As a seasoned researcher with extensive experience in the cryptocurrency market, I have witnessed countless volatility-driven liquidation events in the derivatives market. The latest Bitcoin rally above $63,000 has brought about yet another significant liquidation wave, with short positions taking the brunt of the damage.

The cryptocurrency derivatives market has experienced a notable surge in liquidations following Bitcoin‘s price rise beyond $63,000.

Bitcoin Rally Has Resulted In Short Liquidations On Derivatives Market

Based on information from CoinGlass, the recent market volatility in cryptocurrencies has resulted in significant forced closures of contracts in the derivatives sector. In other words, when a contract suffers substantial losses, the platform takes action to end the contract, which is what we mean by “liquidation.”

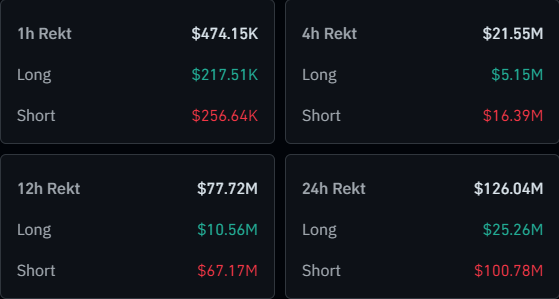

The table below shows how the derivatives liquidations have looked during the last 24 hours:

Approximately $101 million worth of cryptocurrency derivative contracts with a bearing to sell, have been liquidated in the last 24 hours. The total liquidations amounted to around $126 million.

As a researcher examining market trends, I can tell you that this figure represents over 80% of the overall investment pool. Consequently, those who wagered on a bearish market outlook suffered the most significant losses due to recent volatility. This is not unexpected given the widespread positive returns we’ve seen in various assets, with Bitcoin leading the charge during this period.

In simpler terms, when a large number of sell orders lead to the forced buying of assets by short sellers, this phenomenon is often referred to as a “short squeeze.”

When a squeeze occurs, forced liquidations add to the market momentum, amplifying the price movement that triggered them. Consequently, the recent dramatic price increase can be attributed, in part, to this short squeeze effect.

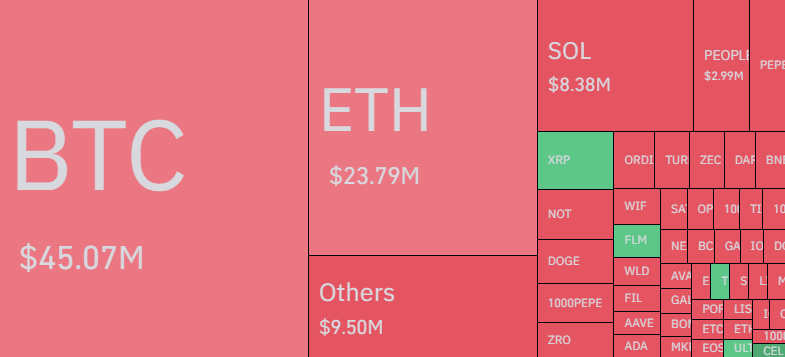

From my perspective as a researcher, it appears that the recent market squeeze resulted in approximately $45 million worth of liquidations for Bitcoin, making it the leading symbol once again.

In simpler terms, Ethereum (ETH) and Solana (SOL) are the next two largest players in the crypto market with $24 million and $8 million worth of liquidations each. Surprisingly, unlike most other cryptocurrencies that have experienced a surge in short liquidations, XRP (XRP) in fourth place has seen more long positions activated instead. This could be due to XRP’s sideways movement compared to the upward trend of other coins.

BTC Has Managed To Reclaim The $62,000 Support Level

As a crypto investor, I’ve witnessed an impressive bounce-back from Bitcoin during the recent rally. The cryptocurrency’s price momentarily soared past the $63,000 mark earlier today.

The chart below shows what the coin’s surge has looked like:

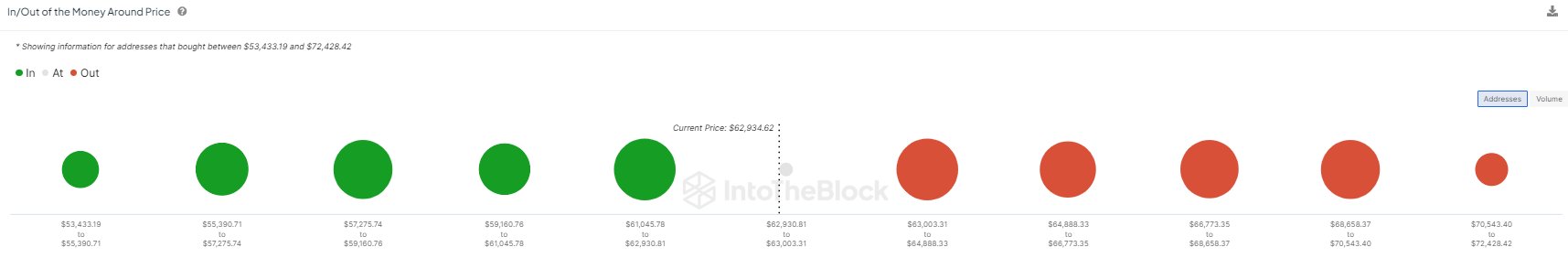

As a researcher analyzing data from the market intelligence platform IntoTheBlock, I’ve observed that Bitcoin currently hovers above a notable on-chain support level of $62,000. Despite robust resistance levels above this price point, the bullish momentum could potentially outweigh selling pressure.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-07-15 21:04