Prominent cryptocurrency analyst Crypto Rover has issued a warning, causing unease in the Bitcoin market. He predicts a possible liquidation event, which may lead to losses for those holding short positions.

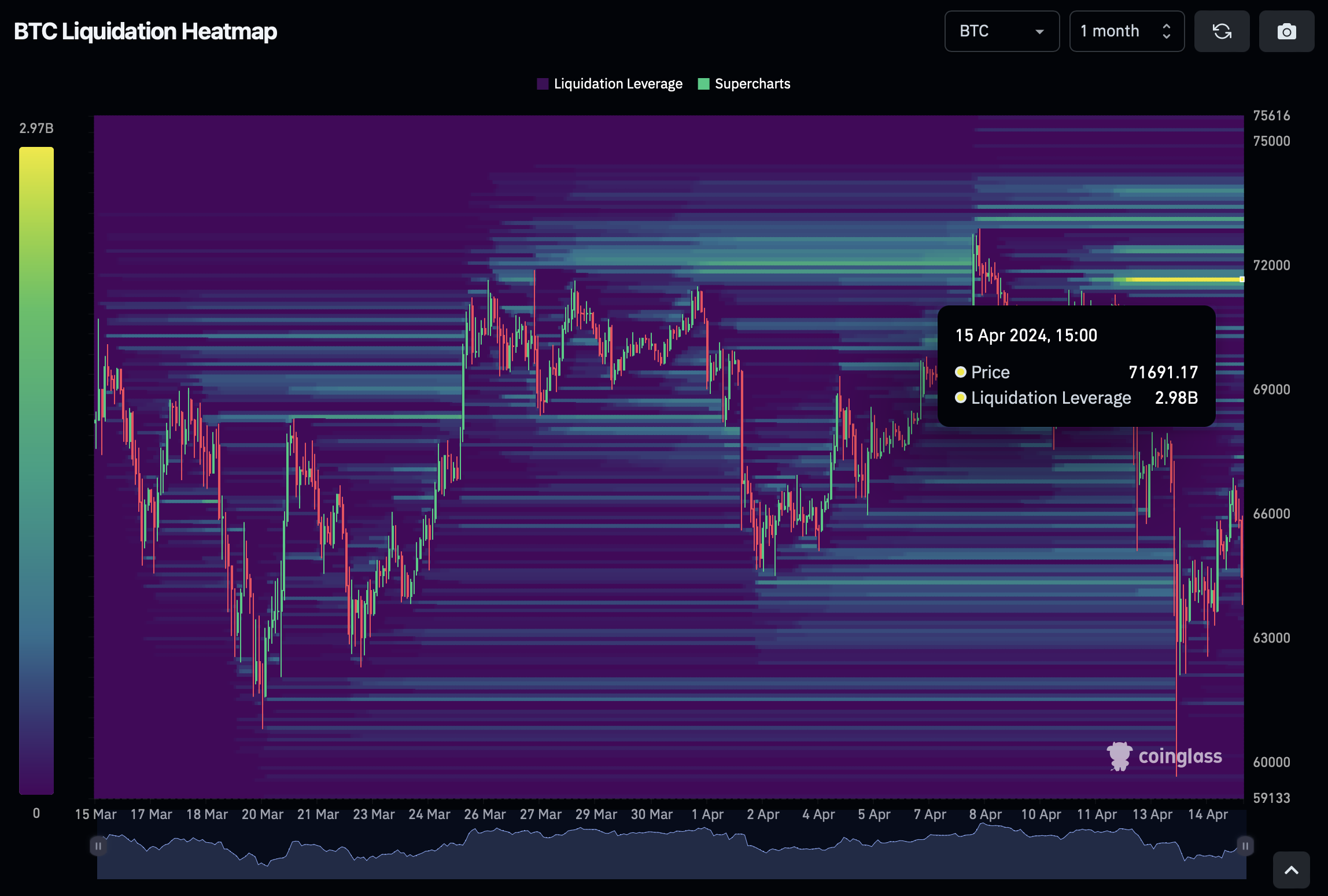

According to Rover’s analysis, Bitcoin is currently in a period of consolidation. If Bitcoin’s price were to rebound and reach a certain level, around $3 billion worth of short positions might be liquidated.

Bitcoin Bears Beware Of This Price Range

Based on information from CoinGlass, a trusted source for derivative market data, Rover identifies the $71,600 mark as significant. If Bitcoin reaches this price, Rover predicts a $3 billion short position liquidation will ensue.

Crypto Rover’s latest alert follows a chaotic stretch in the cryptocurrency market, characterized by drastic price fluctuations and increased buying and selling.

On the weekend, Bitcoin underwent a sharp drop, causing its value to slide down to $62,000. However, there were indications of a rebound in the wee hours of Monday, with the asset momentarily peaking at $66,797 before retreating to its present price of $64,711.

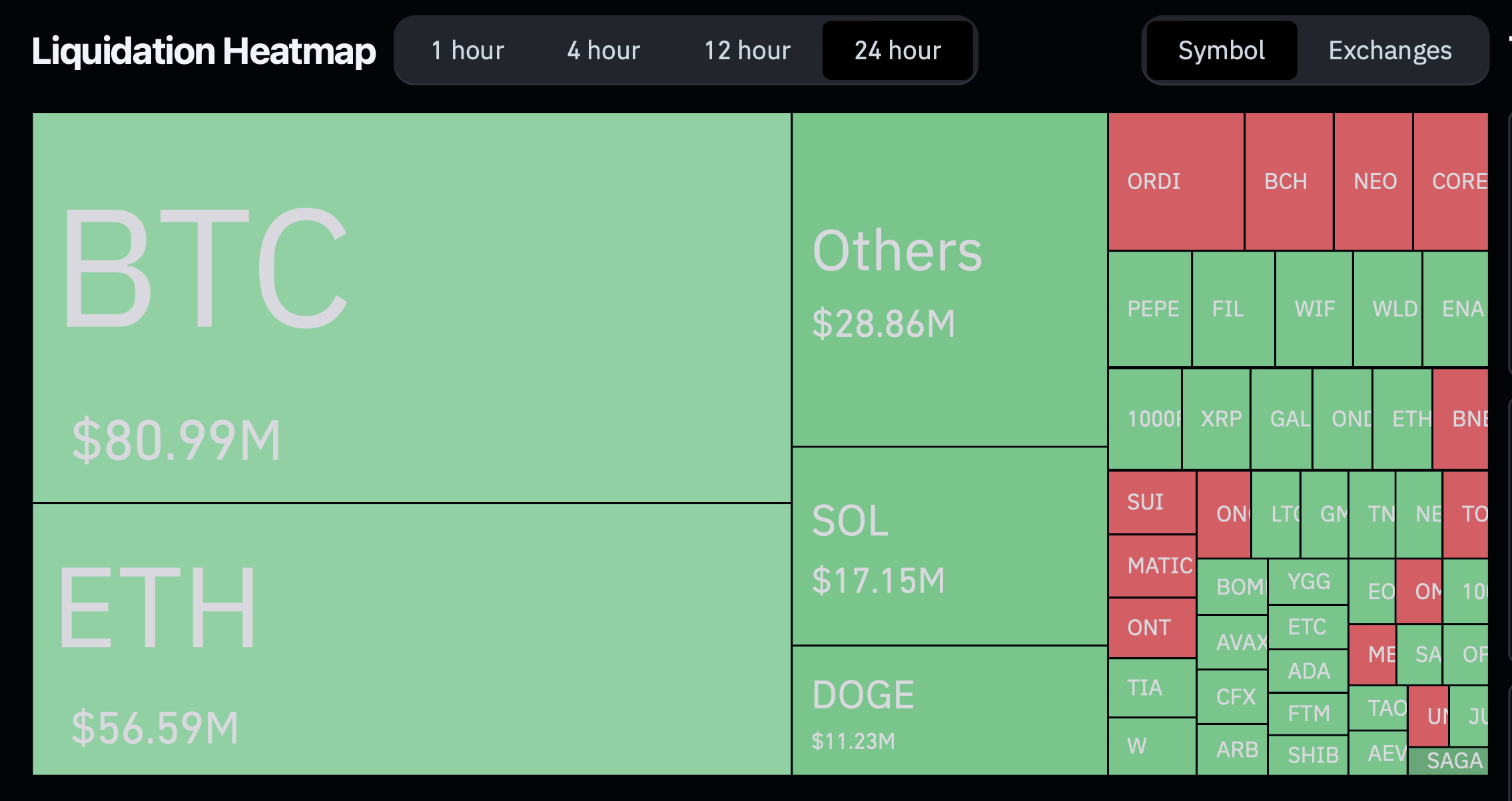

Over the weekend, a large drop in the market led to an unprecedented number of Bitcoin long positions being liquidated, totaling approximately $1.2 billion in just one day, as reported by WhaleWire.

Recent Market Slump Wipes Out Over $1.2 Billion in Bitcoin Long Positions, Surpassing Previous Record of $879 Million.

Today, more Bitcoin bulls have been liquidated than on any day in the last 15 years.

Another reason why buying up…

— WhaleWire (@WhaleWire) April 13, 2024

In the last 24 hours, Coinglass reports that 89,151 traders have had their positions closed for a loss, amounting to a total of $266.1 million.

Analyst Insights And Market Dynamics

Notable is the fact that Bitcoin has made a small comeback, following the news that Hong Kong authorities have given preliminary green light to financial institutions in launching Bitcoin and Ethereum ETFs for direct trading.

Crypto expert Willy Woo has expressed his thoughts on how Bitcoin ETFs might influence market behavior based on his analysis.

Based on Woo’s analysis, the introduction of new Bitcoin ETFs might result in substantial price increases. Estimates suggest a minimum target of $91,000 during bear markets and a maximum target of $650,000 during bull markets.

According to asset manager predictions, investing in new Bitcoin ETFs could lead to price goals of $91,000 during a bear market and $650,000 in a bull market, assuming all ETF investors fully commit their resources.

These are very conservative numbers. #Bitcoin will beat gold cap when ETFs have…

— Willy Woo (@woonomic) April 15, 2024

Woo’s research highlights the increasing importance of Bitcoin in institutional investing, as asset managers plan to devote a significant chunk of their resources to this cryptocurrency.

Woo notes that the estimated values for Bitcoin’s market capitalization mentioned earlier are on the cautious side. It’s possible that Bitcoin could surpass the value of the gold market if more funds flow into the cryptocurrency.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-04-16 07:20