As a seasoned researcher with a decade of experience in the volatile and ever-evolving world of cryptocurrencies, I must admit that my initial skepticism towards Bitcoin has waned over the years. The meteoric rise of this digital gold to surpass $70,000, as it did recently, is a testament to its growing acceptance and the increasing confidence investors have in its potential.

Over the last two days, Bitcoin has continued its upward trajectory, surpassing both $70,000 and $72,000. This surge has triggered a spike in demand. Although the price action at current levels appears somewhat contained, the overall uptrend persists. There are moments of vulnerability, as seen today, but the daily and weekly candle formations suggest resilience.

Is Bitcoin Preparing For A 6X Surge To $462,000?

In a post on X, one analyst thinks Bitcoin will not only break above its all-time high at $74,000 but can easily 6X to over $462,000 in the coming sessions. To support this outlook, the analyst said the coin is breaking out above key resistance levels, and Fibonacci extension levels mirror this shift in trend after the Q3 2024 plunge.

According to the analyst’s evaluation, Bitcoin’s past price trends indicate that it typically reaches its highest point within the range defined by the 1.618 and 2.272 Fibonacci extensions. Technical experts employ this Fibonacci tool to estimate the speed at which prices might surge or decline based on a specific price range.

Based on historical trends and assuming Fibonacci extension levels hold true for the current cycle, we might anticipate Bitcoin reaching anywhere between $174,000 and $462,000. These numbers represent the lower and upper bounds of a range that has marked significant peaks in past cycles.

It’s important to note that while this forecast appears optimistic, the specific range used in the Fibonacci extension is open to interpretation. This means that different analysts might set slightly different ranges, which could lead to shifts in predicted peak points.

Regardless of current circumstances, there’s general agreement that Bitcoin could shatter previous records and reach new peak values by Q4 2024. As for X, another analyst believes Bitcoin has already formed a bullish breakout structure, moving beyond a downward trending channel or bull flag. Simultaneously, the prices are surpassing the resistance of a “cup and handle” pattern.

Institutions Buying As BTC Recovers

If bulls dominate and drive prices upwards, this trend would validate the profits achieved in Q1 2024. Such a move would signify the return of bullish sentiment, a positive indicator after the significant 30% decline from the March peaks.

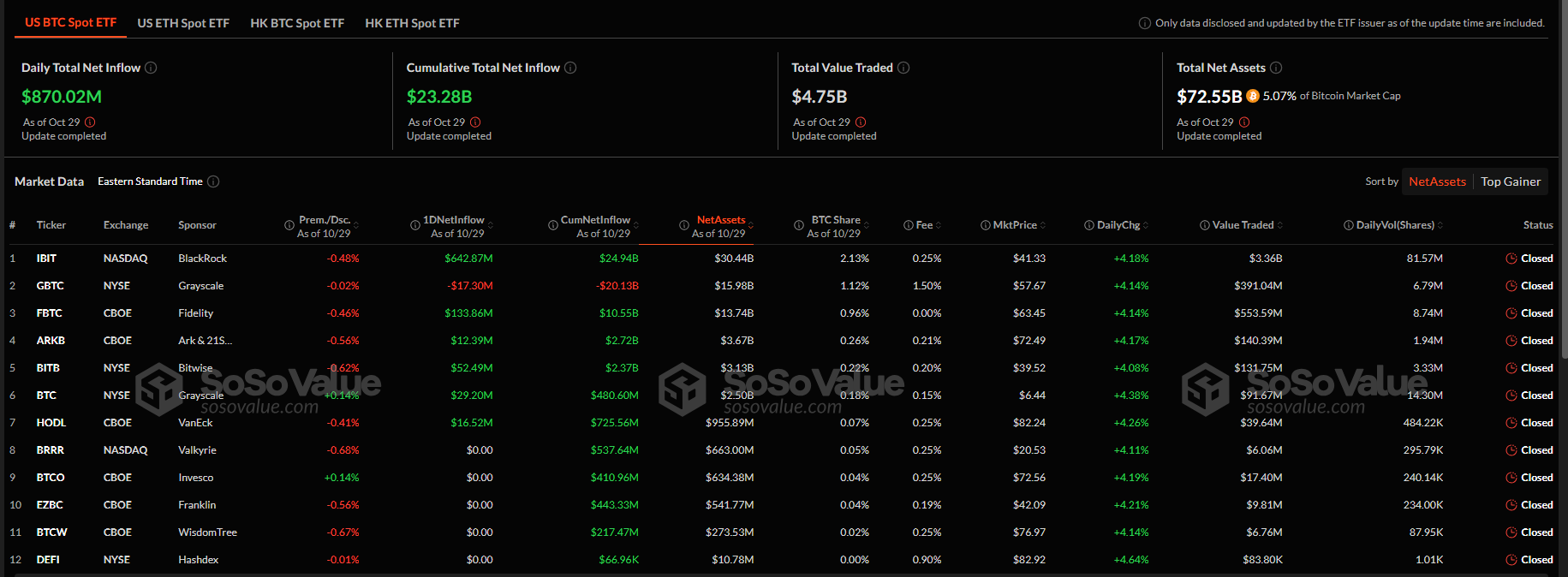

In the midst of widespread positivity, institutions have been joining the fray, gaining visibility through investment in spot Bitcoin Exchange-Traded Funds (ETFs). As reported by SosoValue, these institutions are witnessing significant influxes as they purchase increased shares for their clients.

On October 29th, U.S.-based Bitcoin ETF providers purchased approximately $870 million in shares tied to Bitcoin for their customers’ portfolios. BlackRock’s IBIT specifically acquired $642 million, significantly increasing their managed Bitcoin assets to over $24.9 billion.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-10-31 03:22