There’s a potential threat of a shortage in the world’s leading cryptocurrency due to an unexpected surge in demand for U.S. Spot Bitcoin Exchange Traded Funds (ETFs). By December 2024, the amount of Bitcoin acquired through these ETFs was three times greater than the amount mined that month, highlighting a significant imbalance between the supply and demand of Bitcoin.

Spot Bitcoin ETFs Trigger Supply Shock Risks

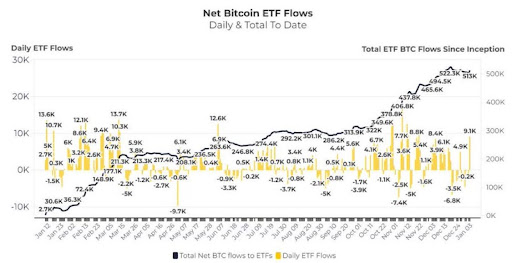

In December 2024, US Spot Bitcoin ETFs bought a staggering 51,500 Bitcoins. Interestingly, Bitcoin miners only produced 13,850 coins during the same period as shown by Blockchain.com data. This suggests that the Bitcoin ETFs accounted for nearly four times the amount of Bitcoin mined and made available to the market in that month.

Based on recent accounts, the desire for Exchange-Traded Funds (ETFs) in December was unprecedented, surpassing the existing stock by a staggering 272%. This explosive growth in demand for Spot Bitcoin ETFs has sparked worries about an imminent Bitcoin supply shortage, with experts predicting that this could occur quite soon.

To put it simply, Lark Davis, a cryptocurrency analyst, warned earlier in December about an upcoming major shortage of Bitcoin supply. His prediction was based on the large amount of Bitcoin being acquired by US Spot Bitcoin ETFs. Davis revealed that during December, these ETFs had purchased approximately 21,423 Bitcoins, while miners were only producing around 3,150 Bitcoins at roughly the same time.

In summary, it’s worth noting that as of December 17, 2024, Bitcoin Exchange-Traded Funds (ETFs) worldwide collectively held around 1,311,579 Bitcoins. This represents approximately 6.24% of the total BTC supply of 19.8 million. Given this significant amount, which is valued at about $139 billion, analyst Davis predicts that during intense bull market periods, Spot Bitcoin ETFs could potentially control between 10-20% of the total BTC supply. This projection raises further concerns about a potential massive disruption in the Bitcoin market due to a significant increase in supply.

Concentration Of Spot BTC Inflows In December

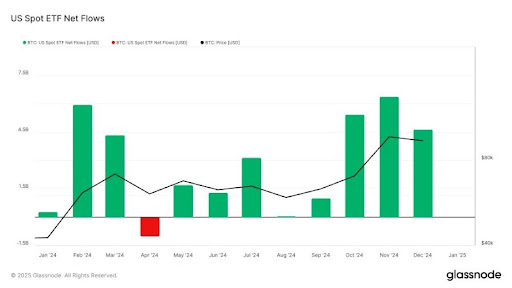

According to data from Glassnode, spot Bitcoin ETFs experienced a total net inflow of approximately $4.63 billion in December, which is nearly double their average monthly intake for 2024 of around $2.77 billion. Interestingly, Glassnode reported that the increase in investments into spot Bitcoin ETFs was primarily observed during the first half of the month, whereas the latter half saw withdrawals, with December 26 being the only exception to this trend.

It’s no wonder that the increase and subsequent decrease in Bitcoin ETF investments mirror Bitcoin’s price fluctuations in December. Towards the start of the month, Bitcoin saw an uptrend, reaching a record high of over $108,000 on the 17th, driven by the excitement of the bull market and rising demand. But after this peak, Bitcoin’s value dropped sharply, a fall that corresponded with the timing of large withdrawals from Spot Bitcoin ETFs, as reported by Glassnode.

Despite a rise in interest for Spot Bitcoin ETFs in December, it appears that investors have prolonged their pattern of buying Bitcoin into January 2025. On the 3rd of January alone, investors bought approximately $900 million worth of Bitcoin through these ETFs. More recently, US Spot Bitcoin ETFs have added another 9,500 Bitcoins to their holdings, which is equivalent to over $966 million at the current market price.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2025-01-08 03:04