The pattern of Bitcoin long-term investors’ holdings hints at the possibility that the ongoing bull market has reached approximately halfway (40%) toward its finish.

Bitcoin Long-Term Holders Have Been Distributing Recently

In his latest article on X, Glassnode’s senior analyst, Checkmate, delved into the recent actions of Bitcoin investors owning their coins for more than half a year, referred to as “long-term holders” (LTHs).

In statistical terms, the longer an investor keeps their cryptocurrency, the less inclined they seem to be to sell it. Long-term investors, who hold for extended durations, are known for their strong resolve.

In other words, they seldom give in to selling pressure from the wider market, making their decision to sell a significant event.

In historical market circumstances, Long-Term Holder (LTH) investors have tended to sell their assets during bull markets after the price surpasses its previous record high (ATH). With their extended ownership durations, these investors accumulate substantial profits, which they later spend when there’s significant buying demand during bullish trends. This results in them willingly offloading their coins at premium prices.

The latest all-time high (ATH) breach of cryptocurrencies, as explained by Checkmate, appears to resemble previous such occurrences. Long-term holders (LTHs) have already begun making purchases for this specific market rally.

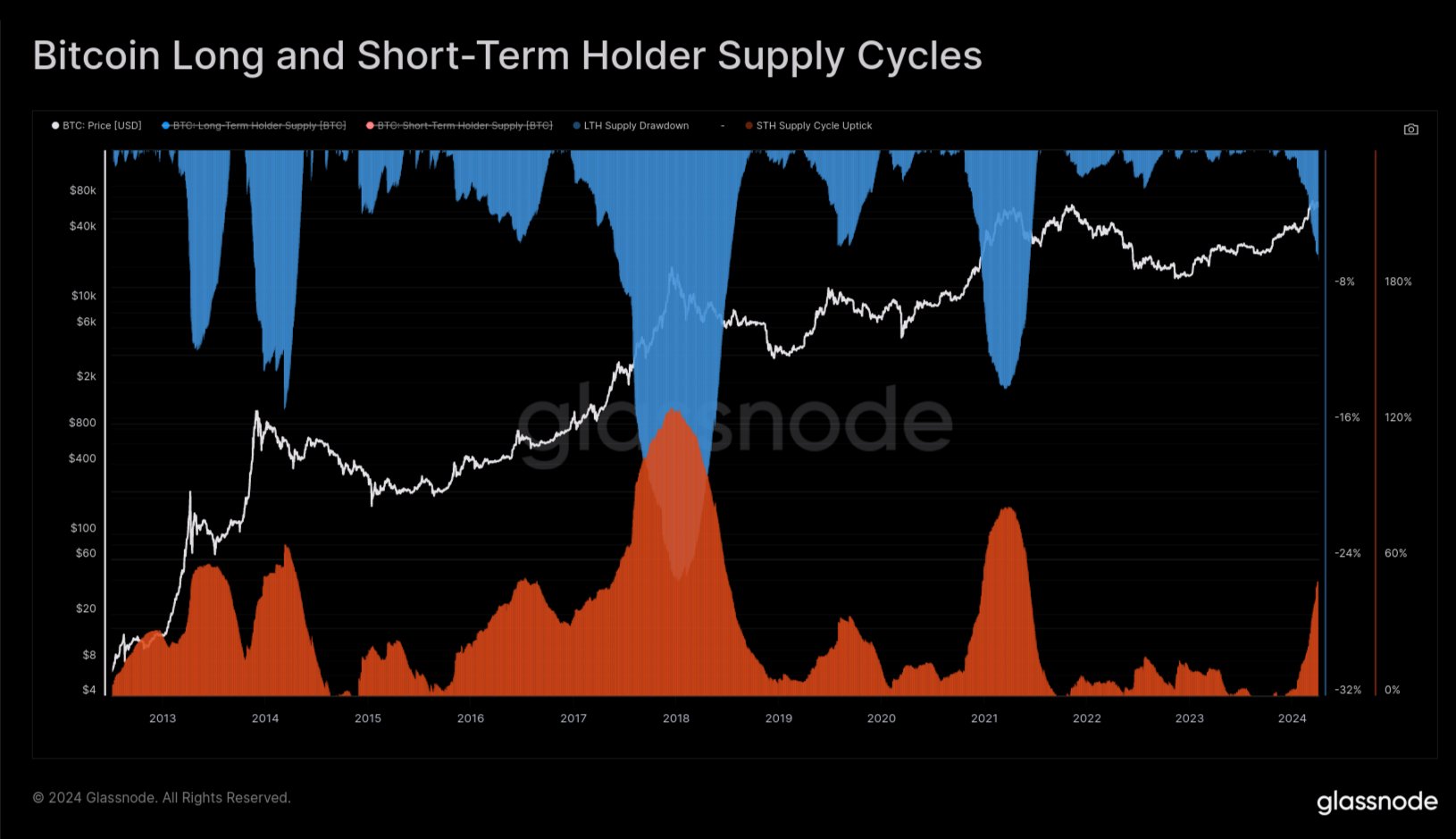

The chart below shows the trend in the supply of Bitcoin LTHs over the past few years.

The graph above shows a recent decrease in the Bitcoin long-term holders’ (LTHs) supply. Keep in mind that when LTHs increase their holdings, there’s typically a lag between the purchasing activity and the subsequent rise in their reported supply.

After purchasing new coins, a six-month waiting period passes before they become part of the cohort’s collection. However, this rule doesn’t apply when dealing with drawdowns. Instead, the age of the coins is instantly reset to zero, allowing them to be removed from the group.

The Glassnode lead explains that in the previous two market cycles, Bitcoin’s price increased significantly within 6 to 8 months after new demand absorbed the selling pressure from Long-Term Holders (LTHs). Thus, it can be concluded that a similar occurrence is taking place with the latest distribution from LTHs.

The graph indicates that the LTH (Large Traders and Institutions) supply usually decreases by approximately 14% during bear markets in bull runs.

Based on historical trends in Bitcoin’s long-term holder supply, Checkmate estimates that the current market cycle is approximately 40% finished.

BTC Price

Bitcoin has surged during the past 24 hours as its price has now returned to $71,800.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- What Happened to Kyle Pitts? NFL Injury Update

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

2024-04-09 05:10