As an analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The current state of Bitcoin, with its struggle to hold above $94K, reminds me of the dot-com bubble burst of 2000 – a period where euphoria turned into fear in the blink of an eye.

Currently battling to maintain the $100K threshold, Bitcoin’s recent pullback has sparked apprehension regarding its capacity to uphold crucial support points. As negative indicators prevail and liquidation spikes occur, the current price is approaching critical resistance areas.

Although there might be a potential decrease to around $70,000 in the near future, certain experts are hopeful for a positive trend that could lead to an uptick by 2025 in the long run.

Bitcoin Price Analysis Hints at $90K Breakdown

Failing to surpass the $100,000 level, a decline of approximately 3.71% occurred yesterday due to price rejection at $99,881, forming a large ‘bearish engulfing’ candlestick and concluding a significant bearish share pattern.

This week, despite some attempts at price recovery, Bitcoin’s trend remains bearish. Today, there has been a dip of 1.11% in the cryptocurrency market, lowering the BTC price to approximately $94,624.

This creates a second consecutive bearish candle and is testing the nearest crucial support level of $94,403. Meanwhile, it is also approaching the 50-day EMA line, priced at $93,170.

As I analyze the current market trends, it appears that the bearish sentiment is gaining momentum. The Daily Relative Strength Index (RSI) has dipped below the midpoint, signaling a potential prolongation of the downtrend. Despite occasional rebounds, the 50-day Exponential Moving Average (EMA) serves as the last line of defense before we approach another test at the $90,000 support level.

In the recent 24-hour period, there’s been a significant drop in the crypto market, with a total of $251 million worth of positions being liquidated. Interestingly, around $200 million of those losses were sustained by investors who had taken long positions. This massive sell-off suggests a widespread selling trend, potentially setting the stage for a bearish beginning to 2025.

Expert Opinions on Bitcoin’s Future

As the possibility of Bitcoin returning to the $90K support level grows more likely, various market experts are advocating for a bearish outlook. For instance, in a recent tweet by Ali Martinez, an independent analyst, several voices are underscoring the ominous signs looming over Bitcoin’s price movement.

In a recent video, Tone Vays, a former Wall Street quant trader, is highlighting the current conditions in Bitcoin as cataclysmic. The analyst believes if Bitcoin starts to trade below the $95K level, it is going to turn very, very bad because it increases the possibility of Bitcoin extending the correction phase to the $73K level.

Similarly, renowned technical analyst Peter Brandt believes that Bitcoin is forming a widening triangle structure on its daily chart. Notably, the key support for this pattern is around the $90,000 level.

If Bitcoin’s price falls below its current level, there might be an opportunity for it to revisit the $70,000 range. According to our charts, a potential decrease could take it down to approximately $76,614.

Despite the technical analysts believing short-term correction, Thomas Lee has strengthened his view on Bitcoin reaching $250K in 2025. However, Chartered Market Technician Mark Newton estimates Bitcoin to take a downswing to $60K before the parabolic rise.

Lastly, according to Benjamin Coven’s prediction, it’s possible that the Bitcoin price could suddenly drop to around $60,000 close to Donald Trump’s inauguration day.

On-Chain Data and Key Levels

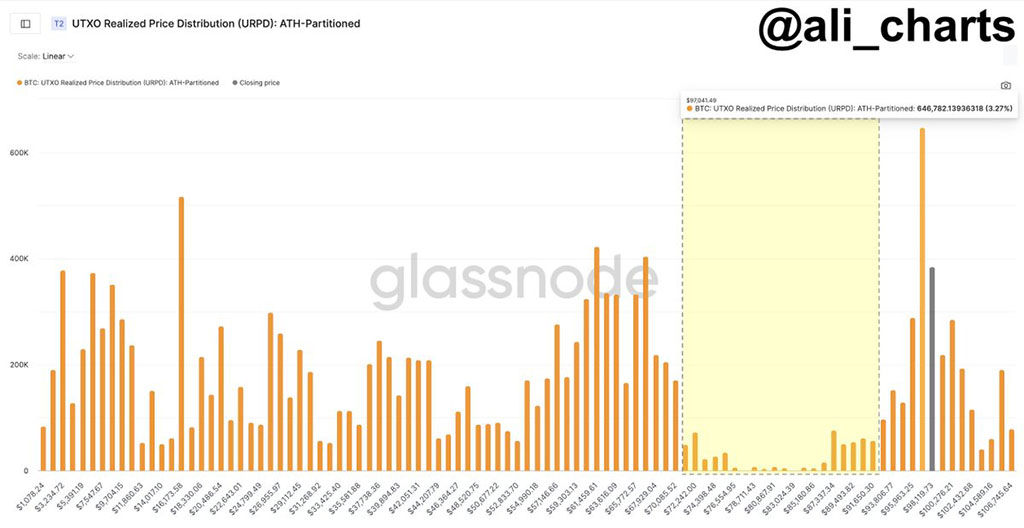

If Bitcoin’s price drops and trades below $93,806, data suggests that a potential downfall target could be around $70,000. Back on December 22, Ali Martinez pointed out a significant support area ranging from approximately $93,806 to $97,041.

According to the distribution of the UTXO Realized Price, if the crucial demand zone fails to withstand the pressure, the closest strong support can be found approximately at the level of $70,085.

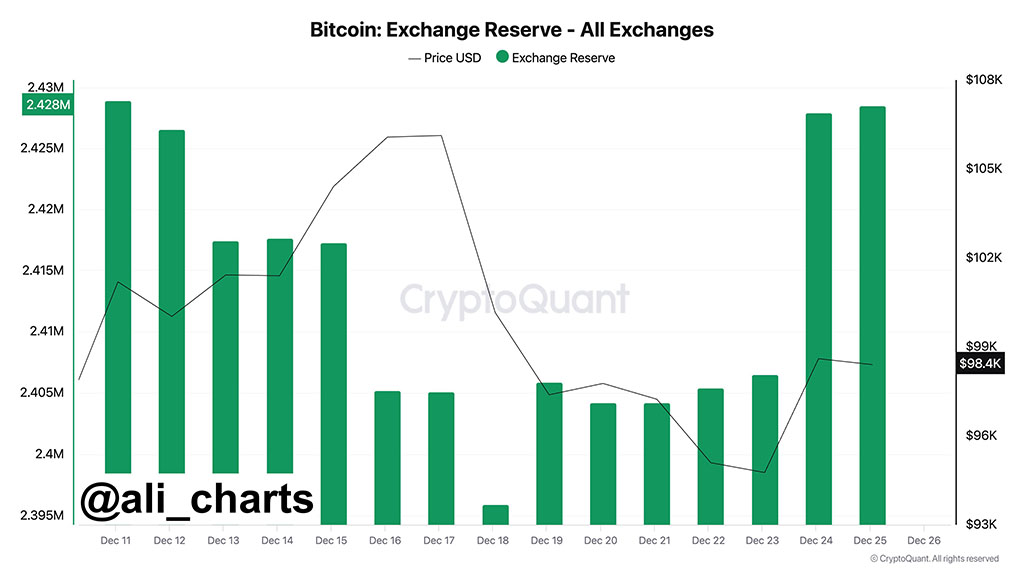

Over the last week, I’ve noticed a shift in the cryptocurrency market as I’ve been closely monitoring my investments. Smart crypto investors like myself have been moving approximately 33,000 Bitcoins to exchanges, which translates to a staggering $3.23 billion in today’s market.

Additionally, some individuals have begun to cash in their earnings as a staggering $7.17 billion in Bitcoin profits were made on the 23rd of December alone.

Conclusion

Experts such as Tone Vays and Peter Brandt indicate that Bitcoin could encounter significant resistance at approximately $94,403 and the 50-day Exponential Moving Average (EMA) around $93,170. If it falls below these levels, there’s a possibility of a retest towards $90,000 or even as low as $70,000.

Although temporary pessimistic factors are in control, there remains enduring optimism about the future, as some experts, such as Thomas Lee, forecast a steep increase up to $250K by 2025. It is essential for traders to keep a close eye on critical turning points to navigate through the current unpredictability.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-12-27 16:28