Hold onto your wallets, folks! In just five days, a whopping 60 companies decided to jump on the Bitcoin bandwagon! 🚀 Between June 9 and 13, these corporate titans added thousands of BTC to their balance sheets, revealing plans for billions more. It’s like a financial buffet, and everyone’s going for the Bitcoin dessert! 🍰

Six New Bitcoin Treasuries Open Doors

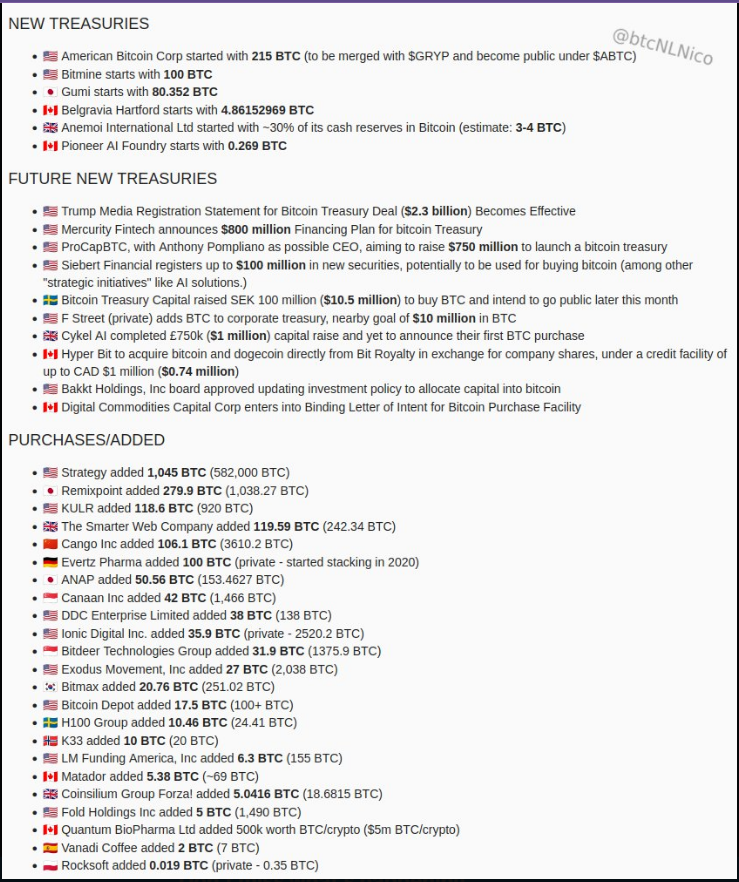

According to our buddy @btcNLNico on X, six firms have opened shiny new Bitcoin treasuries, adding a total of 404 BTC in just one week! American Bitcoin Corp is leading the charge with a hefty 215 BTC purchase, all while preparing for a public merger under the ABTC ticker. Talk about a corporate makeover! 💼✨

Week 24 – #Bitcoin Treasury Strategy Updates

June 9-13 saw a massive 60 announcements!

– 6 new treasuries launched with 404 BTC

– 10 future treasuries announcements

– 23 companies added bitcoin, totaling 2,188 BTC

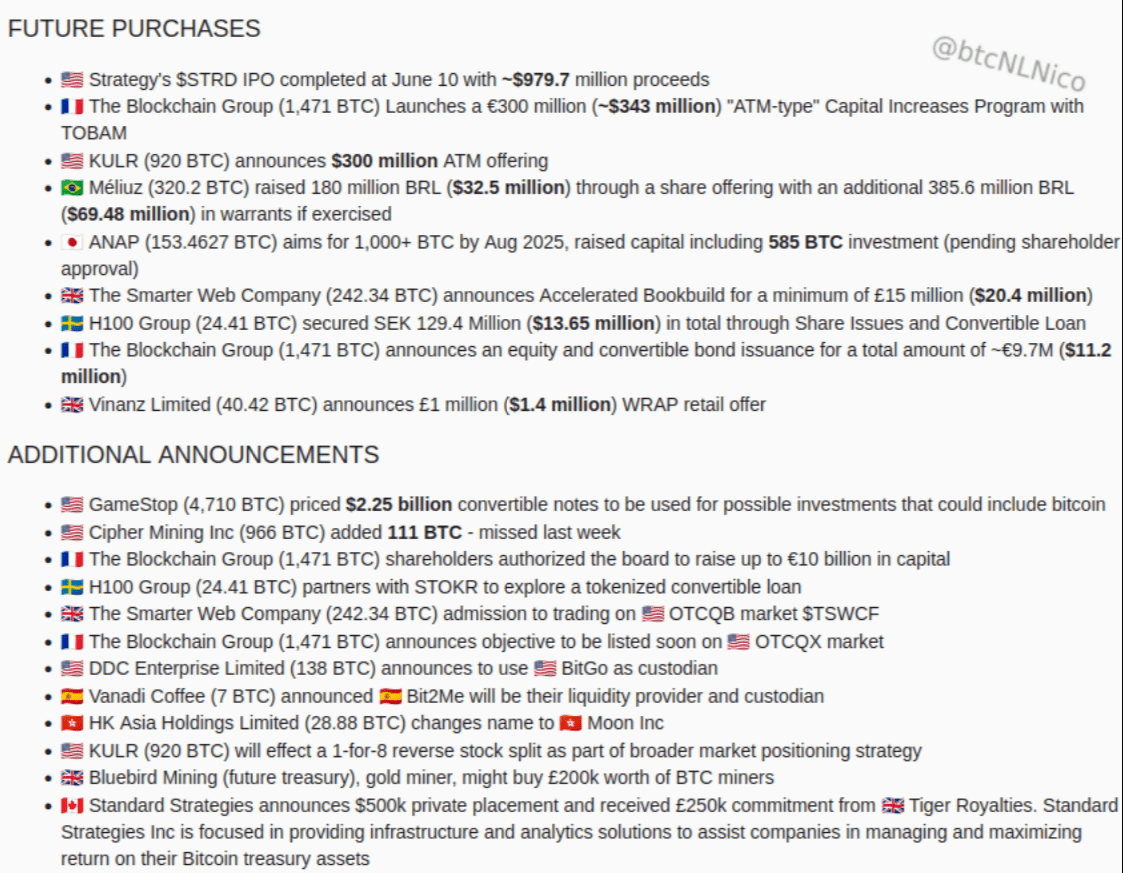

– 9 plans to buy more bitcoin, up to ~$1.83 billion…

— NLNico (@btcNLNico) June 14, 2025

Bitmine and Gumi have also made their grand entrance into the corporate Bitcoin club! 🎉 And guess what? Ten companies—including Mercury Fintech, which just unveiled an $800 million financing plan—are filing paperwork to set up their own Bitcoin reserves. Even Trump Media, yes, that Trump, is in on the action with a $2.3 billion Bitcoin Treasury deal! Can you believe it? 🤯

Existing Holders Expand Their Stakes

Twenty-three firms are not just sitting on their Bitcoin; they’re piling on more! They added 2,188 BTC to their existing stacks. Strategy was the busiest bee, buzzing in with 1,045 BTC and closing a $979.7 million IPO on June 10. Remxpoint, KULR, and Cipher Mining also joined the party, while smaller players like Vanadi Coffee and Rocksoft chipped in with a few BTC each. Every little bit counts, right? ☕💼

This buying frenzy is reminiscent of the Bitcoin ETF rush—BlackRock’s IBIT fund alone saw nearly $1 billion in inflows during the same period. It’s like a financial stampede! 🐂💨

Plans Point To $1.83 Billion In Future Buys

Nine companies are already plotting their next Bitcoin heist, potentially fueling $1.83 billion in fresh demand! ANAP is raising funds for a 585 BTC purchase, while Mélioz is bringing in $32.5 million and setting up warrants that could lead to another $69.48 million in Bitcoin. GameStop is even getting in on the action with a $2.25 billion convertible note issue for crypto investments. Who knew gaming could be so lucrative? 🎮💸

Asset Tokenization And Capital Raises Take Shape

Some firms are going beyond just buying Bitcoin. DDC Enterprise and H100 Group are planning to tokenize real-world assets and use Bitcoin as collateral. Meanwhile, the Blockchain Group in France has kicked off a €300 million capital program, aiming to raise up to 10 billion euros. It’s a financial revolution, folks! 🌍💥

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2025-06-17 00:07