As an analyst with over two decades of experience in traditional finance and cryptocurrency markets, I must admit that the current Bitcoin surge is reminiscent of a rollercoaster ride—one that I find myself eagerly strapped into. The recent breakout above $71,000 has sparked my interest, and I believe we are on the precipice of a historic move for Bitcoin.

Bitcoin is nearing a significant milestone, reaching beyond $71,000 for the first time yesterday, which has sparked optimism among experts who predict further gains in the upcoming weeks, as we approach the U.S. election—a time known for increased volatility and market fluctuations.

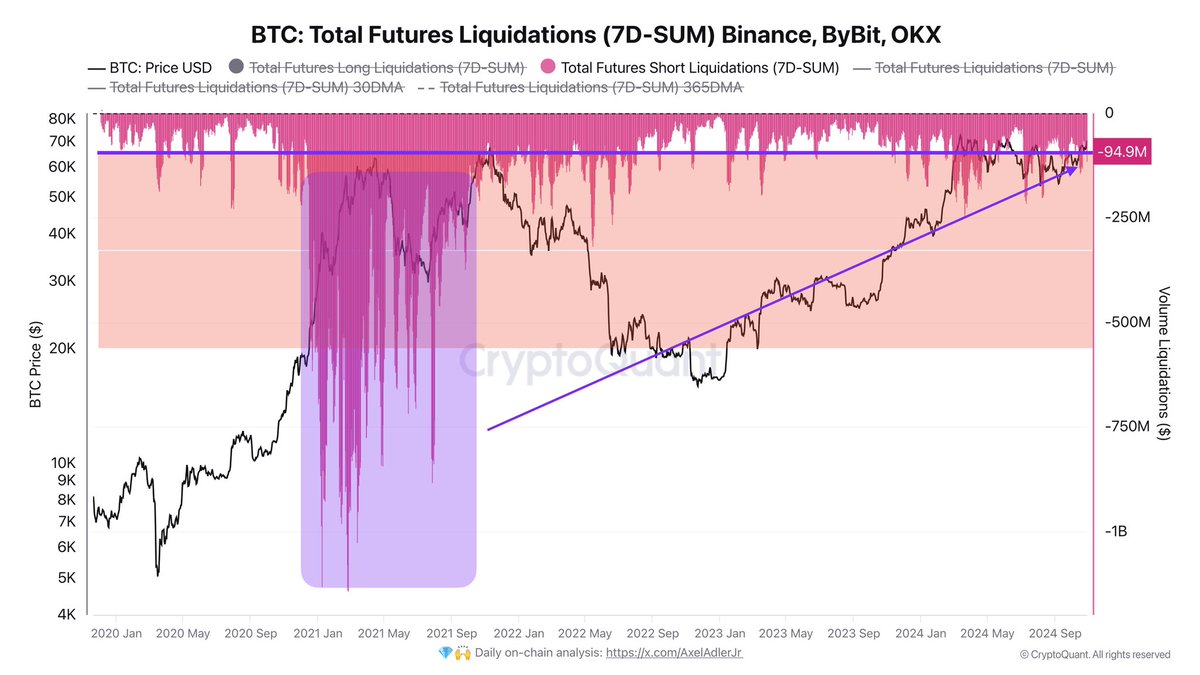

The data from CryptoQuant shows that the Open Interest has reached an impressive $22.6 billion. Interestingly, about half of these positions are held by investors betting on a decrease in Bitcoin price, known as bears. If Bitcoin continues to rise, this situation could lead to a significant risk of short sellers being forced to liquidate their positions. This could, in turn, intensify the buying pressure even more as the price surges beyond $71,000.

Over the coming days, we’ll see if Bitcoin can maintain its upward momentum or if it will enter a phase of consolidation below its record high. Investors are keeping a close eye on these price points, as a clear breakout could indicate even higher prices for Bitcoin in the future. However, if there’s a pause in this trend, it might be a sign that more consolidation is needed before a significant move occurs.

Bitcoin Bears In Serious Trouble

Bitcoin short-sellers could be in trouble as large amounts of shorts are positioned just above the $71,000 mark, potentially leading to forced liquidations. This situation, according to prominent analyst and macro investor Axel Adler, might spark a strong upswing if numerous short positions are liquidated simultaneously. Such momentum could push Bitcoin past its record highs, as suggested by Adler who posted a CryptoQuant chart on platform X, highlighting that the Bitcoin Open Interest has soared to $22.6 billion, with half of these holdings being short positions.

In Adler’s perspective, the existing market setup is ready for a significant increase in price. He advises not to hesitate in getting rid of short positions to boost the price, as a series of such actions beyond $71,000 might serve as a platform for Bitcoin to soar, reaching unprecedented price exploration territories. This phenomenon, referred to as a “short squeeze,” happens when heavily leveraged short sellers are compelled to close their positions due to the influx of large buy orders, which in turn further pushes the prices upward.

If this situation develops, it’s not just Bitcoin that would see gains. With Bitcoin dominating the market, a surge beyond its previous peaks might herald the start of a brand-new cycle for the entire cryptocurrency sector. Often, altcoins mirror Bitcoin’s movements, and the positive impact could spark a widespread bullish trend, pushing numerous assets to new record highs.

Observers are keeping a close eye on this development, as it might spark fresh curiosity and financial commitment in the cryptocurrency sector, potentially attracting both individual and institutional investors. Given that Bitcoin is nearly at its price discovery stage, the coming days could be crucial in determining the market’s trajectory.

BTC Testing Cruial Supply

The price of Bitcoin is currently testing the resistance zone around $71,200, which represents a potential barrier before it hits its record high. The bulls seem to be in charge, suggesting that there might be a breakthrough above this level soon. Maintaining and surpassing the $70,000 mark is crucial for further price increases because it serves as a strong psychological indicator that encourages more investors to jump on board.

From my perspective as an analyst, temporarily pulling back to accumulate liquidity at lower demand zones seems advantageous for Bitcoin’s overall uptrend. A potential dip to around $69,000 or even $66,500 would be consistent with a bullish outlook. This dip could spark additional interest and establish a solid foundation for the next surge toward new record highs. These levels would provide an opportunity for Bitcoin to collect liquidity before making a more powerful move upward.

Investors are keeping a close eye on the situation since surpassing $71,200 might open up opportunities for prices to reach new record highs. If this breakthrough is achieved, it could rekindle market momentum, igniting a widespread bullish trend with Bitcoin taking the lead.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Overwatch 2 Season 17 start date and time

2024-10-30 00:04