As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of market ebbs and flows. The current situation with Bitcoin is reminiscent of a rollercoaster ride that keeps me on the edge of my seat. Just when we thought we were reaching for new highs, the market took a sudden dip, sending us back to the drawing board.

Bitcoin is currently facing difficulties, trying to regain the significant $100,000 level after a swift change in investor sentiment. Not long ago, optimism was prevalent, with prices soaring towards new records. However, the tone has drastically changed, as fear has spread across the market due to a sudden price correction.

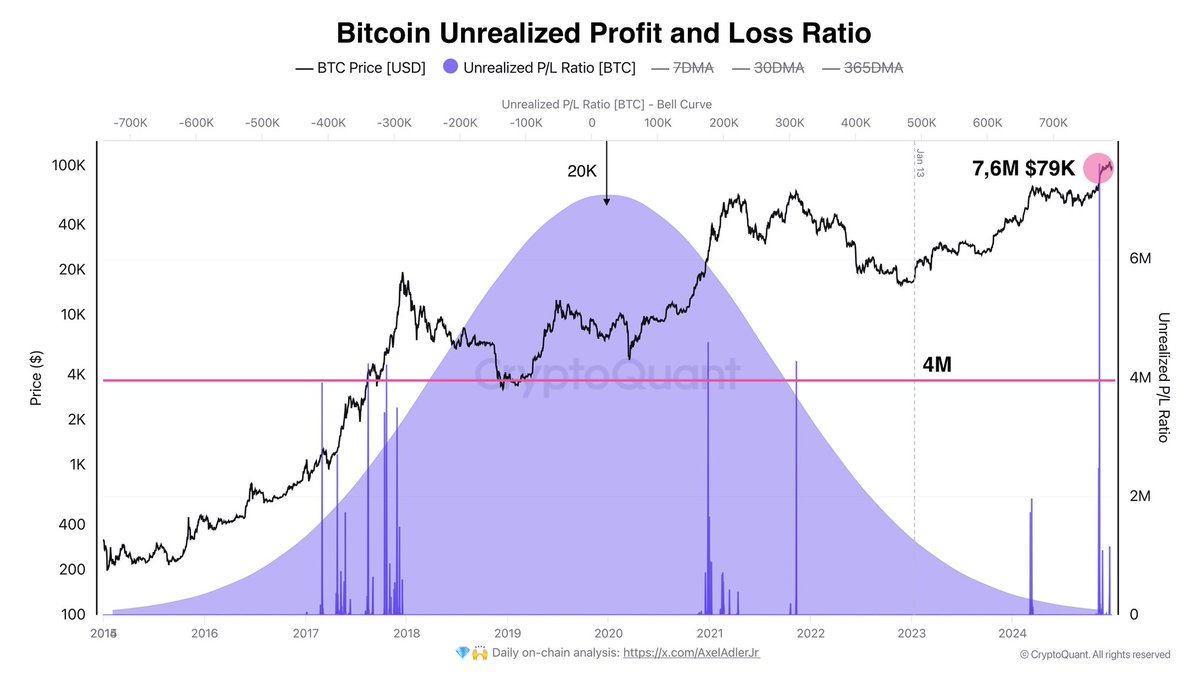

As an analyst, I’m observing the current price of Bitcoin hovering below the $100,000 mark, which seems to indicate heightened uncertainty among investors. Notably, top analyst Axel Adler has shed light on this situation, underscoring the importance of the $90,000 level as a robust support zone that stretches down to a lower boundary of $79,000. This range is seen as a safety net in case of any further price drops. Crucial for Bitcoin’s stability and potential recovery of bullish momentum, Adler stresses, is the need for this support to hold firm.

Presently, there’s a general air of caution in the Bitcoin market, but past patterns indicate that Bitcoin tends to prosper following significant support tests. Now, attention is turning towards whether Bitcoin can withstand this crucial area and initiate a recovery. In the forthcoming days, the $90K level will serve as a key battleground, deciding whether Bitcoin can rebound or continue its downward trend. Both investors and analysts are keeping a close eye on these events, eagerly waiting for the next significant shift.

Bitcoin Finding Demand Below $100K

Bitcoin’s price action has shifted from testing new all-time highs to finding solid demand below the $100,000 mark. This zone will determine whether the rally resumes or the market confirms a deeper correction. Amid this uncertainty, top analyst Axel Adler has provided critical insights on X, shedding light on key levels shaping Bitcoin’s trajectory.

According to Adler’s findings, the $79,000 mark has become particularly important due to it being the point with the highest potential profit and loss in the last ten years. This indicates that $79K not only serves as a psychological milestone but also a pivotal support level where significant market actions occur.

Furthermore, Adler highlights the $90,000 level as a strong support zone, with its lower limit fixed at approximately $79,000. He suggests that if the price remains above $90,000 in the near future, it will strengthen bullish sentiment significantly, making a breakthrough above $100,000 more likely than not.

Adler also warns of the possibility for Bitcoin’s market movement to temporarily sideways, acting as a pause before continuing its advance. This period could help the market absorb recent gains and prepare for further growth. At present, Bitcoin’s price fluctuation stands at a crucial juncture, with its capacity to hold onto support levels determining whether the next stage will be an escalation or a retreat. The eyes of investors are glued to the developments.

Technical Analysis: Key Levels To Hold

At the moment, Bitcoin is being bought and sold at approximately $96,200. This comes after several days of hesitation and sideways movement, which has left traders guessing about the market’s next step. However, even during this period of consolidation, Bitcoin continues to reside within a crucial price range. The direction it will take next is expected to hinge on whether the bulls or bears gain dominance in the market.

To bring back a positive trend in Bitcoin, it needs to break through significantly over the symbolic $100,000 barrier. Reaching this point would indicate restored vigor and might open up opportunities for additional price growth, possibly sparking another surge in its rally. Conversely, staying above the $92,000 threshold would preserve a bullish outlook since it shows strength at an important resistance level.

Nevertheless, some analysts continue to express worries about an upcoming economic decline. Certain specialists foresee that Bitcoin might plummet to around $70,000 within the next few weeks if its current support at $92K weakens. This pessimistic outlook suggests a substantial correction and could potentially disrupt market confidence.

At present, Bitcoin’s value stands at a crucial juncture. If buyers manage to regain dominance, the market could potentially rise. However, until that happens, the market stays susceptible to both upward surges (bullish breakouts) and downward slides (bearish breakdowns). Consequently, investors are keeping a close eye on these significant benchmarks for additional guidance.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-27 19:34