As a researcher delving into on-chain Bitcoin analysis, I’ve noticed a recent downward trend in the Bitcoin Accumulation Trend Score. This shift could indicate that certain groups of investors are choosing to offload their Bitcoin holdings.

Bitcoin Accumulation Trend Score Is Currently Sitting At 0.21

On their latest blog post at X, Glassnode, a leading on-chain analytics firm, provides insights into recent trends in Bitcoin’s Accumulation Trend Score. This score serves as a signal indicating whether Bitcoin investors are currently accumulating or not.

The calculator determines its value not only by considering the fluctuations in investor wallet balances, but also by evaluating these changes relative to the size of their respective investments.

When this metric approaches 1, it signifies that significant nodes within the network or numerous small participants are contributing to a build-up phase. Conversely, if it’s close to 0, it suggests investors are in a dispersal stage where they are either selling or not actively purchasing.

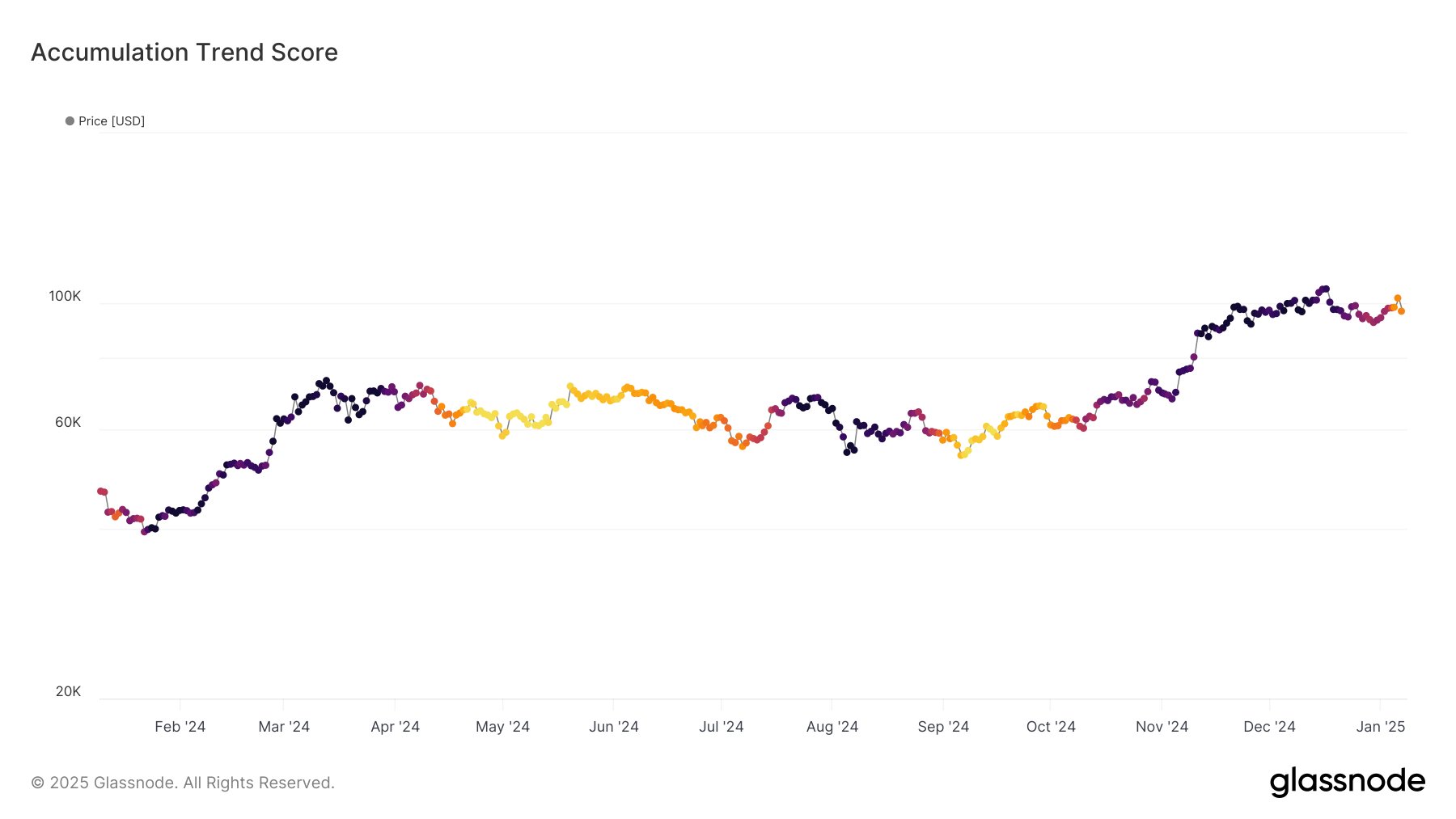

Presently, you can see a graph depicting the pattern of the Bitcoin Accumulation Trend Score during the last twelve months.

Here’s a chart that illustrates the evolution of the Bitcoin Accumulation Trend Score throughout the past year.

Both versions convey the same information in an easy-to-understand manner.

On the given chart, you’ll notice that deeper shades of blue or purple indicate higher values for the Bitcoin Accumulation Trend Score. Conversely, lighter shades of orange or red imply values nearer to zero.

Based on the graph, it seems clear that the Bitcoin Accumulation Trend Score became quite dark towards the end of 2024. This suggests that large investors (whales) have been actively purchasing a significant amount of Bitcoin, contributing to the surge towards the recently set record high price.

As we approach the year-end, investor contributions have been steadily decreasing. This year, however, the situation has drastically changed for the worse, with the indicator plunging to an all-time low of 0.21.

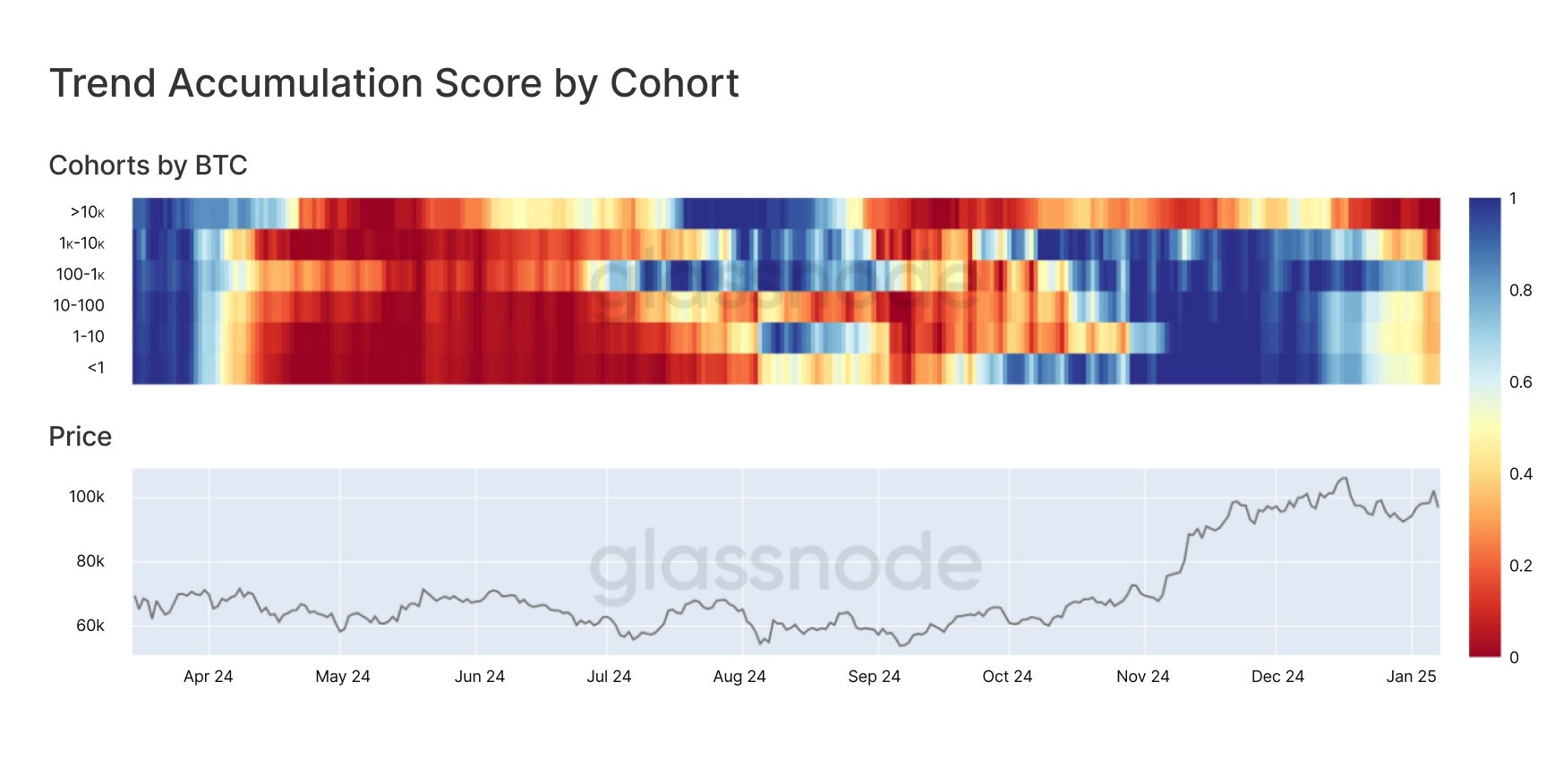

Glassnode has additionally disclosed information about a different form of the Accumulation Trend Score, which highlights the accumulation and distribution tendencies among Bitcoin’s multiple groups or categories.

According to the provided graph, it’s worth noting that the biggest players in the Bitcoin sector, often referred to as “mega whales,” have been offloading their BTC holdings since September. The rate of sell-offs has notably increased over the past few weeks, resulting in a heavier distribution of Bitcoin sales.

Initially, other groups were purchasing during the surge, but they’ve since shifted to offloading their assets. Interestingly, the significant investors (known as ‘whales’), who possess between 1,000 and 10,000 BTC, are currently engaged in a substantial wave of selling.

If the blue line on this graph continues without changing back to blue, it seems likely that Bitcoin will keep moving along its present downward trend.

BTC Price

At the time of writing, Bitcoin is trading around $93,900, down more than 3% in the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-01-10 12:40