As a seasoned analyst with over two decades of experience in traditional and digital markets, I have seen my fair share of market anomalies, bull runs, and bearish corrections. The current state of Bitcoin is reminiscent of a chess game where both optimistic and cautionary pieces are poised, ready to make their moves.

Bitcoin surged more than 10% in the last week and reached $60,000 again on Friday. After a shaky start in September, this sudden increase in price from the crypto’s leading market has sparked optimism among investors. Nevertheless, an analyst at Cryptoquant with the handle CRYPTOHELL cautions that the bullish trend could be facing resistance due to conflicting factors pushing the Bitcoin market towards a critical juncture.

Bitcoin Market Forces At A Standstill – What Next?

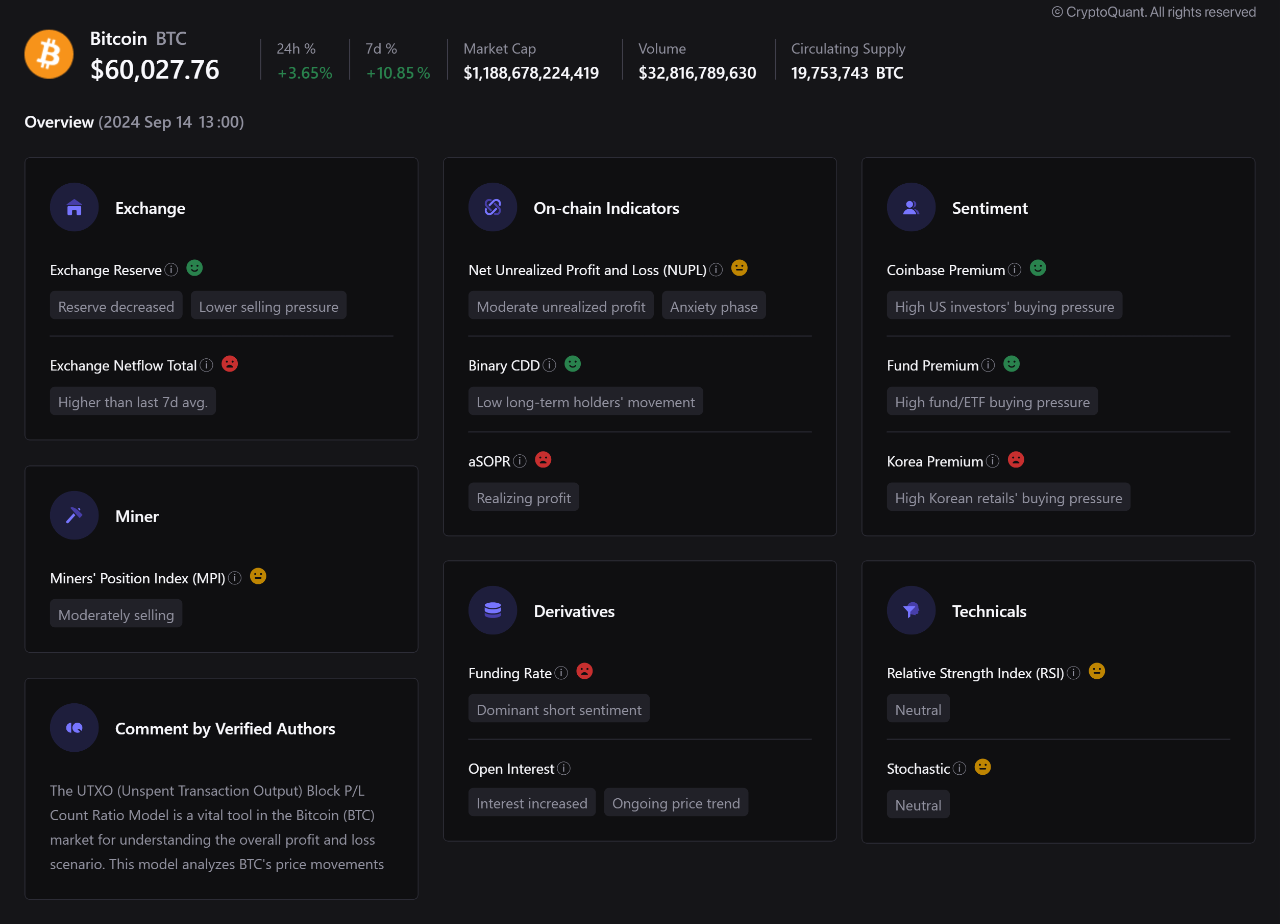

In a Quicktake post on Saturday, CRYPTOHELL stated that the current Bitcoin market presents both optimistic and cautionary signals.

On a optimistic note, the crypto analyst points out that there’s been a reduction in BTC exchange reserves, suggesting less selling pressure since investors choose to keep their Bitcoins, hoping for an increase in price later on. This positive outlook is reinforced by a robust interest from US investors, as demonstrated by the high demand for Bitcoin spot ETFs and reflected in indicators like the Coinbase Premium Index.

Alternatively, CRYPTOHELL states there are market developments that may require investors to apply some caution.

Initially, it’s pointed out that the amount of Bitcoin being exchanged has been above average during the past week, potentially signaling strong selling activity. Additionally, the Adjusted Spent Output Profit Ratio (aSOPR), a crucial tool for gauging market sentiment, suggests that investors are gradually cashing out their profits, which could mean increased selling pressure on Bitcoin.

Moreover, this pessimistic outlook is reinforced by unfavorable borrowing costs in the futures market, suggesting that numerous traders are opening leveraged short trades in expectation of a price decrease.

In this situation, both optimistic (bullish) and pessimistic (bearish) factors coexist, causing unease among many Bitcoin investors as they struggle to predict the digital asset’s direction. Interestingly, long-term investors remain relatively inactive, which is a strong indication of continued support for bullish sentiments.

To summarize, CRYPTOHELL suggests that the Bitcoin market has reached a critical juncture. With technical signs showing a balanced stance, the direction of future price fluctuations may heavily depend on substantial shifts in market opinions and noteworthy events related to adoption or regulatory matters.

BTC Leverage Ratio Hits New Yearly High

Speaking as an analyst here, I’ve noticed a noteworthy trend: The total Bitcoin leverage ratio across exchanges has hit a fresh annual high this year. This suggests that Bitcoin traders are increasingly venturing into riskier territories by opening more positions using borrowed funds. While leveraging can potentially magnify profits, it also carries the risk of substantial losses that could trigger widespread liquidations. Therefore, it’s crucial to exercise extra caution in the BTC market.

Currently, as I’m typing this, one Bitcoin is being traded for approximately $60,220, representing a slight decrease of 0.23% over the past day. It’s worth noting that the trading volume has decreased significantly by 51.83%, amounting to around $15.74 billion.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2024-09-15 12:22