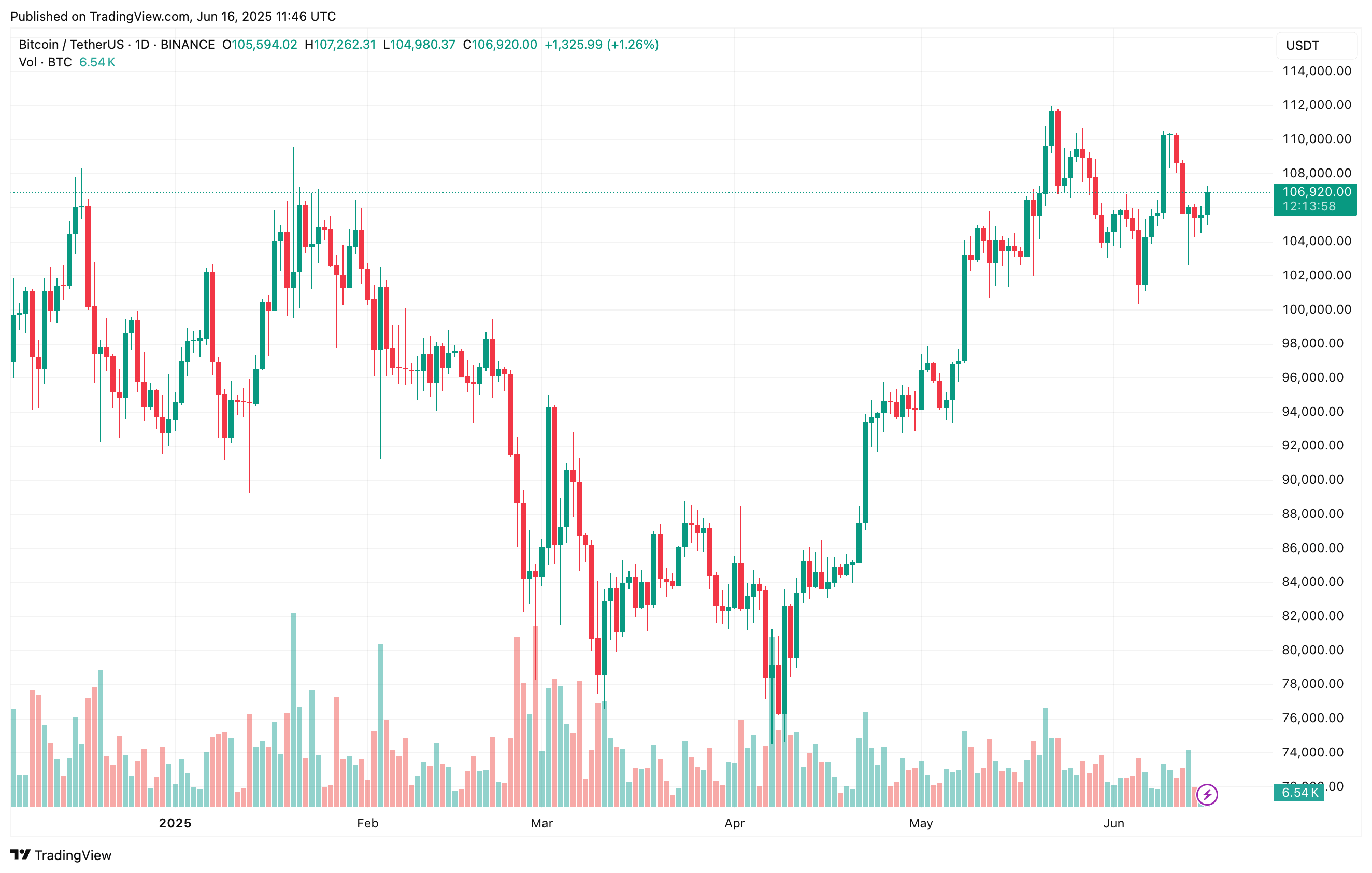

It’s another beautiful day in the wild-west saloon known as cryptocurrency, and, true to form, the coins are misbehaving. Bitcoin, always the drama queen, has taken a tumble—dropping from a sky-high $110,530 on June 9 to a slightly more pedestrian $106,900. What’s to blame this time? Geopolitics, of course! Israel and Iran are at it again, and apparently, Bitcoin does not subscribe to “ignorance is bliss.”

Binance Inflows: Now Practically on Life Support

CryptoQuant contributor Darkfost—whose name sounds suspiciously like a villain from 1980s cartoons—points out that the great Bitcoin migration towards Binance has slowed to a level best described as “comatose.” Both whales (those mysterious crypto millionaires who presumably lair in villainous volcano fortresses) and retail investors (Uncle Dave, at it in his pajamas) have essentially stopped sending their precious BTC to the exchange.

The chart (which looks like it was designed to terrify, confuse, and possibly hypnotize) shows inflows at their lowest ebb since the distant year of 2024—a time when people still believed eating raw kale was character-building. Whales and retail folk alike are “holding” their coins with the tenacity of toddlers clutching blankies, suggesting nobody wants to be seen as the weak link.

For those with a taste for market trivia, this collective holding pattern has historically led to—wait for it—market tops. When both major players and commoners decide to flood the exchanges together, it’s like calling “last drinks” at the bar: prices get rowdy and things tend to spiral.

But, in a plot twist worthy of a daytime soap, Darkfost thinks this current holding pattern is “highly constructive” (which sounds suspiciously optimistic for a man named Darkfost). Maybe everyone’s just scared or, more charitably, waiting for a sign from the macroeconomic gods. Or they really, truly believe that this time, Bitcoin rises to Valhalla.

The vibe? Slap-on-the-back optimism that everyone will be rich Real Soon Now™.

Meanwhile, crypto analyst Ash Crypto, never one to pass up a dramatic flourish, points out a whale who went full Vegas—plunking down $200 million on a 20x leveraged long. Because what could go wrong with that, right? 🎲

BTC: Should You Panic, or Just Make Tea?

Let’s not pretend everyone’s sipping champagne. Some analysts are already hoarding canned goods and batteries. A fellow called MIRZA, who presumably enjoys breaking hearts, sees Bitcoin plummeting to $85,000. Not to be outdone, Peter Brandt chimes in: “You think that’s bad? How about $23,600, just like 2021-22.”

On the other hand, Bitcoin seems to be leaving exchanges—like Elvis, but with worse hair—raising hopes for a sudden shortage that could make those holding it feel very, very smug. As of the moment, Bitcoin is enjoying a modest 1.8% rise. Cue dramatic music, gentle suspense, and possibly, popcorn.

To sum up: The whales and the small fry are united in their commitment to not make any sudden moves. Is it the calm before the storm, or are we all just overcaffeinated? Only time—and possibly another international incident—will tell. 🕵️♂️

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2025-06-17 03:06