As an experienced financial analyst, I’ve seen my fair share of market rallies and crashes. The recent volatility in the Bitcoin price has been intriguing, to say the least. After a significant drop below $60,000, the premier cryptocurrency bounced back above that level last Friday, raising questions about its potential for a sustained rally.

Last Friday saw a robust recovery for Bitcoin‘s price after enduring heavy bearish influence during the previous week. Specifically, on May 1st, the leading cryptocurrency dipped beneath the $60,000 threshold for the first time since late March.

On Friday, May 3rd, Bitcoin’s price rebounded and surpassed the $60,000 mark, peaking at $63,000 within the past day. Yet, the query remains – will Bitcoin’s price maintain an upward trend after this most recent surge?

How Long Will The BTC Price Rally Last?

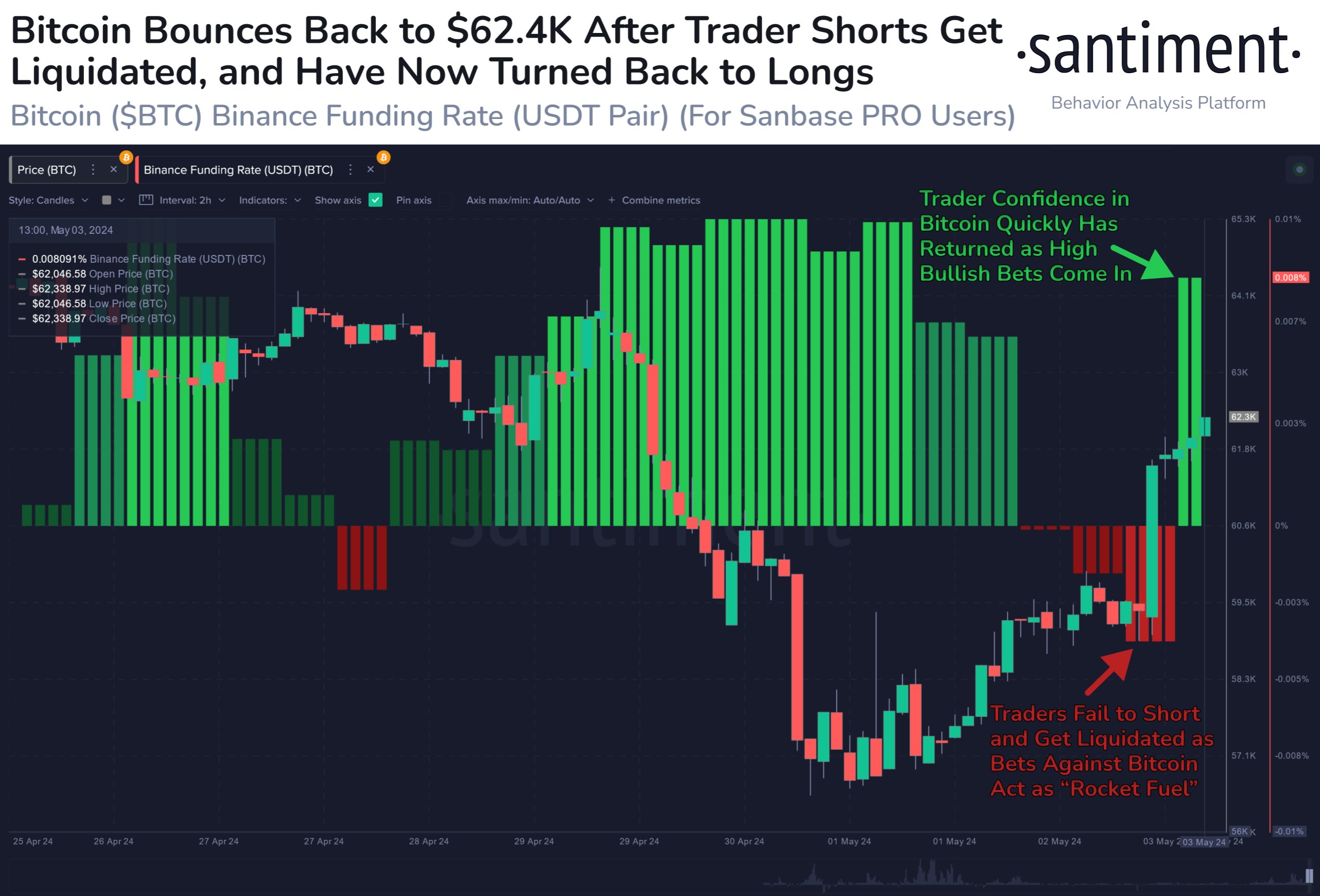

As a crypto investor closely monitoring the Bitcoin market, I’ve noticed an intriguing development based on Santiment’s recent analysis on the X platform. According to their on-chain analytics, there has been a significant shift in investor sentiment and trading positions following Bitcoin’s surge above $62,000. Specifically, traders on Binance have started to move from holding liquidated short positions to opening long positions. This trend indicates a growing bullish sentiment among investors, potentially signaling further price increases for Bitcoin.

Although this change in attitude towards Bitcoin may indicate heightened positivity among its supporters, Santiment issued a cautionary note for investors closely monitoring the digital currency’s price and considering entry into the market. In their statement, the blockchain company advised:

To keep the rally going strong, it’s important that fear of missing out (FOMO) doesn’t escalate beyond its current level.

As a researcher studying financial markets, I’ve come across the concept of FOMO, or “fear of missing out.” This phenomenon occurs when investors feel compelled to buy in-demand assets rapidly due to the fear of missing out on potential profits. In the short term, this can indeed push up asset prices. However, if FOMO becomes excessive, it may lead to unsustainable bullish trends that eventually give way to downturns.

Contrarily, cryptocurrency prices often go against the grain of popular belief. For instance, if most investors anticipate Bitcoin to surge, it might instead decrease in value.

Behind The Bitcoin Price Surge

From my perspective as an analyst, the current price of Bitcoin is approximately $62,871, representing a noteworthy 6% surge over the past 24 hours. The underlying cause for this recent Bitcoin price rise remains elusive. However, intriguing on-chain indicators suggest that recent whale transactions could be responsible for fueling the bullish trend.

As an analyst, I’ve come across an intriguing revelation from Ki Young Ju, CEO and founder of CryptoQuant, in a recent post. He disclosed that a large group of Bitcoin investors, often referred to as “whales,” purchased approximately 47,000 BTC within a single day. Despite this significant acquisition, Ju emphasized that not all these addresses can be attributed to ETF-related investments.

#Bitcoin whales accumulated 47K $BTC in the past 24 hours. We’re entering a new era.

— Ki Young Ju (@ki_young_ju) May 3, 2024

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-04 09:40