This morning, Arthur Hayes, one of BitMEX’s co-founders, sold off 237,672.8 GMX tokens worth approximately $10 million from his stash, leading to a significant drop in GMX prices upon transfer to the market maker of NFT platform Blur.

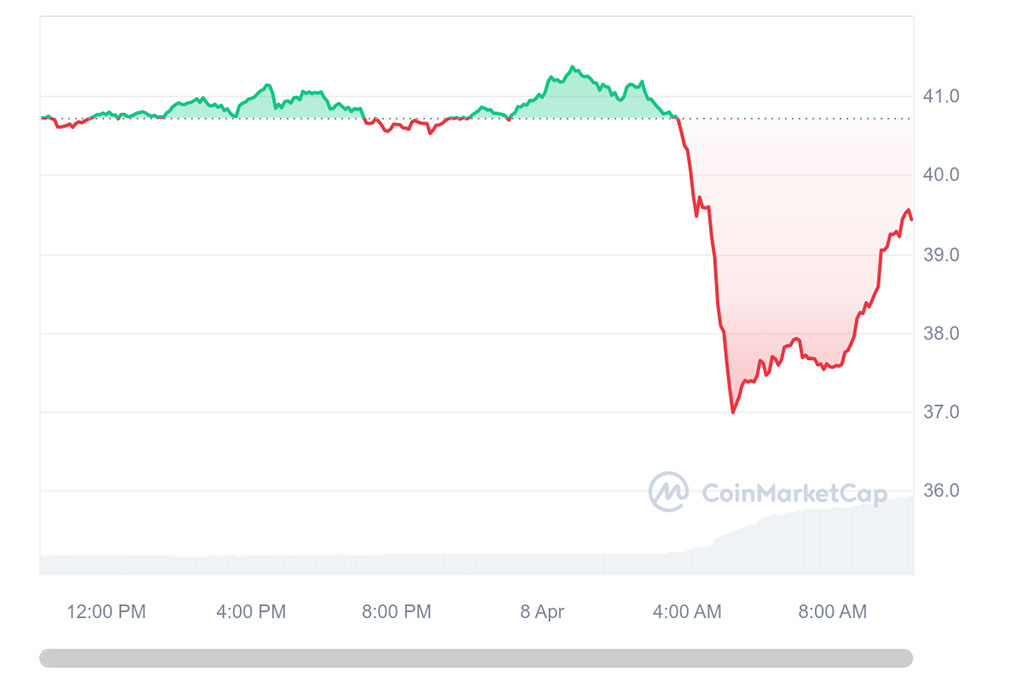

According to Lookonchain’s report, Hayes was poised to earn approximately $3 million in profit if he sold off. However, the market reacted swiftly, causing a significant 10% price decrease and dropping GMX from its peak of around $41 down to $37.

Photo: CoinMarketCap

Although it’s impossible to trace the sold GMX tokens that were not staked by Hayes, the massive sell-off that ensued after his alleged sale provides strong evidence of the transaction.

Investors GMX Sentiment Unshaken

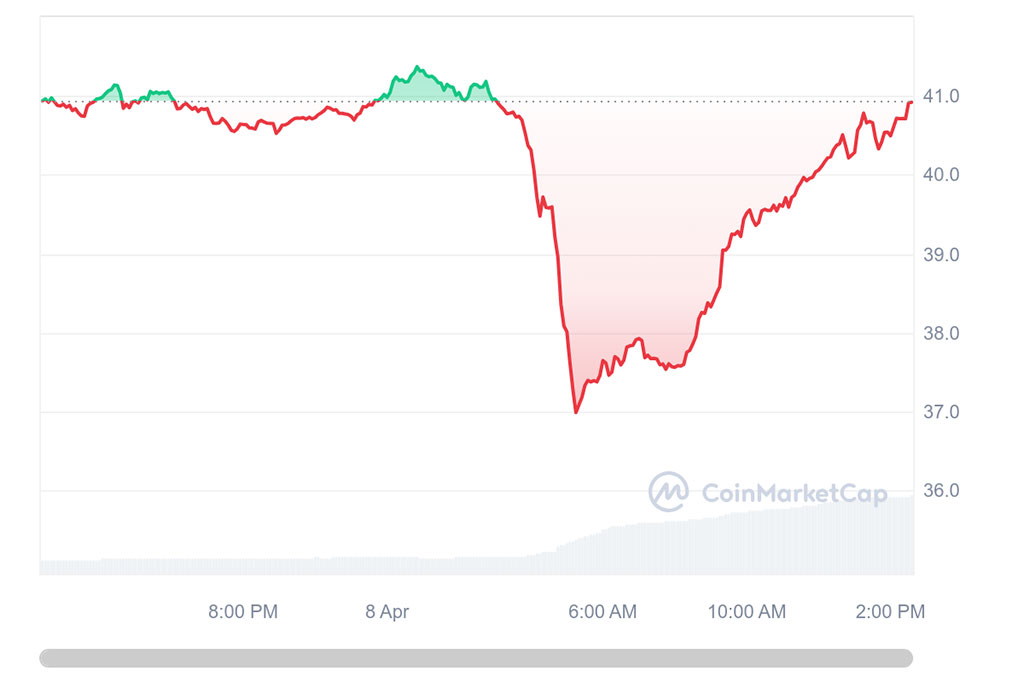

Although Hayes hadn’t yet sold off, GMX‘s price showed signs of recuperation and attained some level of stability around $39 after a while. This price stabilization could be linked to the unwavering enthusiasm of GMX investors, as one individual put it, “similar to ETH during the FTX turmoil. I’m buying more.”

It’s believed that one of the major investors in GMX has transferred his shares to a stock broker for sale. This leads us to assume that he is disposing of his holdings.

My question, why is price not tanking hard?

Feels a bit like the price of ETH during the FTX debacle.I’m buying more.$GMX

— JJcycles (@JJcycles) April 8, 2024

The investor excitement remained strong throughout the day, nearly bringing the GMX price back up to its opening cost of around $41.

Photo: CoinMarketCap

GMX V2 Single Token Pools Approved

Starting from March 31, GMX held a poll for members to vote on the establishment of two new single token pools in the GMX V2 platform.

Proposed by coinflipcanda was an idea to establish gmBTC2 and gmETH2 Markets on Avalanche and Arbitrum, aiming to attract “more market liquidity to GMX.” If these new markets for single tokens thrive, they may pave the way for additional single token markets featuring stablecoins, yield-bearing stablecoins, LSTs, GMX, and other volatile assets as backings.

Nearly all respondents endorsed the final plan, giving their approval to over 99% for both the gmBTC2 and gmETH2 Market pools.

Hayes PENDLE Pump

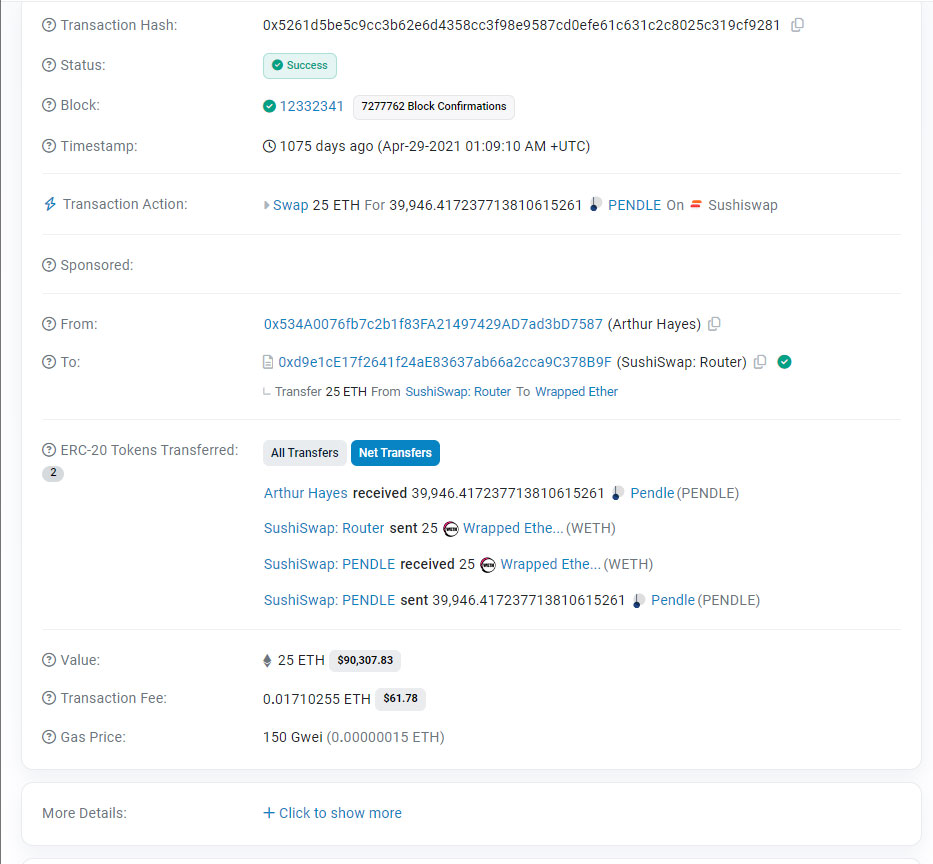

In the year 2021, on the 21st of April, Hayes received approximately 40,000 PENDLE tokens as reward for exchanging around 25 Wrapped Ethereum (WETH), which was valued at about $67,500.

Photo: Etherscan

Currently, the PENDLE with a value of 39,946 dollars is significantly profitable, worth over $265,000 – approximately a triple return on investment. The price is currently around $6.56.

On the 5th and 6th of April, Hayes shared optimistic updates about Pendle on X (previously known as Twitter), reaching out to his nearly half a million fans and potentially showcasing his investments.

The future of #DEFI is $PENDLE.

Yachtzee bitches 😘😘😘😘😘

— Arthur Hayes (@CryptoHayes) April 5, 2024

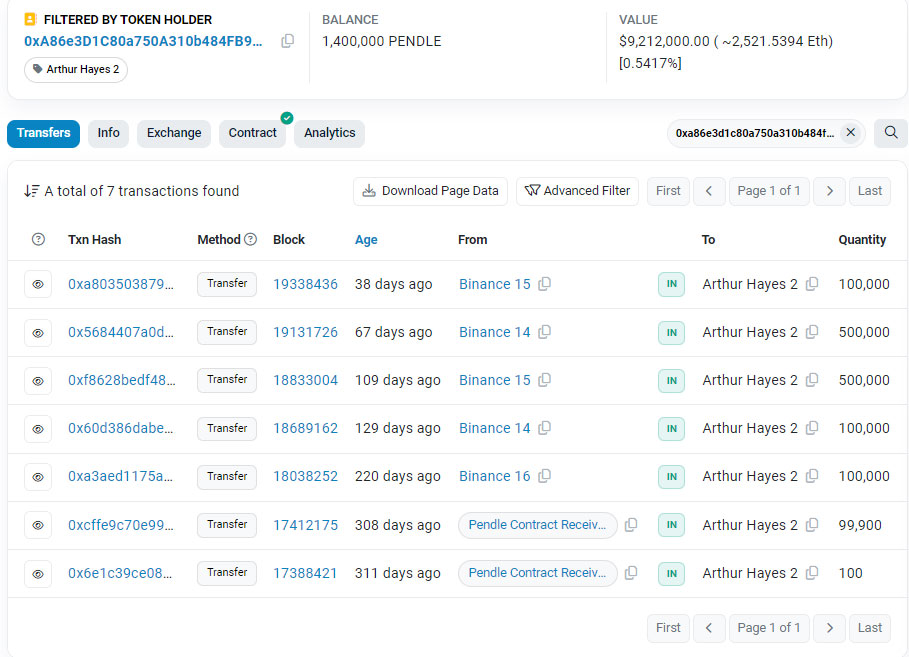

Additionally, the ‘Arthur Hayes 2’ identified wallet contains approximately 1.4 million PENDLE tokens in its balance, obtained within the past 311 days.

Photo: Etherscan

An Emerging Theme

In the last month of 2023, according to Lookonchain’s reports, Hayes frequently expressed on Twitter that the price of Solana (SOL) would surpass $100 by December 6, 2022.

Hayes sold his holdings on December 22, 2023, when SOL reached $99.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-04-08 17:38