As a seasoned analyst with over two decades of market observation under my belt, I must say that this recent surge in Bitcoin and the broader crypto market has certainly piqued my interest. With such a tumultuous past few weeks behind us, it’s encouraging to see the market bouncing back, especially following Jerome Powell’s hint at an interest rate cut.

Over the last several weeks, after a string of adjustments, both Bitcoin and the wider cryptocurrency sector have seen a substantial rise, climbing up from the lower values of 2024.

On Friday, the pace of events accelerated significantly following Jerome Powell’s announcement as Chair of the Board of Governors of the Federal Reserve System, suggesting a possible reduction in interest rates in September. This prospect has ignited enthusiasm among investors, resulting in heightened trading activity in the market.

As a dedicated crypto investor, I find it intriguing to note that long-term holders (LTH) are raking in a staggering $138 million in daily profits, according to data from Glassnode. However, this raises the question of what this trend might imply for the market in the days ahead. Could this be an indication of a sustained bull run? Or could it signal a potential correction as profit-taking ensues? Only time will tell, but keeping a close eye on these trends is essential for any informed crypto investor like myself.

Bitcoin Daily Capital Inflows Crucial For Price Stability

Long-term Bitcoin holders have been consistently cashing in profits during the past few months, even with the market’s unpredictability and fluctuations. As shown by the Bitcoin Long-Term Holder Net Realized Profit/Loss chart from Glassnode, these investors are currently disposing of Bitcoin at a daily rate of about $138 million. This regular selling contributes significantly to the market, demonstrating the quantity of fresh capital needed each day to offset this selling and maintain the price stability.

Should daily Bitcoin inflows fail to reach the $138 million threshold, there might be a possible increase in downward price pressure as Large Token Holders (LTH) continue to sell. This situation highlights the sensitive equilibrium between market demand for buying and the selling actions of LTH based on their profit-taking opportunities.

Over the next few weeks, it’ll be intriguing to observe how Bitcoin’s price behaves as the market progresses through its current phase. The question is whether incoming investments from new investors can outweigh the existing selling pressure. This balance could significantly influence Bitcoin’s next significant directional shift.

BTC Breaks Past $64,900: What’s Next?

At the moment, Bitcoin is being bought for approximately $64,360. This comes after a period marked by intense selling, anxiety, and doubt that led its value to drop down to $49,577 only twenty days back.

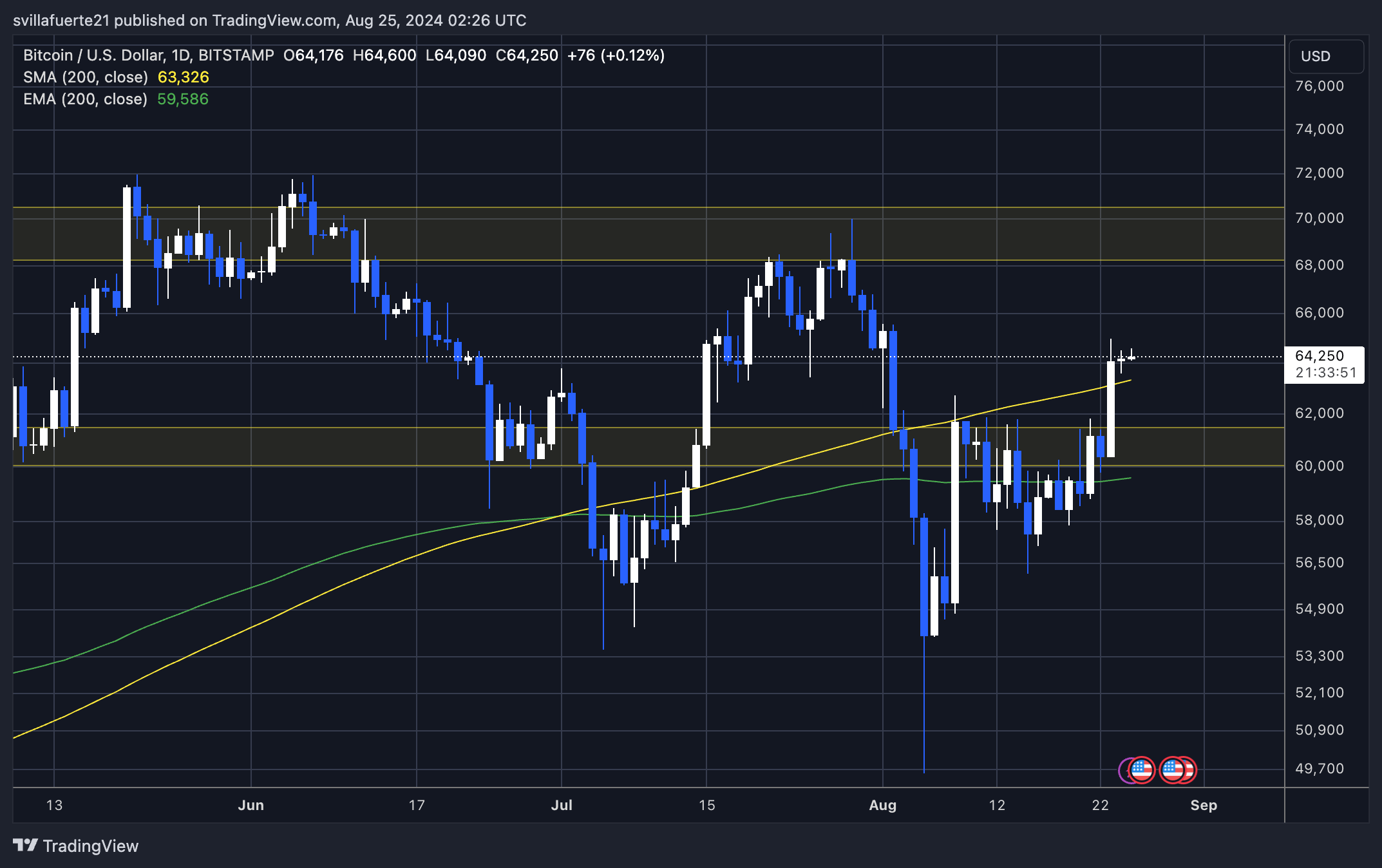

Currently, Bitcoin has been inching closer to the $65,000 level, as it has managed to close two consecutive days above its significant 200-day moving average. This moving average is a crucial tool that investors employ to discern whether the market is on an upward or downward trajectory.

From my personal perspective as a long-time cryptocurrency investor, I find this recent development in Bitcoin’s price trend quite intriguing. Having observed various market cycles, I believe that the upward movement indicates Bitcoin may be regaining its strength. However, to ensure the uptrend remains sustainable, it is crucial for the price to maintain itself above the mentioned indicator and even test it as a potential support level. This strategy has proven effective in my past investments, as holding strong during critical points can lead to significant gains over time.

As a crypto investor, I see that if Bitcoin (BTC) can sustain its current level, surpassing the $65,000 mark seems like a logical next step, with the following target potentially set at around $67,000. However, it’s crucial to keep an eye on the price action. If BTC fails to stay above its 200-day moving average, which is roughly around $63,000, there could be a possible retest of local support levels near $60,000.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-08-25 07:52