Over the past day, Bitcoin‘s price has witnessed a significant surge, gaining approximately 2.45% and exceeding $97,300 at the time of reporting. According to Markus Thielen, head of research at 10x Research, this upward trend could signal a substantial breakout in BTC price prior to the Federal Open Market Committee (FOMC) meeting on January 29th.

In his January 14 markets report, Thielen wrote:

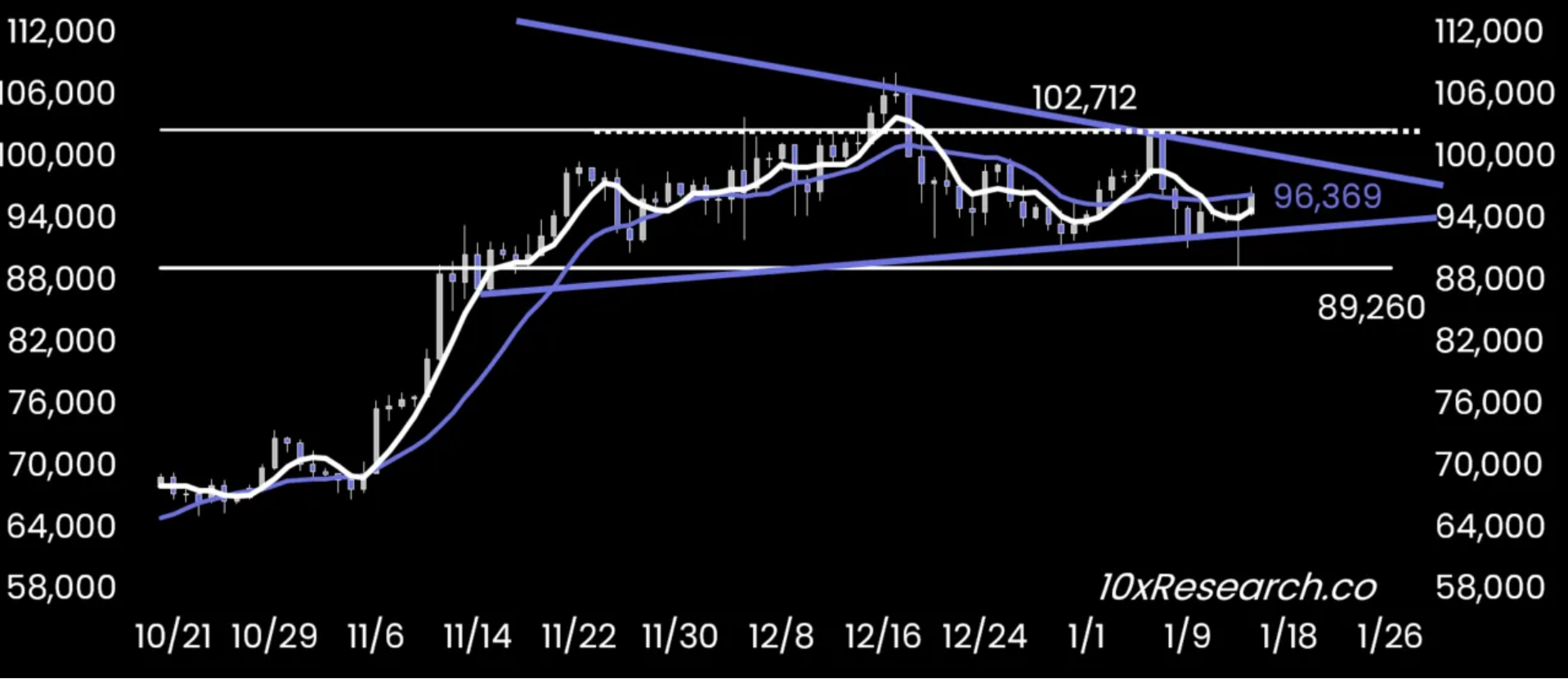

The price of Bitcoin is moving inside a shrinking pattern, suggesting a significant shift could happen soon – perhaps even before the Federal Open Market Committee (FOMC) meeting on January 29.

Source: 10x Research

Thielen stated that in terms of trading strategy, it’s advisable to adhere to the breakout, whether it heads upwards or downwards. A significant factor driving an increase in Bitcoin price could be the release of today’s Consumer Price Index (CPI) data.

Expectations for a higher Consumer Price Index (CPI) are on the rise, suggesting that if inflation turns out to be lower than anticipated, it could lead to an upsurge in Bitcoin prices beforehand. At their meeting in January 2025, the US Federal Reserve will announce their initial interest rate decision of the year.

With Jerome Powell’s hawkish stance last month in mind, investors will keenly observe any additional remarks he makes. Moreover, the solid job market reports and a thriving U.S. economy have pushed back the initial Fed rate cuts for 2025 to June this year.

According to information provided by Bitfinex, using data from the CME FedWatch Tool, it appears that traders in the Fed Funds futures market anticipate a 38.3% chance that the Federal Reserve will not reduce interest rates at all during the first six months of 2025.

Bitcoin Price Volatility and Trump Inauguration

As Donald Trump’s inauguration draws near on January 20th, crypto market analysts are adopting a cautious stance due to Bitcoin’s repeated rejections at $100K prices. In his latest analysis, Thielen predicts that Bitcoin may hold its ground for a while longer, possibly for the next two months, suggesting potential consolidation.

“Due to weak market drivers, Bitcoin will likely remain range-bound until mid-March.”

In a January 14 post, crypto expert Lark Davis pointed out that Bitcoin’s current price fluctuations resemble those observed around the time of the previous U.S. presidential election and inauguration.

Davis posted a graph illustrating that as President Biden’s 2021 inauguration approached, Bitcoin dropped to approximately $30,000, then surged to around $55,000 soon after the event. Davis noted, “History doesn’t always repeat itself, but it often has similar patterns.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-01-15 12:39