As a researcher with extensive experience in the crypto market, I find the recent events on July 5th, 2024, quite intriguing and concerning. The sudden sell-off of Bitcoin (BTC) below $54,250, resulting in over $685 million in liquidations, is a stark reminder of the volatility that characterizes this market.

I experienced a tumultuous day in the crypto market on July 5th, 2024. Over $685 million worth of positions were liquidated as Bitcoin (BTC) dipped below the $54,250 mark. This sudden sell-off intersected with ongoing developments at defunct exchange Mt. Gox, which is in the process of making payouts to creditors.

Mt. Gox Shakes Confidence

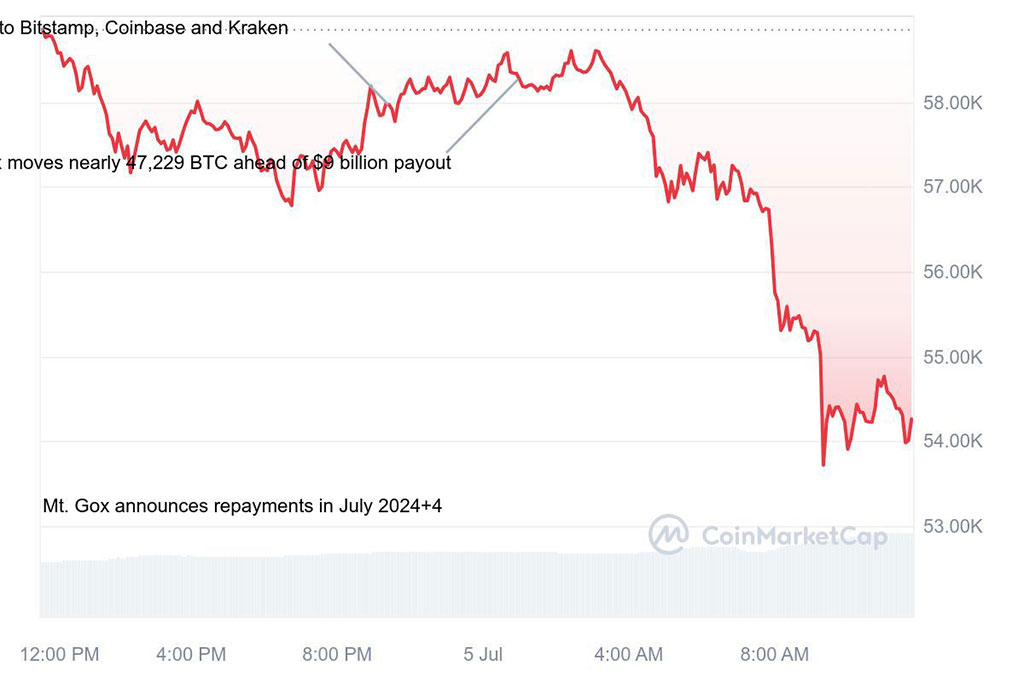

The price of Bitcoin declined by 7.89%, landing at $54,258. This downward trend occurred concurrently with apprehensions surrounding Mt. Gox. The defunct exchange, set to distribute creditor payouts in early July, transferred a substantial amount of Bitcoin, approximately $2.7 billion in value.

Photo: CoinMarketCap

Experts believe that Mount Gox’s recent actions could be contributing significantly to the market’s price fluctuations. According to Peter Chung, the head of research at Presto Research, this is his assessment.

“The demand to sell may be greater for Bitcoin Cash (BCH) compared to Bitcoin (BTC). Due to a weaker investor community supporting BCH, it’s likely that Mt. Gox creditors will want to convert their holdings into cash right away.”

As a crypto investor, I’ve experienced firsthand the consequences of a sudden price drop. According to data from CoinGlass, over 236,000 traders were forced to sell their positions in the last 24 hours due to these market conditions. The total value of these liquidations reached an astounding $685.39 million on centralized exchanges alone.

As a crypto investor, I’ve noticed that Bitcoin took the lead in liquidations with approximately $230.39 million worth of positions being forcedly closed. Shockingly, more than 80% of these liquidations, amounting to $185.37 million, were long positions held by over-leveraged bulls. Ethereum (ETH) wasn’t far behind, with around $163.4 million in liquidations and a large portion, $167 million, being long positions as well. The price of Ethereum followed suit and dropped a substantial 10.71% to $2,859.

Bitcoin’s Long-Term Potential

In simpler terms, when a cryptocurrency trader doesn’t have enough collateral or has suffered substantial losses, their open positions are automatically closed by the exchange – this is called a liquidation. Despite the current unfavorable market conditions, some crypto specialists maintain a positive outlook.

“Despite market volatility and extended periods of selling, Bitcoin’s underlying fundamentals remain unchanged. Although we might see prices dipping into the lower 50,000s or even slightly below for a few weeks, this short-term price action doesn’t alter the market structure significantly. Such fluctuations are primarily relevant to speculators with a short-term focus.”

Despite potential price fluctuations in the immediate future, Caselin underscores the significance of considering Bitcoin’s long-term prospects. The forthcoming events surrounding Mt. Gox payouts are expected to significantly influence market behavior, shedding light on investor confidence restoration.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-07-05 14:22