As a seasoned researcher with a keen interest in digital finance and technology, I’ve witnessed the fascinating evolution of both legitimate innovations and malicious activities in the realm of cryptocurrencies. The recent efforts by ASIC against crypto scams are undoubtedly commendable, yet their struggle against the increasingly sophisticated techniques employed by fraudsters, such as AI-generated deepfakes, is a testament to the cat-and-mouse game that ensues between regulators and cybercriminals in the digital age.

The Australian Securities and Investments Commission (ASIC), Australia’s financial oversight body, is advancing in its efforts to combat cryptocurrency scams. However, a fresh challenge has arisen – the increasing application of artificial intelligence by deceitful actors.

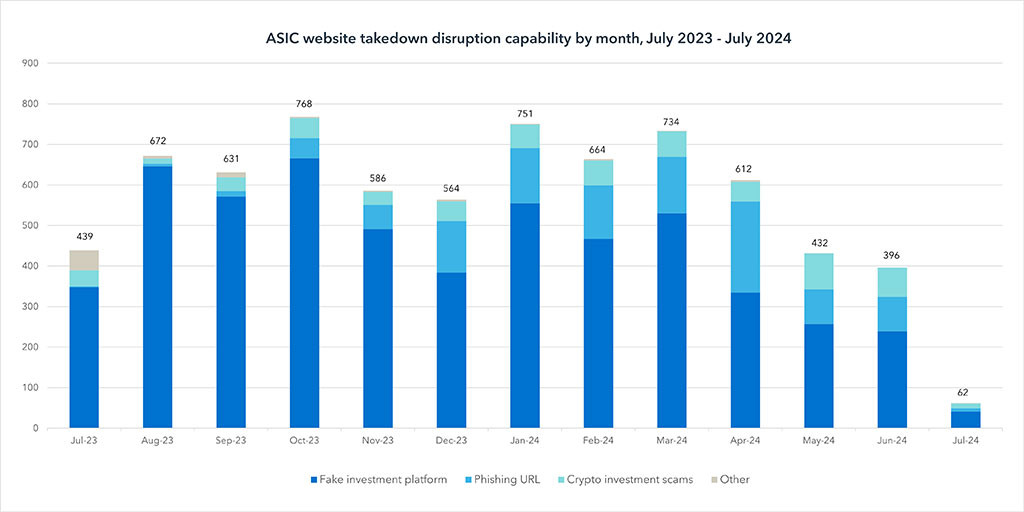

Over the past year, I’ve noticed that ASIC, in a statement on August 19th, has taken down over 600 instances of cryptocurrency scams alone. This substantial number underscores how pervasive these fraudulent activities are within our crypto community. Interestingly, their work didn’t stop at just cryptocurrencies; they also targeted a staggering total of 5,530 fake investment platforms and 1,065 phishing links. Clearly, it’s crucial for us as investors to stay vigilant in this rapidly evolving digital landscape.

Nevertheless, Sarah Court, Deputy Chair of ASIC, cautions that the battle against scams isn’t over yet. She underscores the point that the scam environment is continuously changing and progress in technology not only enhances our lives but also provides new opportunities for unscrupulous individuals to take advantage.

Scammers Misuse AI for Fake Celebrity Endorsements

A major issue that demands attention is the misuse of Artificial Intelligence (AI) by swindlers. Deceptive practices such as deepfake technologies, capable of generating convincing video and audio fakes, are becoming more challenging for consumers to differentiate authentic from fraudulent material.

The court points out instances where bogus celebrity endorsements by stars like Australian actor Chris Hemsworth and tech mogul Elon Musk were misused to attract victims into suspicious, high-profit investment plans. These fraudulent schemes frequently rely on falsified news articles and reviews to give the impression of authenticity.

A noteworthy example is the situation with Tesla’s CEO, Elon Musk. In June, approximately 35 YouTube channels concurrently broadcasted an AI-created imitation of Musk’s voice, claiming to offer double returns on cryptocurrency investments for those who fell for the fraud. Shortly after, The Bitcoin Way, a consulting firm specializing in Bitcoin, reported another occurrence of a deepfake scam utilizing Musk’s voice.

Photo: ASIC

Fake Investment Firms and the Fight Back

In July, ASIC unmasked Dexa Trade Markets as a dishonest cryptocurrency investment company. Deceitfully, the firm boasted about global regulation, massive trading activity, and an extensive clientele. Yet, an investigation by ASIC found that Dexa Trade Markets did not possess the necessary licenses to operate within Australia.

To this, some consider AI as a weapon against fraudulent activities. As per SingularityNET CEO Ben Goertzel, AI is capable of examining data and reports, providing personalized assessments of a cryptocurrency’s reputation. Although not infallible, these tools could pinpoint potential risks and aid consumers in making wiser investment decisions.

In addition to deepfakes, there’s growing concern about potentially misleading cryptocurrency ads on Facebook. The Australian Competition and Consumer Commission (ACCC) claims that more than half of these ads might be scams or violate Facebook’s advertising policies. Meta challenges this claim, saying the data is old and they have already taken measures to rectify the situation.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-08-19 12:22