As a seasoned analyst with over two decades of experience navigating the ever-evolving financial landscape, I find myself increasingly intrigued by the corporate adoption of Bitcoin as a strategic asset. The recent move by Rumble to allocate part of its cash reserves to BTC is another compelling example in this growing trend.

The use of Bitcoin (BTC) by corporations is on the rise, as evidenced by Rumble’s recent announcement of a Bitcoin-focused treasury plan. This decision reflects a global trend of companies viewing Bitcoin as a valuable strategic resource.

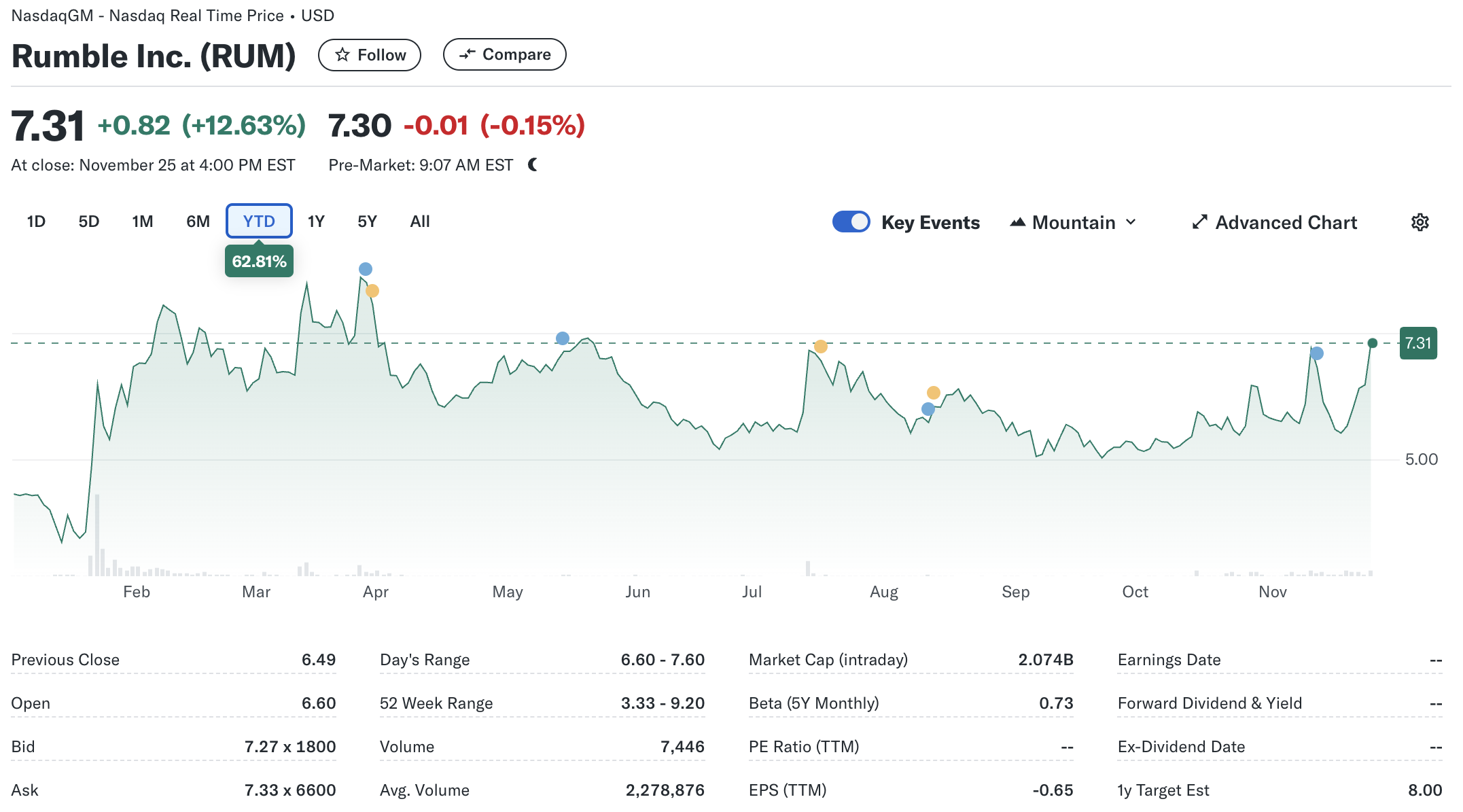

Rumble Announces Bitcoin Treasury Strategy, Stock Rises

The most recent firm entering the Bitcoin scene is none other than our YouTube rival, who has now endorsed a corporate plan for diversifying their treasury by investing some of their surplus funds in Bitcoin.

Under this approach, Rumble intends to invest up to $20 million in Bitcoin, viewing it as a strategic asset for future decision-making. In his own words, the CEO and Chairman of Rumble, Chris Pavlovski, elaborated on this move.

It’s our viewpoint that the global acceptance of Bitcoin is still in its initial phases, with this process picking up speed following the election of a pro-crypto US presidential administration and growing institutional interest. Unlike traditional currencies issued by governments, Bitcoin remains immune to devaluation due to unlimited money printing, making it a valuable tool for combating inflation and an advantageous asset for our treasury.

The firm announced that they will consider variables like market trends, the value of Bitcoin at exchange, and Rumble’s financial demands for buying Bitcoin, to decide when and how much to invest. They stressed though, that this plan might be adjusted, temporarily halted, or even abandoned.

It’s worth noting that the decision came after a survey by Pavlovski regarding X, where he posed the question about whether Rumble should invest in Bitcoin. A staggering 93% of the 43,790 participants expressed support for this idea.

Following the announcement, there was a significant rise in Rumble’s share price, demonstrating investors’ optimism. By the end of trading, the technology firm’s stocks were valued at $7.31 each, representing a notable daily increase of 12.63%.

BTC as a Corporate Asset: A Winning Strategy?

As a researcher, I find it intriguing how Rumble’s recent move to incorporate Bitcoin into their assets echoes MicroStrategy’s pioneering strategy in Bitcoin treasury management. In fact, just yesterday, the esteemed firm led by Michael Saylor announced the purchase of an additional 55,000 Bitcoins, boosting their holdings to a staggering $5.4 billion.

Remarkably, MicroStrategy’s strategic move towards Bitcoin has significantly boosted the company’s stock value. Over the past year, the price of MSTR has soared by a staggering 670%, surpassing both Bitcoin and the S&P 500 in terms of investment returns.

Currently, Metaplanet, a Japanese company, has surpassed 1,000 Bitcoins in its holdings, continually increasing its Bitcoin investments through regular purchases. Furthermore, rumors about tech giants such as Dell and Microsoft potentially entering the Bitcoin market could spark interest and potentially push the asset’s value to unprecedented levels.

According to a recent assessment by cryptocurrency specialists, Bitcoin (BTC) could potentially reach its eagerly awaited seven-digit value milestone as early as next year. At the moment of writing, BTC is trading at $92,071, representing a 5.5% decrease over the past day.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-27 06:05