As an analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and bear markets. The recent surge of Bitcoin to the $63,000 mark is indeed reminiscent of the market dynamics we saw during the 2017 bull run.

Bitcoin, the most valuable digital currency, is taking the lead in market recovery as it soars towards $63,000. Over the past week, Bitcoin’s value has increased by 8%, making it one of its strongest showings in September since it was first created.

Bitcoin Registers Sixth Green Daily Candle

In the first seven days of the month, Bitcoin’s price had difficulty staying above $55,000, eventually dipping down to the $52,000 support level and causing concern among investors. This trend was mirrored across the sector, with other cryptocurrencies experiencing a 12% drop and the total market cap reaching approximately $1.81 trillion earlier this month.

After that, the market experienced a substantial surge, primarily driven by the US Federal Reserve’s (Fed) interest rate reduction. In the wake of the Fed’s statement, the sector rebounded by approximately 5% and maintained an upward trend over the weekend.

Because of favorable market opinions, crypto investment goods concluded the week with an inflow of $321 million, marking the second consecutive weekly positive net flows. The inflows were primarily driven by Bitcoin-focused products, which recorded a flow of $284 million the previous week, as indicated in the CoinShares report.

Bitcoin gained momentum following Kamala Harris’ recognition of the cryptocurrency market. This surge allowed it to climb back approximately 20% from its lowest point on September 6. The recovery movement brought the digital currency close to the $64,000 resistance level, a barrier it last encountered about a month ago.

Following its unsuccessful attempt to surpass a significant resistance point, Bitcoin’s value has stayed within the vicinity of $63,000 to $63,900 during Monday morning hours. Since September 17, it has recorded six consecutive daily increases.

Will BTC See Four Green Months In A Row?

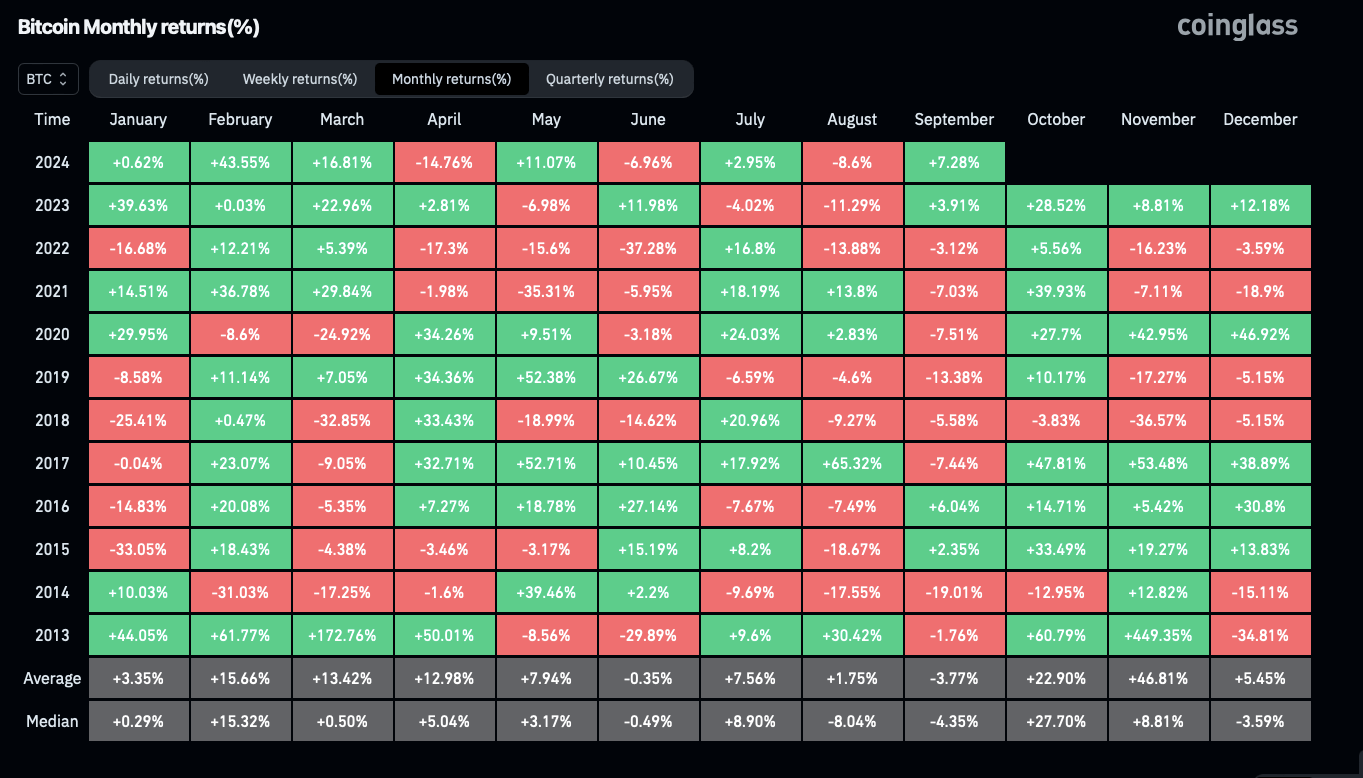

In simple terms, Bitcoin’s current market behavior has resulted in positive gains this month (September), which means it’s been a “green” or profitable month for Bitcoin. Data from Coinglass shows that Bitcoin has yielded a 7.94% increase in value so far this month compared to the start.

Some market analysts have observed this performance and posit that Bitcoin could be setting a record for its best September yet. In a recent post on X, Crypto Jelle pointed out that BTC is currently heading towards its most robust September performance ever, as its current monthly return has surpassed that of September 2016.

As a crypto investor, I’m excitedly anticipating a “promise-filled” showing from our leading digital currency in the upcoming quarter. Notably, Bitcoin has managed to close September with positive figures only thrice before.

Even when there were instances of volatility or sudden drops, Bitcoin’s monthly earnings have consistently ended up as profits for four consecutive months. This could indicate that Bitcoin might be preparing for a significant upward trend in the fourth quarter (Q4).

To end this month profitably (in the black) increases the likelihood that we’ll also see profits in October, November, and December.

This week is expected to be crucial for the leading cryptocurrency, as it’s almost within touching distance of reaching a new high. If Bitcoin manages to surpass the $65,000 resistance barrier, it could potentially alter the current perspective and push prices to levels not experienced since early August.

As an analyst, I’ve been closely observing the cryptocurrency market, and I noticed that its price chart exhibits a “substantial, descending broadening wedge formation.” This technical pattern, if broken out of, could potentially propel the value of the cryptocurrency to around $90,000. However, I believe that Bitcoin won’t be confined within this pattern for an extended period.

Currently, the flagship is priced at $63,700, representing a 1.7% increase on a daily basis and a significant 10% rise over the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-09-24 12:40