As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself increasingly intrigued by the recent trends in the market. The meteoric rise of Bitcoin and other large-cap assets is reminiscent of the digital gold rush that began a few years ago. However, this time around, there seems to be a more substantial foundation supporting these gains.

Over the last week, I’ve observed a remarkable surge in the value of Bitcoin, consistently reaching new peak prices. Likewise, notable cryptocurrencies like Ethereum, Solana, and Cardano have shown significant upward momentum over the past few days. It’s been quite an exciting period for these digital assets!

It’s worth noting that recent analyses of blockchain transactions indicate that the cryptocurrency market, specifically Bitcoin, might still have room to grow. This prediction arises from the fact that investors appear to be increasingly holding onto their investments instead of quickly cashing out for immediate profits.

Bitcoin Investors Continue To Load Their Bags

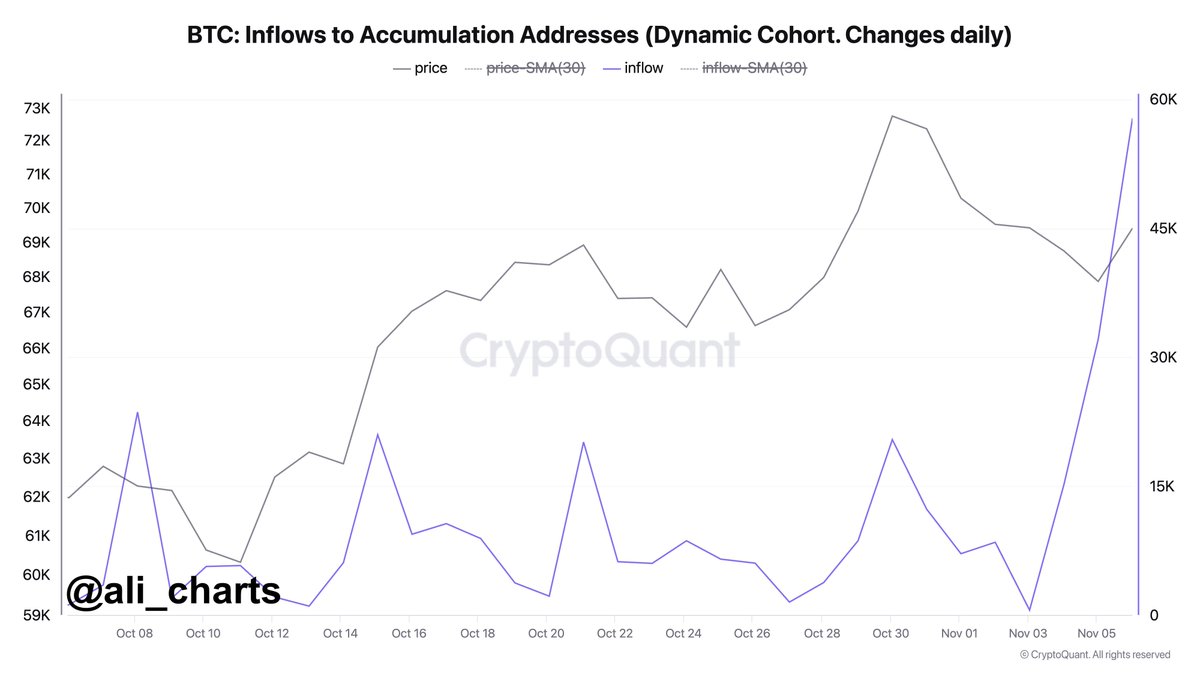

As an analyst, I recently noticed a surge in Bitcoin inflows to accumulation addresses, as observed through CryptoQuant’s “Inflows to Accumulation Addresses” metric, on the X platform, where popular crypto pundit Ali Martinez shared this insight.

As an analyst, I would define accumulation addresses as those that primarily receive Bitcoin without sending it out, or at least have not spent their holdings for a specific duration. These addresses should also meet two additional criteria: they must have received at least two separate incoming transactions, and they should possess more than 10 Bitcoins. Typically, these types of Bitcoin addresses are managed by significant entities such as whales, institutional investors, and other major players within the market.

Based on CryptoQuant’s reports, an astounding 57,800 Bitcoins worth around $4.16 billion have been transferred to accumulation wallets since November 3rd. As the graph indicates, Bitcoin inflows to these storage addresses have been steadily increasing over the past few weeks.

Generally speaking, this upward trajectory is a promising indication for the value of BTC, which has been quite volatile lately. Holding onto BTC instead of selling it suggests an increased belief in its long-term growth potential. This could mean that significant investors anticipate further increases in the price of Bitcoin, the pioneering cryptocurrency.

Currently, the Bitcoin price hovers approximately at $76,550, showing a minimal 1% rise within the last day. Yet, it has surged over 10% in value over the course of the past week.

USDT Netflow On Exchanges Surpasses $2 Billion

Based on a recent article on the CryptoQuant platform’s Quicktake, there’s been a substantial increase in the USDT stablecoin moving into centralized exchanges. The on-chain data indicates that this coin’s net inflows have surpassed $2 billion, which is its highest level since late December 2022.

A larger holding of stablecoins (which frequently signal greater liquidity) implies substantial purchasing power among investors, boosting their demand. If this surge in exchange liquidity aligns with increased accumulation, it might have a favorable influence on the price of Bitcoin.

Read More

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Paradise Season 2 Already Has a Release Date Update

- Who Is Christy Carlson Romano’s Husband? Brendan Rooney’s Job & Kids

- What Happened to Daniel Bisogno? Ventaneando Host Passes Away

- Why Is Ellie Angry With Joel in The Last of Us Season 2?

- Why Was William Levy Arrested? Charges Explained

- Arjun Sarja’s younger daughter Anjana gets engaged to long-term boyfriend; drops dreamy PICS from ceremony at Lake Como

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

2024-11-09 21:40