As a researcher with a background in finance and economics, I’ve followed Bitcoin closely for years. The recent turmoil in the US banking sector has once again brought Bitcoin into the limelight, with some predicting its price could surge to unprecedented heights.

As a crypto investor, I’m keeping a close eye on Bitcoin once again as it regains prominence in the financial news cycle. Some optimistic voices forecast a breathtaking surge up to $1 million per coin, driven by escalating economic instability. However, others in the community remain cautious and skeptical about such predictions.

Banking On Bitcoin’s Rise?

Bitcoin supporters view it as a beacon of stability in turbulent times. Unlike conventional assets that are linked to the well-being of institutions, Bitcoin offers unique features: a limited supply and decentralized structure. Proponents believe these characteristics make Bitcoin an ideal choice during periods of economic instability or financial crisis, when investors scramble for safe havens from a potentially failing banking system.

As a crypto investor looking back at the market events, I can’t help but notice how Bitcoin’s price behavior during times of financial instability sets it apart from traditional assets. For instance, in March 2023, when significant institutions like Silicon Valley Bank faced difficulties, Bitcoin experienced a remarkable surge of approximately 40% within a week. This occurrence is often cited by industry experts as evidence supporting Bitcoin’s status as an “uncorrelated asset class.” In simpler terms, during economic turbulence, Bitcoin seems to function as a protective hedge, shielding investors from the volatility experienced in traditional financial markets.

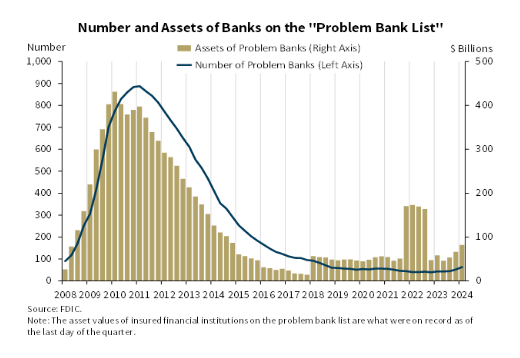

The FDIC’s most recent report adds weight to this argument with its revelation of increasing unrecovered losses on securities in the US banking sector.

The accumulated losses in the financial sector, fueled by increasing interest rates, have now surpassed $500 billion. Furthermore, the number of banks identified as troubled by the FDIC has climbed from 52 to 63 within a single quarter, stoking concerns about the industry’s overall well-being.

Million-Dollar Dream Or Flight Of Fancy?

Bitcoins’ expected growth in value is undeniable, but reaching a price tag of $1 million may encounter significant obstacles. Economic experts issue cautions, suggesting that such a steep increase could trigger an economic crisis, potentially harming Bitcoin’s future prospects.

In addition, the relationship between Bitcoin’s historical price movements and those of other assets is not fixed. While there are stretches of time with little correlation, there have also been significant instances of strong correlation, most notably during marketwide slumps. This raises questions about Bitcoin’s capacity to completely sever ties with a faltering conventional financial system.

An intriguing aspect to take into account is the current surge in the M2 money supply, signifying the amount of cash and easily-convertible deposits in circulation within the economy. Precedent shows that expansions in M2 have often coincided with rising Bitcoin prices. Nevertheless, the complex relationship between monetary expansion and Bitcoin, particularly in a banking system perceived as unstable, merits further exploration.

The Road Ahead For Bitcoin

Bitcoin’s future is a bit of a guessing game right now. Banks in the US are having some problems, and that could make Bitcoin more valuable. But if the whole economy goes downhill, even Bitcoin might suffer. So, it all depends on how bad things get with the banks and the economy in general.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-05 08:28