As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by yesterday’s Bitcoin spike following Jerome Powell’s unexpected announcement. The Fed’s potential 25bps rate cut has certainly added fuel to the market’s volatility.

Yesterday, the price of Bitcoin (BTC) surged by more than 6% after Federal Reserve Chairman Jerome Powell declared they were modifying their policy and suggested a possible 0.25% rate reduction at the September 18 meeting. This surprising news has contributed to Bitcoin’s recent market fluctuations, as its value has been fluctuating erratically over the past few weeks.

Important information from CryptoQuant suggests a hint of optimism. The data indicates that traders are preparing for potential price increases.

In my role as a researcher, I’m closely observing the market’s response to the Federal Reserve’s latest policy shift. My focus is particularly on Bitcoin, as its performance in the coming days may signal the commencement of a fresh, upward trend.

Bitcoin Data Showing Market Optimism

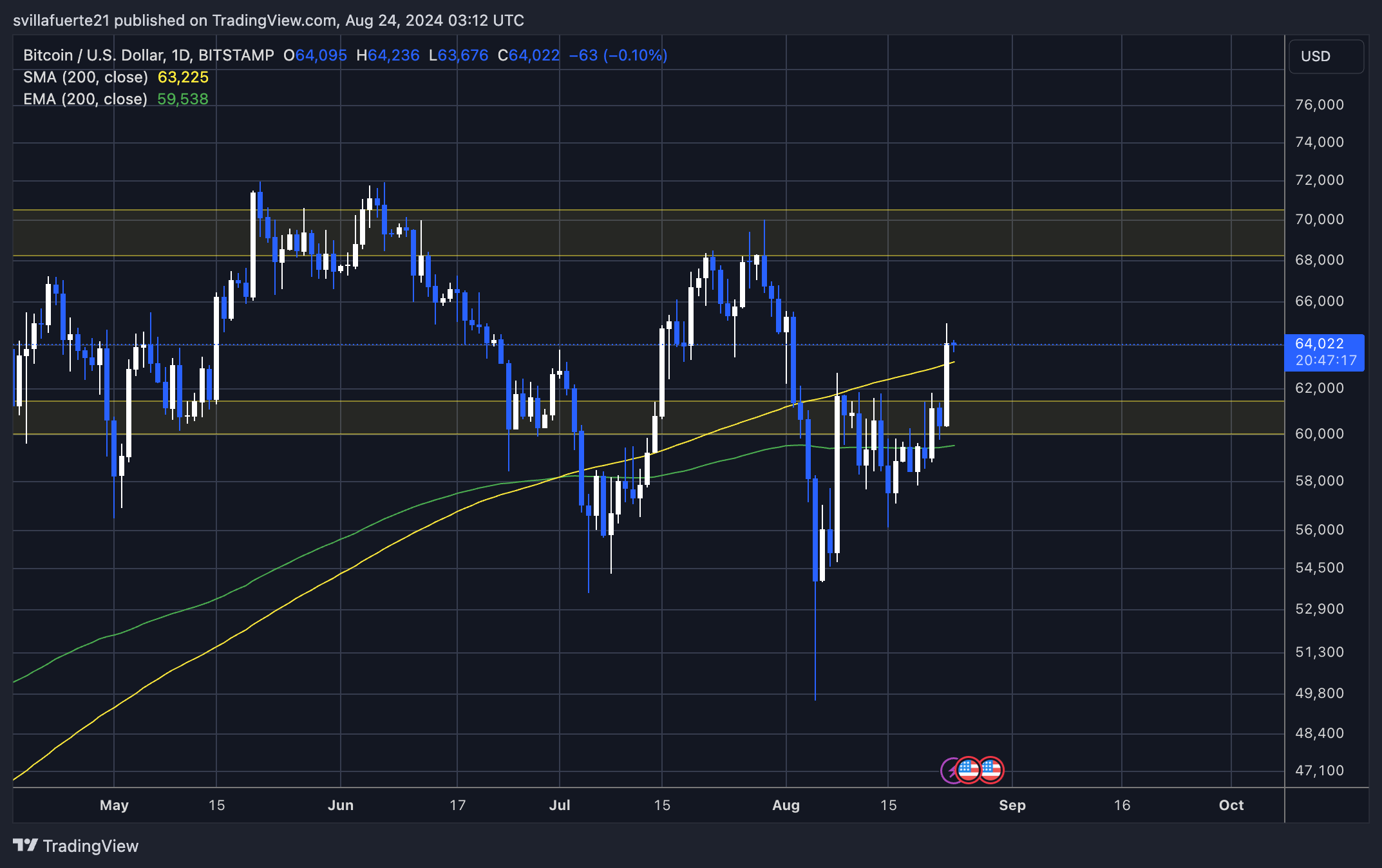

Bitcoin’s current price stands over $63,000, building strength as it approaches the significant resistance level of $65,000.

Data recorded on the blockchain by CryptoQuant indicates an increase in market confidence, pointing towards a potentially strong upward trend. This is supported by the fact that Bitcoin reserves on centralized exchanges have hit a record low. Since late July, the amount of BTC kept on these exchanges has dropped significantly, from more than 2.75 million to around 2.67 million in merely 30 days, which translates to a 3% decrease.

Reduced amounts of Bitcoin being traded on exchanges suggest a scarcity, which might result in a sudden imbalance between supply and demand if the demand continues to exceed the supply. This could potentially trigger a rapid rise in Bitcoin’s price. As less Bitcoin becomes available for trading, the probability of an increase in its price becomes more likely.

As a researcher observing recent developments, I find myself intrigued by the growing momentum of Bitcoin. The market’s keen interest in this trend could potentially propel Bitcoin further into optimistic territories, signaling a possible bull run.

BTC Price Action: $65,000 Next?

Following a period of fluctuation and stabilization, Bitcoin is presently being exchanged for approximately $64,100, maintaining its position above the significant Daily 200 Moving Average (MA), as noted at this moment.

At this stage, it’s crucial for the upward momentum to continue in the higher time frames for bitcoin. To surpass the $65,000 threshold, it’s important that its bullish pattern remains intact by consistently staying above the $57,500 point. For optimal results, it would be best if it manages to remain above the daily 200 Exponential Moving Average (EMA), currently at approximately $59,538.

Maintaining these levels is crucial for maintaining a positive market trend. Remaining above them suggests market robustness, boosting traders and investors’ confidence. The decrease in Bitcoin exchange reserves coupled with the central bank’s policy update has sparked optimism. More and more investors are now anticipating a potential Bitcoin surge in the near future, driven by these positive signs.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-24 10:34