As a seasoned crypto investor with a decade of experience under my belt, I’ve seen the ups and downs of the market like the changing seasons. Today, watching Bitcoin (BTC) reach an all-time high while Ethereum (ETH) struggles against it, brings back memories of the early days when BTC was the only player in town.

When Bitcoin hit an unprecedented peak of $98,310 today, the value of Ethereum compared to Bitcoin, represented by the ETH/BTC trading pair, dropped to its lowest in years. This has sparked discussions about Ethereum’s position as the second-largest digital currency.

What’s Causing Ethereum’s Underperformance Against Bitcoin?

Reaching a fresh all-time high earlier today, Bitcoin now hovers around $98,000 – just shy of the significant $100,000 milestone. However, this consistent strength in Bitcoin has led to a less favorable performance for alternative cryptocurrencies like Ethereum throughout the year.

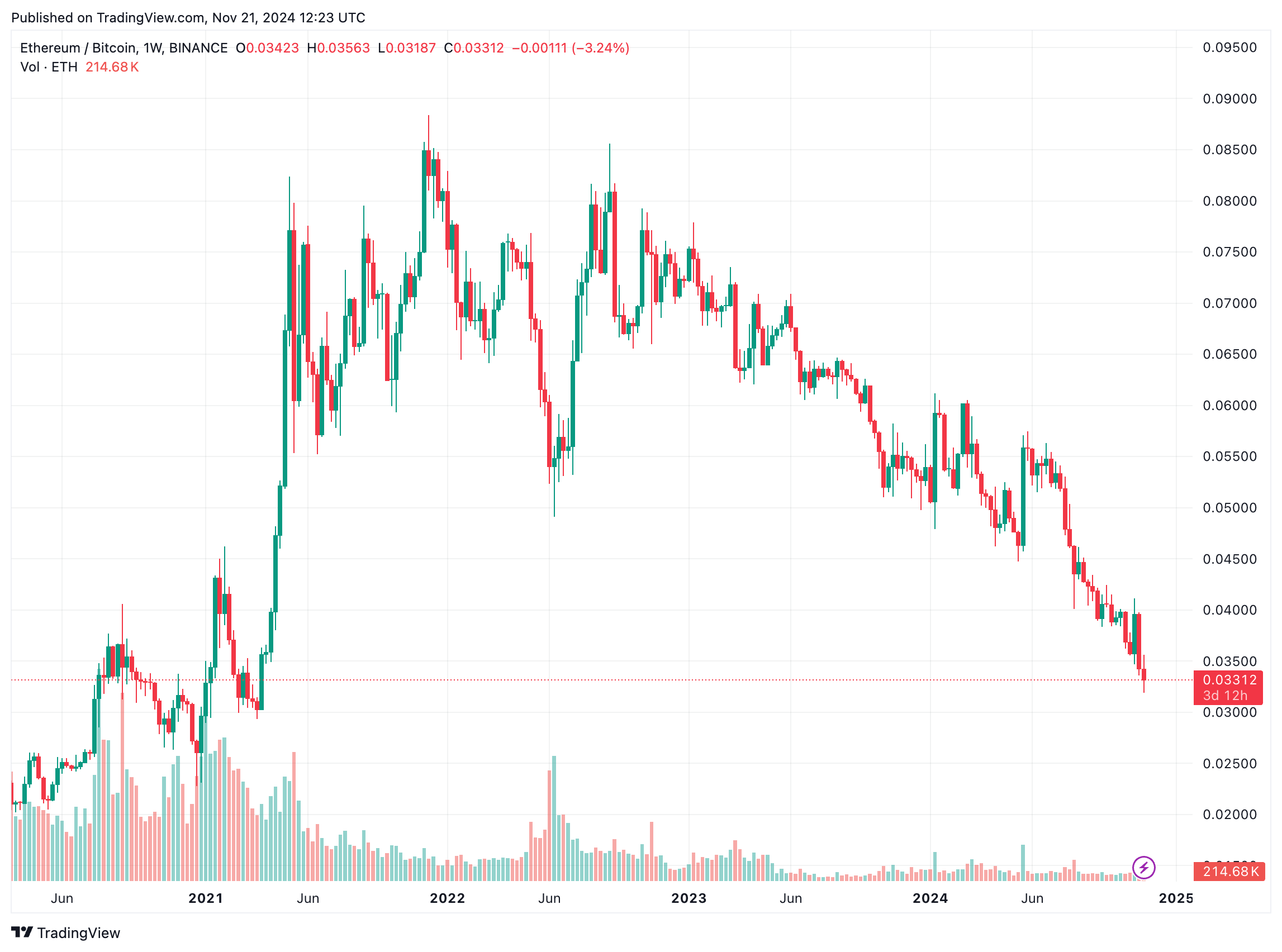

The weekly chart illustrates that the ETH/BTC trading pair has plummeted to its lowest point in several years, reaching 0.0331 – a level last observed in March 2021. Since December 2021, it has struggled to establish a new peak, indicating a decrease of approximately 60%.

As a crypto investor, I’ve noticed a steep increase in our pair’s losses since last summer of 2024, which seems to align with Bitcoin’s price spike. This surge appears to be fueled by growing enthusiasm among investors, particularly those supporting the pro-crypto Republican candidate, Donald Trump, in the U.S. presidential election.

The surge in popularity of Bitcoin Exchange Traded Funds (ETFs) has boosted institutional interest in Bitcoin (BTC), making it a preferred choice among cryptocurrencies. Currently, these BTC ETFs collectively manage over $100 billion in assets.

Although Ethereum ETFs have secured regulatory approval, they’ve yet to replicate the achievements of Bitcoin ETFs. To illustrate, U.S.-listed spot Ethereum ETFs have amassed merely $8.96 billion in total net assets thus far.

Beyond other aspects, the upcoming Bitcoin halving in April 2024, which decreases miner rewards from 6.25 Bitcoins to 3.125 Bitcoins, continues to emphasize the scarcity storyline of BTC. On the flip side, Ethereum’s increasing issuance rate causes some analysts to challenge its claim as a “digital gold” or “ultrasound money.

Beyond these factors, the Bitcoin halving event in April significantly reduced miner rewards from 6.250 BTC to 3.125 BTC, thus emphasizing the digital currency’s scarcity narrative even more. Conversely, Ethereum’s increasing issuance rate has led certain analysts to challenge its claim as a “digital gold” or “ultrasound money.

When Will Ethereum Recover Losses Relative To BTC?

As the ETH/BTC exchange rate plummets to fresh bottoms, investors in Ethereum are keenly awaiting signs of a price recovery for ETH. Multiple experts have weighed in on this topic, providing their predictions about when Ethereum might regain its lost value.

The crypto expert known as CryptoGemRnld has pointed out two robust areas of potential support: a trendline area and a demand region. As per this analyst’s assessment, since 2017, the ETH/BTC pair has tended to recover from these points, frequently marking the start of altcoin rallies.

Just like experienced trader Peter Brandt, it is being proposed that the Ethereum to Bitcoin (ETH/BTC) ratio could be nearing its lowest point. According to Brandt’s analysis, there might be a possible turnaround in December, marking the start of an upward trend for this trading pair.

Backing this perspective, the latest figures demonstrate that Ethereum (ETH) might be trading below its actual value. The minimal transfer of ETH to trading platforms, combined with a scarcity of substantial selling, indicates that investors who favor ETH are anticipating more price hikes.

Moreover, it’s worth noting that Ethereum (ETH) Exchange-Traded Funds (ETFs) have experienced substantial investments, totaling approximately $515 million from November 9 to November 15. As we speak, ETH is trading at around $3,333, marking a 7.4% increase in the past 24 hours.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- How to Update PUBG Mobile on Android, iOS and PC

- Brody Jenner Denies Getting Money From Kardashian Family

2024-11-22 12:40