As a researcher with experience in the cryptocurrency market, I’ve seen firsthand how volatile Bitcoin can be and how quickly sentiment can shift from bullish to bearish. The recent crash from the all-time high price above $73,000 has caused a wave of fear among traders, leading many to place short trades on BTC in anticipation of further price declines.

The price of Bitcoin keeps experiencing dramatic swings since plummeting from its peak value over $73,000. This downward trend has sparked pessimism among investors, leading many to sell off their Bitcoin holdings in anticipation of further drops. Consequently, these traders face potential losses if the Bitcoin market rebounds and resumes its bullish trend.

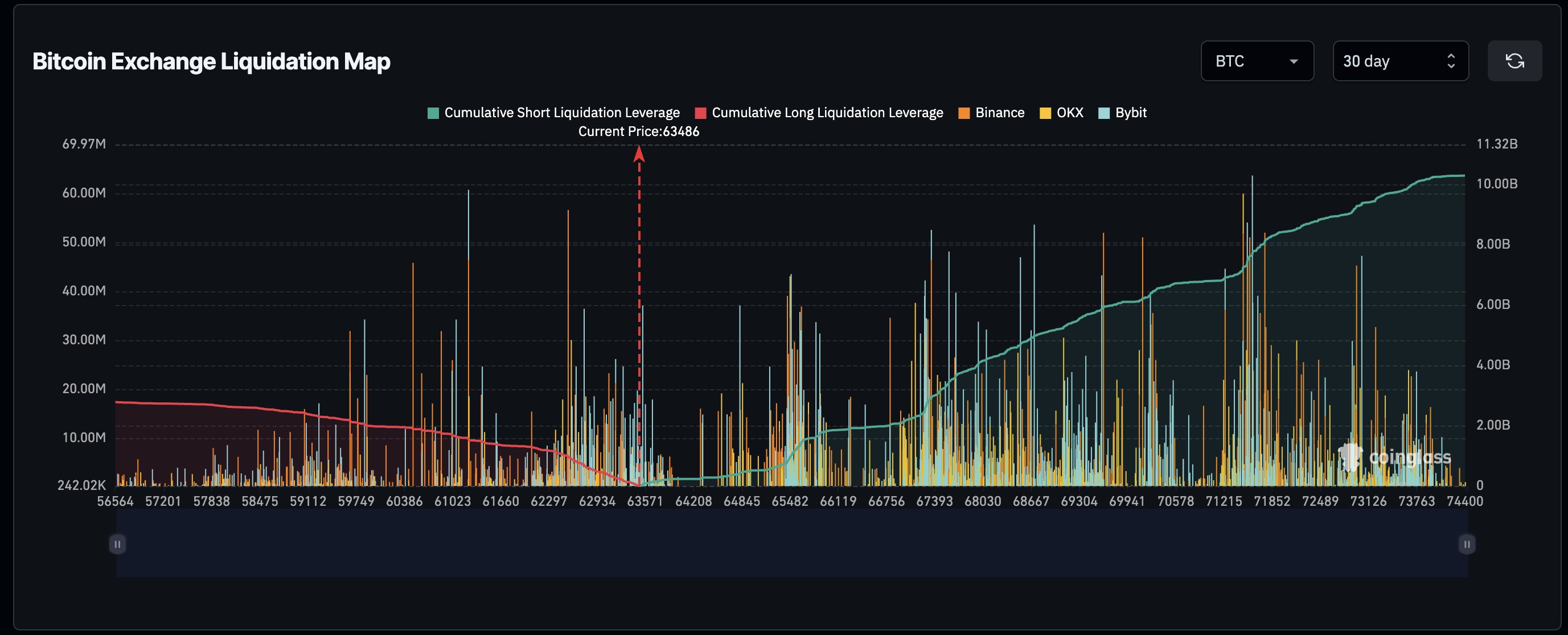

Bears Will Lose $7.2 Billion If Bitcoin Reclaims All-Time High

In a recent post on X, previously known as Twitter, cryptocurrency analyst Ash Crypto disclosed an intriguing Bitcoin trend. A screenshot accompanying the post indicates a significant volume of short positions opened on Bitcoin, suggesting that some traders anticipate further price decreases.

Currently, these investors seem correct as Bitcoin has yet to surpass the $67,000 mark. But, they face significant losses if Bitcoin manages to break through this resistance and continues climbing. Based on Ash Crypto’s analysis, there are approximately $7.2 billion in short positions for Bitcoin, which would be liquidated if the cryptocurrency reached a new record high above $74,000.

Currently, the Bitcoin price had bounced back above $66,000 earlier, triggering a surge of pessimistic sentiment among investors. Yet, it appears that these bears have managed to bring down the BTC price, which now hovers around $64,000 at present.

Due to recent price drops, bears have grown more confident, anticipating that Bitcoin’s value will continue to decline. The risk of liquidation has escalated as the BTC price falls. According to Coinglass, if Bitcoin recovers and sets a new all-time high above $44,000, bears would incur over $10 billion in losses.

BTC Bulls Are Not Giving Up

As a market analyst, I’ve noticed that while bears are celebrating the price drop of Bitcoin, bulls remain unfazed. They’ve actually been using this decline as an opportunity to buy more coins and add to their holdings. This trend has been particularly noticeable among Bitcoin whales, who have acquired approximately 1.4% of the total supply within the last month.

According to Santiment’s latest report, within the past four weeks, Bitcoin megawhales (those with a stash between 1,000 and 10,000 BTC) have accumulated approximately 266,000 Bitcoins. The total expenditure for their acquisitions amounts to an impressive $17.8 billion.

Due to their continuous acquisition, approximately 1,000 to 10,000 significant Bitcoin holders currently control around 25.16% of the total existing Bitcoins. The population of these whales is increasing, as noted by Santiment, reaching the “Highest bullish sentiment among the crowd since the peak week in early March.”

Currently, Bitcoin is fighting against bearish forces to maintain its position above the $63,000 mark. The cryptocurrency has experienced a decrease of 4.05%, bringing its price down to $63,600 as of now.

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- The First Descendant fans can now sign up to play Season 3 before everyone else

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-04-26 02:10