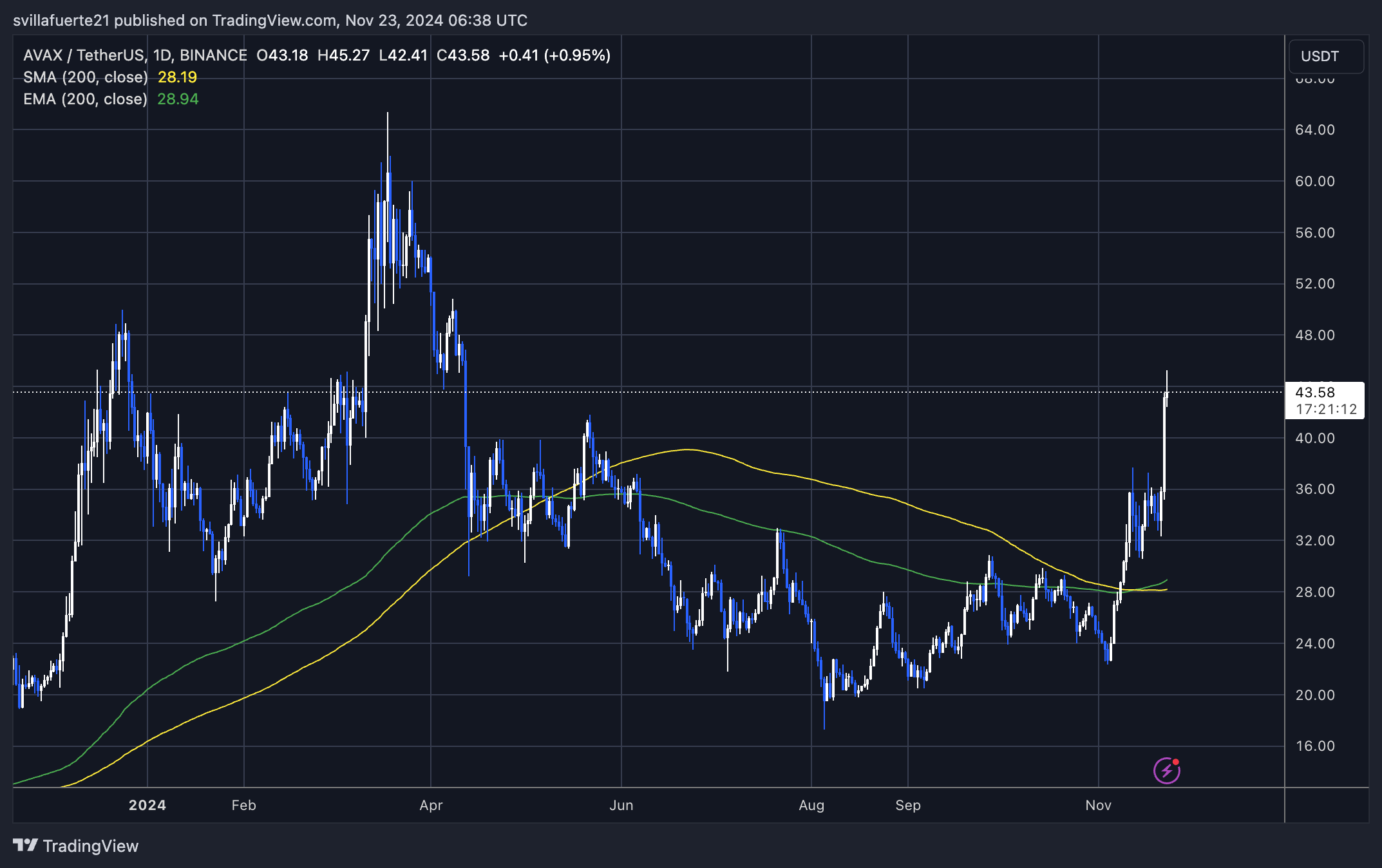

As a seasoned analyst with over two decades of experience in both traditional and digital markets, I have witnessed numerous market cycles and learned to read price trends like a seasoned astrologer reads the stars. With Avalanche (AVAX) currently on an upward trajectory, breaking above crucial resistance levels and surging over 20%, my optimistic side can’t help but dance a little jig of joy.

In simpler terms, the cryptocurrency called Avalanche (AVAX) has experienced a strong upward trend, breaking past an important barrier and jumping more than 20% within just one day. This rapid increase has sparked renewed confidence among financial analysts and investors, who are now closely watching to see if AVAX will hit the significant $50 mark in the near future. The jump suggests a change in market trends, as increased interest and positivity drive the price movement.

Noted analyst and cryptocurrency investor Kaleo provided an in-depth examination of X, indicating that if AVAX exceeds the $50 mark, it could ignite a substantial surge. He emphasized the significance of this key level, both psychologically and technically, as a potential catalyst for rapid price escalation, potentially drawing in more buyers motivated by momentum.

Avalanche’s latest performance suggests a robust overall crypto market trend, as popular altcoins witness increased attention during a bullish phase. Given that market circumstances seem advantageous, AVAX might maintain its growth trend if it manages to stay above its current positions. Yet, traders are keeping a watchful eye and mindful of potential profit-making or obstacles around the $50 mark.

Avalanche Prepares For A Rally

An avalanche appears poised for a significant upsurge, mimicking a similar trend observed during its previous bullish period. The price has forcefully breached crucial selling points and currently hovers about 15% below the pivotal $50 threshold. This level is garnering substantial interest among traders and analysts, as crossing it might indicate the commencement of an intense bullish trend.

Kaleo recently shared a technical analysis on X, emphasizing the importance of the $50 level. According to Kaleo, breaking this psychological and technical barrier could trigger a powerful rally, potentially doubling AVAX’s value in a short period.

Additionally, he pointed out the AVAX-BTC graph, exhibiting a comparable breakout trend, reinforcing the positive outlook towards Avalanche. According to Kaleo’s forecast, if the momentum persists, Avalanche could potentially surge to $100 in a short period of time.

Even though there’s a sense of positivity, the possibility of a broad market adjustment calls for a measure of prudence. Given that Bitcoin seems to be indicating potential reversals to strengthen and regain speed, Avalanche (AVAX) might experience short-term declines.

On the other hand, these adjustments might create chances for investors aiming at long-term profits. As Avalanche reaches a crucial point, there is great anticipation among investors about whether it will surpass the $50 mark and trigger the powerful surge predicted by analysts.

AVAX Testing Fresh Supply Levels

Currently, Avalanche is at $43.6, which is its highest point since April. This rise comes after a powerful surge that pushed it past the significant barrier of $35, igniting optimism among investors and analysts alike. The strong performance of AVAX suggests it’s making headway towards new supply zones.

As a researcher, I find myself observing AVAX’s trajectory that seems primed to breach the significant $50 barrier. This milestone, both psychologically and technically, could signal the commencement of an extended rally. Yet, it’s also plausible that the token might temporarily stabilize or consolidate beneath this threshold in the near future. Consolidation serves as a period for the market to assimilate recent gains and gather steam for a more potent surge upwards.

If Avalanche (AVAX) fails to regain $50, it might lead to a dip in price due to reduced demand, which could act as a base for its future surge. This dip isn’t indicative of a bearish market but rather a normal correction that may fortify AVAX’s path toward continuous growth.

As Avalanche keeps rising, investors are keeping a close eye on price movements and trading volume to gauge if there might be more growth ahead. The $50 threshold still stands as a significant point to focus on, since crossing it successfully could open the path for new record highs and strengthen AVAX’s bullish trend.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-11-24 04:16