The Great Bitcoin Tease: To Dance or Not to Dance?

Ah, Bitcoin, the capricious digital diva, continues to flirt with the $84,000 mark, teasing us with a tantalizing twirl only to step back into the shadows. It’s a pas de deux with destiny, as our cryptic ballerina refuses to don her tutu and leap past $90,000. For over two weeks, she’s been rehearsing the same steps, leaving us to wonder if she’ll ever perform the grand jeté to new heights.

Since January’s crescendo, our dear Bitcoin has been caught in an enigmatic embrace with uncertainty, as traders, like overzealous directors, scrutinize the stage of macroeconomic conditions and the looming specter of the Federal Reserve’s policy decisions. Will the music of the markets play a tune favorable to our digital swan? Only time, and perhaps a bit of Bulgakovian magic, can tell.

The Binance Bazaar: A Surge of Sentiment! 🎢

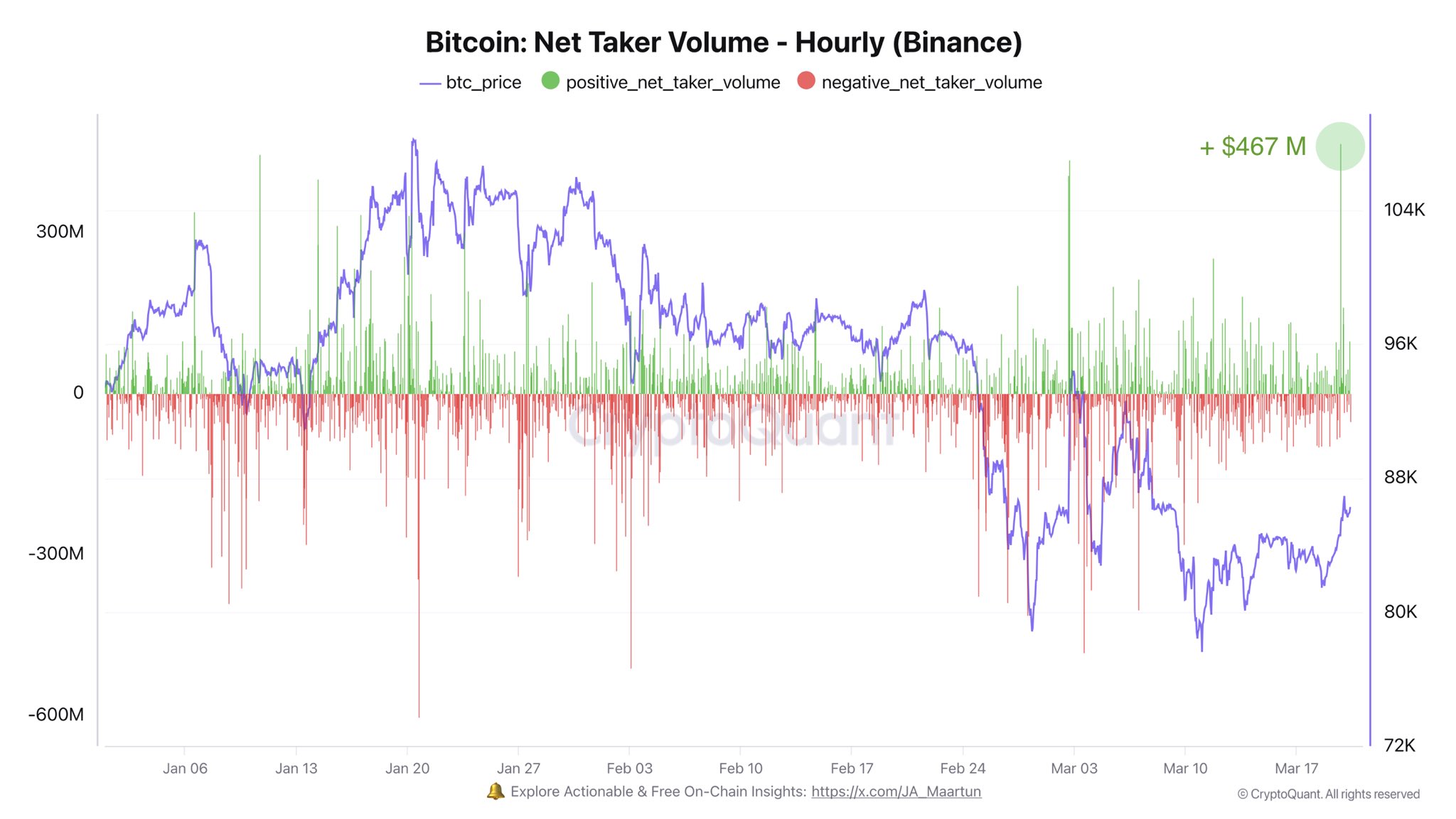

Amidst the Bitcoin ballet, a curious phenomenon has emerged from the depths of Binance, the grand bazaar of cryptocurrency exchanges. Darkfost, our modern-day soothsayer armed with the arcane tools of on-chain analysis, has detected a veritable tsunami in net taker volume. A $467 million spike in a mere hour—a figure that would make even the Master and Margarita raise an eyebrow—has marked the zenith of 2025’s trading fervor on this digital stage.

This metric, a barometer of trader sentiment as delicate as the wings of a butterfly, fluttered upwards just as the High Priests of the FOMC prepared to unveil their latest proclamations. Could it be that the traders are waltzing in anticipation of a favorable financial forecast? Or is it merely a minuet before the market’s next grand act?

Buying pressure from Binance traders might be back. 🚀

— Binance, the CeX with the highest trading volume, is particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and…

— Darkfost (@Darkfost_Coc) March 20, 2025

Whales in the Wings: Preparing for a Plunge or a Leap? 🐳🌊

Enter EgyHash, the cautious conductor of the cryptocurrency orchestra, who warns us that the whales are circling. The Exchange Whale Ratio, a measure as ominous as the arrival of Woland in Moscow, has surged to heights unseen in over a year. This, dear friends, is the sound of large holders shuffling their digital fortunes towards the exchanges, a prelude that could herald a storm of selling or a symphony of profit-taking.

As Bitcoin continues her cautious pirouettes, the question on everyone’s lips is whether the market will follow the lead of the whales or the tunes of the takers. Will the scales tip towards newfound demand or the siren call of supply from the cryptocurrency leviathans? Only the blockchain knows for sure, and it’s notoriously tight-lipped.

So, dear spectators, keep your eyes on the digital stage, where fortunes are made and lost in the blink of an eye. Will Bitcoin lead us in a triumphant march to new price peaks, or will she leave us in the lurch, pondering the mysteries of the market? Stay tuned, for the next act in this cryptocurrency drama promises to be as unpredictable as a Bulgakov novel! 🎭

Read More

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Is Average Joe Canceled or Renewed for Season 2?

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- KPop Demon Hunters 2: Co-Director on if Sequel Could Happen

2025-03-22 14:50