As a seasoned researcher with years of experience analyzing the crypto market, I find the recent trend among Binance’s top traders towards shorting Bitcoin rather intriguing. The fact that more than half of these traders expect a price decline suggests that we might be in for some significant downward pressure on BTC.

Analyst Ali Martinez has disclosed a pessimistic outlook among Binance‘s prominent traders regarding Bitcoin. This trend indicates that Bitcoin could face substantial selling pressure in the near future.

Binance Top Traders Are Shorting BTC

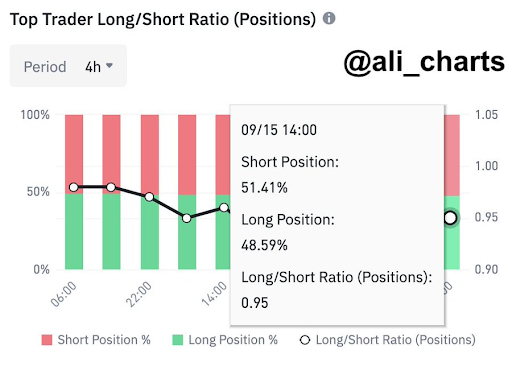

Martinez revealed in an X (formerly Twitter) post that 51.41% of the top traders on Binance are shorting Bitcoin. This indicates that these traders expect the flagship crypto to experience a price decline despite its recent recovery above $60,000. Indeed, BTC started this week with a price correction, dropping to $58,000.

As a researcher studying the cryptocurrency market, I’ve found that my analysis indicates the surge to $60,000 for Bitcoin might have been a relief bounce rather than a significant bullish reversal. In my latest assessment, I’ve observed that the flagship digital currency is still in a downtrend. This observation was supported by examining the Bitcoin market value to realized value (MVRV) momentum. I noted that this indicator suggests the crypto has been trending downwards since it fell below $66,750 in June. At this point, the trend hasn’t shown any signs of changing yet.

In its current downward trend, cryptocurrency might face additional decreases, according to Martinez. He emphasized that the price level of $58,100 is significant, as falling below this point could cause a slide towards $55,000. However, if Bitcoin manages to stay above the lower boundary of its channel, it might recover and reach the mid or upper levels around $60,200 or $62,000.

Currently, crypto expert Jelle has pointed out that for Bitcoin to experience a bullish turnaround, it needs to surpass the $65,000 price point. However, attaining this level appears challenging at the moment due to the uncertainties surrounding potential interest rate cuts and the upcoming US presidential elections. Bitcoin optimists are holding off on making any significant moves until they can analyze the market’s response to the Federal Reserve’s interest rate decision, which is scheduled for September 18th.

It is also worth mentioning that September is historically a bearish month for Bitcoin. This isn’t expected to be different as investors look to October as the month they will return to the market.

Bitcoin Could Still Drop To As Low As $15,000

Renowned economist Peter Schiff has warned that Bitcoin could still drop to as low as $15,000. He highlighted what he believes to be a triple top on Bitcoin’s chart. The expert added that the chart is worse if the flagship crypto is priced in gold. At the minimum, the economist expects BTC to drop to the upward trend line at about $42,000, but he doubts it will hold that support line.

Based on his analysis, he anticipates that Bitcoin will again approach its long-term support, which ranges from $15,000 to $20,000. Whether this occurs or not is yet uncertain, but it’s important to note that Schiff has often expressed skepticism towards Bitcoin and has repeatedly argued in favor of Gold instead of the leading crypto.

Currently, as I’m typing this, Bitcoin is approximately valued at $58,200, experiencing a decrease over the past 24 hours, based on information provided by CoinMarketCap.

Read More

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-17 14:10