Bitcoin’s volatility from its early days, I find the current data intriguing and potentially bullish. The combination of key on-chain metrics and historical trends suggests that we might be on the cusp of another rally.

Based on current data from CryptoQuant, Bitcoin seems to be preparing for an upward trend. As per Darkfost, a CryptoQuant analyst, certain on-chain indicators are pointing towards a shift towards a bullish market, hinting at improving market sentiments.

Key On-Chain Metrics Indicating Recovery

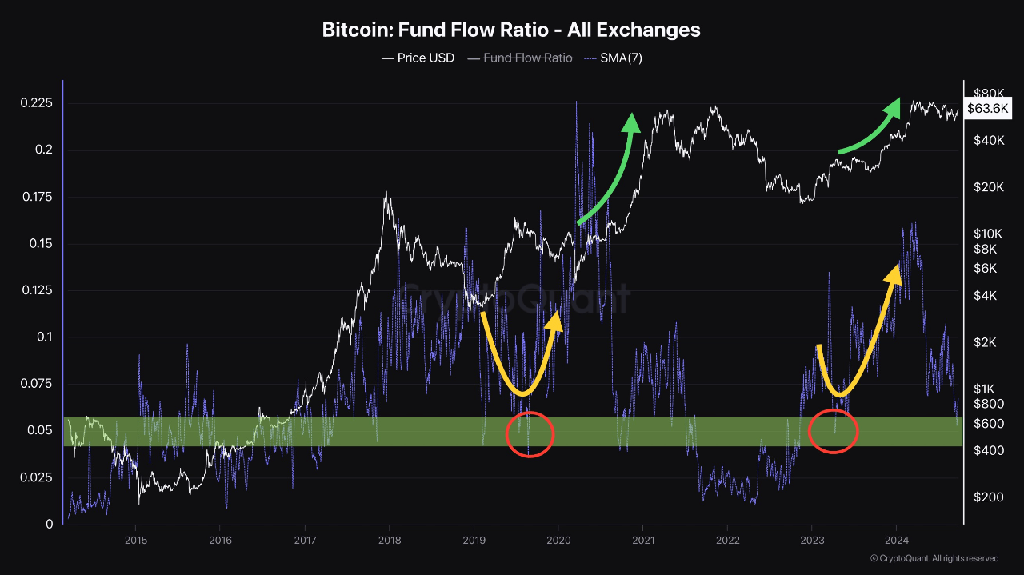

One key signal emphasized by Darkfost is the 7-day Simple Moving Average (SMA) of the Fund Flow Ratio, currently sitting at 0.05. In the past, this value has often signaled the end of a bear market or the beginning of a new bullish trend. Notably, an uptick in the Fund Flow Ratio suggests growing trading activity among investors, typically a precursor to significant price spikes.

Credit: CryptoQuant

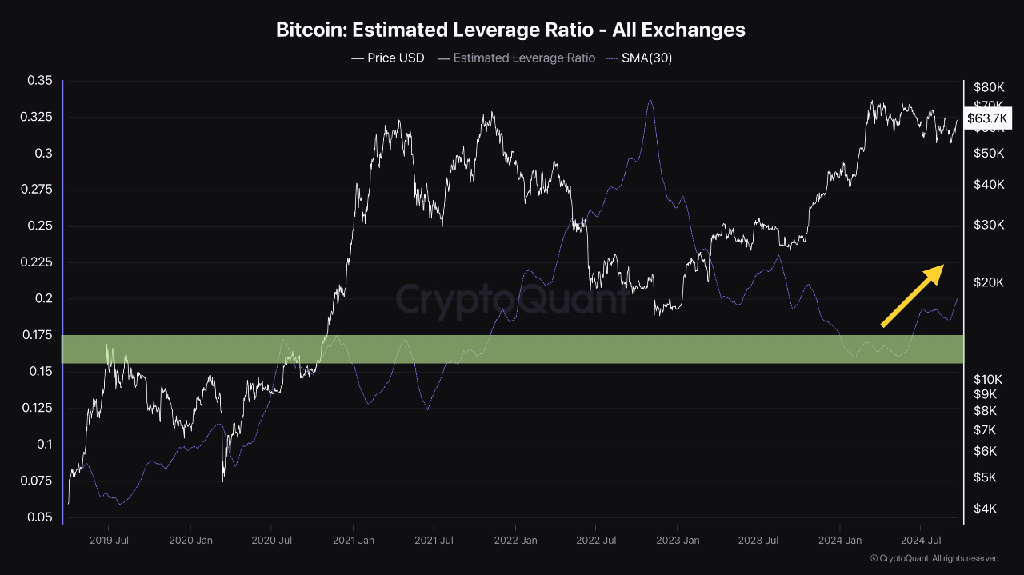

A significant indicator suggesting improvement is the 30-day Simple Moving Average (SMA) of the Estimated Leverage Ratio, which monitors the application of leverage in Bitcoin transactions. At present, this ratio is on an upward trend, remaining within a supportive range of 0.15 to 0.175. This suggests growing trust among market participants, as increased leverage is also indicated by heightened interest in future ETFs and options trading related to Bitcoin.

Credit: CryptoQuant

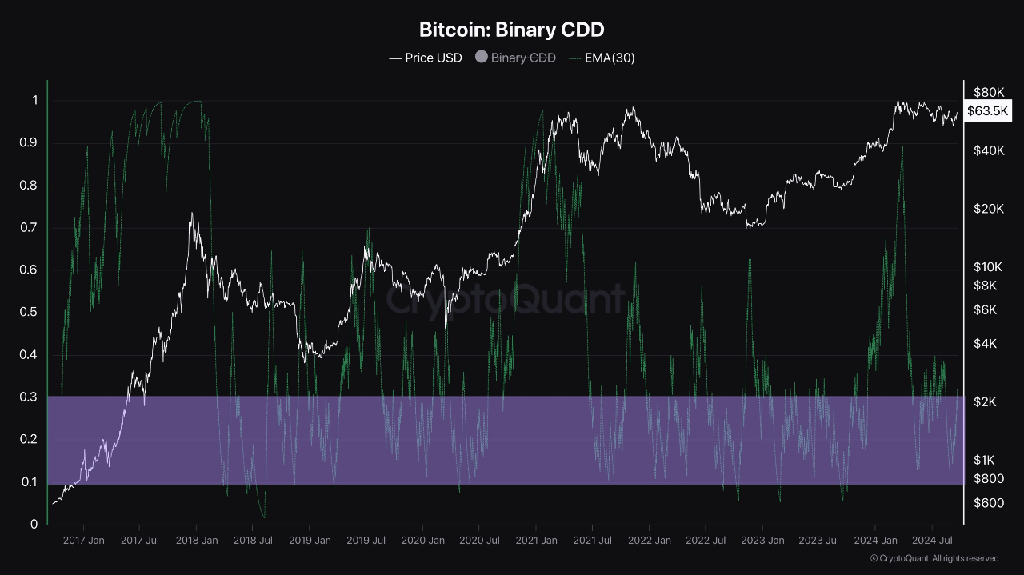

Darkfost highlights the 30-day Exponential Moving Average (EMA) related to Binary Coin Days Destroyed (CDD), an indicator that tracks the actions of long-term Bitcoin investors. A sudden increase in this figure typically indicates the winding down of a bear market period. At present, it appears that these long-term investors are preparing for potential profits, which may bolster Bitcoin’s price over the coming months.

Credit: CryptoQuant

Historical Trends Suggest a Bullish Breakout

Additionally, along with the on-chain information, past cycle trends hint that Bitcoin could soon experience a surge in value. As per a post by the anonymous analyst Rekt Capital, Bitcoin typically bursts out of its accumulation phase approximately 154 to 161 days following a halving event. If this theory holds true, it seems we might be nearing such a breakout since 157 days have elapsed since the most recent halving occurred.

As a crypto investor, I’ve learned that past trends don’t always predict future price fluctuations, but it’s interesting to note that Bitcoin followed a pattern similar to its behavior in 2016 and 2020. This year, September, which is typically a bearish month, surprised us all by posting a 9% gain, making it the second-best September performance for Bitcoin since 2016.

Long-Term Outlook Remains Positive

Looking ahead, Bitcoin’s overall projection seems optimistic. It’s hard to predict the timing or magnitude of the next significant price surge, but current trends suggest that a substantial rally for Bitcoin may be imminent. Currently, Bitcoin is only 14.6% below its highest recorded value at $73,738, so the coming days could play a crucial role in shaping Bitcoin’s future price trend.

Over the next few months, it’s anticipated that the U.S. elections will potentially sway investor attitudes towards the market, albeit many professionals suggest the effect could be limited. Both presidential contenders have shown curiosity about cryptocurrencies, with Trump being particularly outspoken and expressing solid backing for them.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-24 11:48