As a seasoned crypto investor with a decade of rollercoaster rides in this dynamic market, I can’t help but feel a sense of déjà vu when reading Binance Research’s latest report on Ethereum. The shifting tides within the crypto ecosystem are nothing new to me; we’ve seen altcoins rise and fall, promising revolutions that often fizzle out.

A recent Binance Research study called “The ETH Value Controversy” examines Ethereum’s evolving role within the cryptocurrency world and identifies key factors impacting its worth. The report suggests that while Ethereum has been a pillar in the blockchain movement, its significance within the crypto ecosystem is currently being questioned.

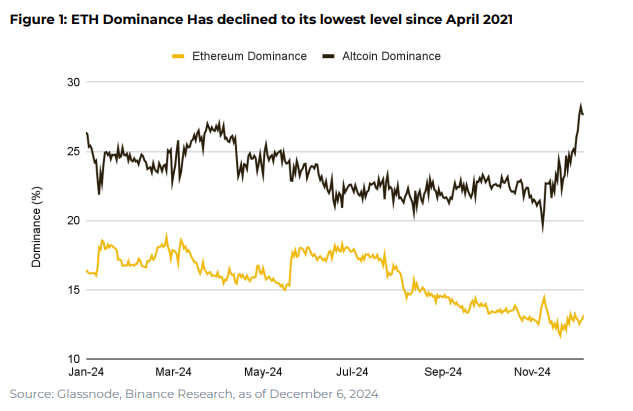

Although Ethereum has made significant progress with updates like Dencun and Spot Ethereum ETFs, its market share has fallen to a record low of 13.1% since April 2021 – the lowest it’s been in over a year. On the other hand, the influence of alternative cryptocurrencies (altcoins) has increased dramatically to 28.2%, while Bitcoin has reached and surpassed the $100,000 mark.

Source: Binance Research

The Dencun update, a key element of Ethereum’s plan focusing on rollups, has significantly altered the fee structure within the system. This update reduced the transaction fees for Layer 2 (L2), making it more affordable for users, however, the collection of fees on Layer 1 (L1) reached record lows. As a result, the rate at which ETH is being burned has decreased, counteracting the deflationary tendencies that surfaced post Ethereum’s shift to proof-of-stake (PoS) in 2022.

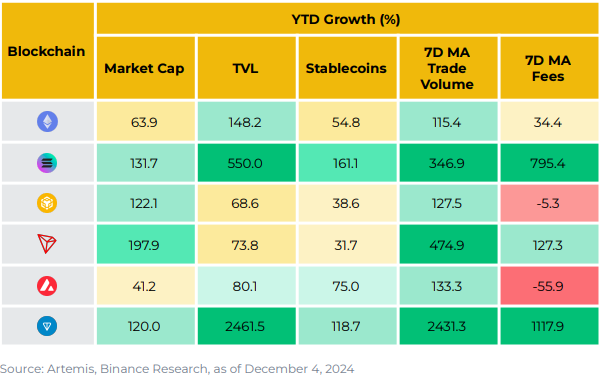

The general feeling towards the market isn’t particularly favorable. When Spot ETH ETFs were launched in July 2024, initial interest was low, but it subsequently increased, reaching over $1.7 billion in inflows following the U.S. election. However, Ethereum’s trading volumes and search activity have remained steady, while alternative Layer 1 platforms such as Solana have witnessed a significant surge, with a 131.7% increase in market cap growth so far this year.

Source: Binance Research

L2 Growth and App-Chains Challenge Ethereum

The use of Ethereum for second-layer solutions is increasing, with more than 4 million ETH now transferred to these platforms. This connection highlights Ethereum’s expanding influence as a fundamental component in the world of decentralized finance (DeFi). Yet, the emergence of app-chains like Uniswap’s transition to Unichain suggests a change in the distribution of value that might divert from Ethereum’s central ecosystem.

The challenge facing Ethereum in terms of prioritization is becoming more apparent. Some individuals suggest emphasizing value capture via Layer 2 scaling, while also reinforcing ETH’s role as non-sovereign currency within this structure. On the other hand, others propose maintaining the power of Ethereum on its Layer 1 by boosting demand for transaction fees and fostering a vibrant decentralized application (dApp) economy.

The change to inflationary tendencies has influenced how people view Ethereum in the market as well. By 2024, Ethereum’s 30-day annualized inflation rate will be positive, which has weakened the appeal of the “ultrasound money” idea among its supporters.

Solana, Sui, TON Gain Ground

Recently, the emergence of alt-L1s (alternative Layer 1 platforms) such as Solana, Sui, and The Open Network (TON), along with rollups, has brought forth fresh complications. These innovative chains have surpassed Ethereum in terms of user engagement and growth indicators, commanding a more significant portion of trading and transactional traffic. However, the generation of value through means like sequencer services and cross-chain transfers in rollup-centric systems is still in its nascent stages.

In the future, planned upgrades such as the Pectra upgrade slated for early 2025 are intended to rectify existing issues. By boosting L2 scalability and improving user experiences, Ethereum aims to maintain its competitive edge. However, any uncertainties in striking a balance between scaling on L2 and preserving value on L1 could potentially slow the growth of its long-term worth.

In the future, as more economic worth moves to second-layer networks (L2s), Ethereum will encounter hurdles such as division, compatibility, and the risk of centralized sequencers. Since L2s might heavily utilize affordable data availability services like Celestia, this could lead to a more decentralized fee collection process.

Ethereum’s Fee-Driven Future in Question

At the heart of Ethereum’s value debate lies a pivotal question: Will transaction fees and miner extractable value (MEV) drive greater value capture, or will ETH’s utility as a gas token, medium of exchange, and collateral asset prevail? While Ethereum’s issuance rate remains below 1%, maintaining its scarcity, declining fee collections have raised concerns about sustaining its burn mechanism’s efficacy.

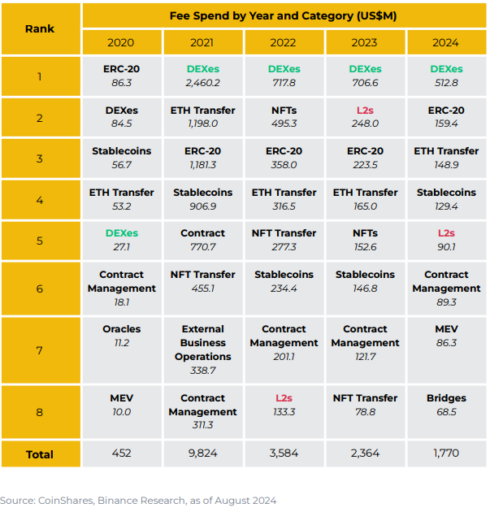

The importance of Ethereum in Decentralized Finance (DeFi) continues to be prominent. In the year 2024, decentralized exchanges accumulated a staggering $512.8 million through fees. Transactions involving ERC-20 tokens and ETH contributed approximately $159.4 million and $148.9 million respectively. However, as platforms such as dYdX and Hyperliquid migrate to other networks, Ethereum’s fee-related usage patterns are undergoing a substantial shift.

Source: Binance Research

In the midst of these changes, the need for Ether (ETH) as a non-government controlled currency within the L2 economy remains promising. The focus on rollups in their strategic plan underscores this purpose, strengthening ETH’s role as a reserve asset. As Ethereum moves ahead, maintaining a definite course – be it through L2 scaling or preservation of fees on L1 – will be essential for its ongoing significance.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-12-14 02:15