As a seasoned crypto investor with a keen interest in technical analysis, I find the TD Sequential buy signal formed by Arbitrum (ARB) on its weekly chart intriguing. Having observed several market cycles and various indicators over the years, I believe that this potential reversal point could mark an opportune moment for entering or increasing my position in ARB.

As a crypto investor, I’ve been keeping a close eye on Arbitrum (ARB)’s price action, and an intriguing observation was made by an analyst. They noted that TD Sequential buy signals have appeared on ARB’s weekly chart lately. This technical indicator suggests that higher prices could be on the horizon based on past historical price patterns.

Arbitrum May Have Hit A Point Of Reversal According To TD Sequential

As a crypto investor, I’ve come across an intriguing analysis piece by Ali on X where he discusses a TD Sequential signal that has caught my attention in Arbitrum’s weekly price chart. This technical indicator is a valuable tool for identifying potential reversal points in an asset’s price trend.

During the initial stage, referred to as the “setup,” the market forms candles with the same polarity, which can amount to as many as nine in succession. After this sequence of nine candles, there’s a strong likelihood that the price has reached a potential turning point.

If the candles appeared green on the chart, the TD Sequential indicator would signal a possible opportunity to sell the asset. Conversely, with red candles on the chart, this technical analysis tool would indicate a potential buy signal.

As a crypto investor, once I’ve completed the necessary setup for my investment strategy, I enter the “countdown” phase. This stage is similar to the setup, but it lasts for thirteen candles instead of nine. The conclusion of this countdown often signifies another potential peak or trough in the price.

Here’s a simple way to rephrase that: Ali has recently provided us with a chart displaying the TD Sequential signal that Arbitrum has newly formed in its weekly pricing.

Based on the weekly chart I’m observing, Arbitrum has just finished forming a TD Sequential setup with red candles according to the indicator. Consequently, as a crypto investor, I would anticipate that this signal implies an imminent price reversal in an uptrend direction.

As an analyst, I recommend interpreting this buy signal as indicating a potential recovery of approximately one to four candlestick periods for the ARB coin. However, it is essential to keep in mind that the future price action is uncertain based on this pattern alone.

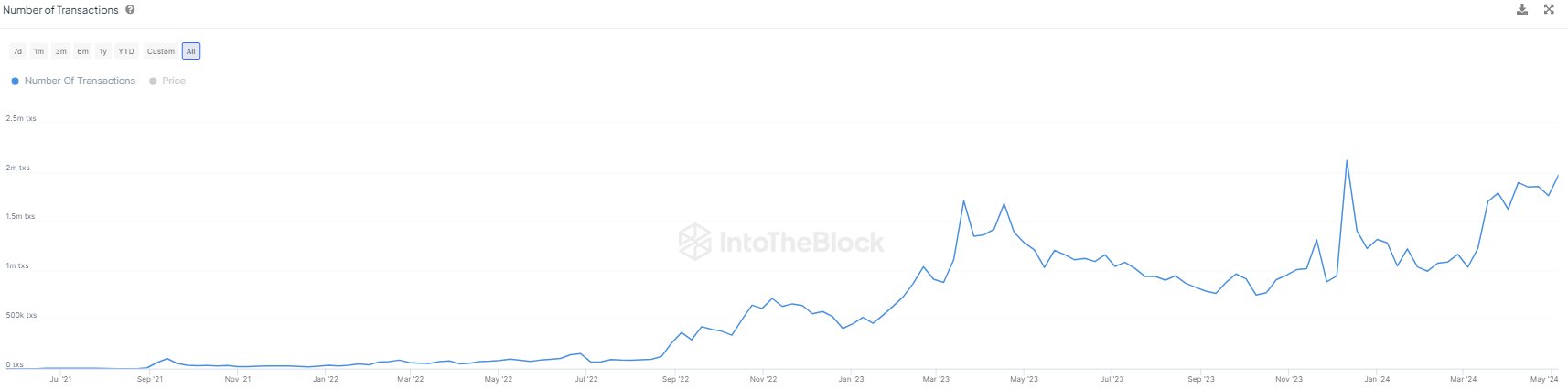

Elsewhere, there’s been a surge in transaction activity on the Arbitrum network, according to recent data from market intelligence platform IntoTheBlock.

I have analyzed the given chart and found that the average number of transactions on Arbitrum has witnessed a significant surge over the past couple of months. Initially, in early March, the network recorded approximately 1 million transactions per day. However, more recently, this figure has surpassed the 2 million mark.

An asset with a large number of transactions usually indicates strong trader engagement. Consequently, this might result in increased price fluctuations for the coin, though the trend may be bullish or bearish.

ARB Price

At the time of writing, Arbitrum is trading around $1.01, down almost 2% over the past seven days.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-10 03:05