As a seasoned analyst with over a decade of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market movements that could make even the most hardened investor dance a jig. Today, I find myself quite intrigued by the meteoric rise of Aptos (APT).

In the past 24 hours, Aptos (APT) surged more than 10% due to Aptos Labs buying HashPalette. The token is currently leading the pack as it ranks as the biggest gainer among the top 100 cryptocurrencies in terms of market capitalization.

Aptos To Expand Its Presence In Asia

Last Thursday, Aptos Labs, creators of the Aptos network, disclosed that they have reached an agreement to purchase HashPalette, a blockchain development firm from Japan. HashPalette is responsible for developing Japan’s Palette Chain and is a subsidiary of HashPort Inc.

The deal seeks to establish itself as a “pivotal moment” for both Japan and the Aptos ecosystem, as it’s about to fortify its influence within the Asian market by merging with the Japanese blockchain technology.

Japan consistently leads the way in technological advancements, and this is evident in its adoption of blockchain technology. The country’s fusion of cutting-edge tech and widespread blockchain usage sets a global standard for Web3 projects. Today, we’re taking a significant step forward in this market by agreeing to acquire HashPalette Inc., which represents one of our most daring strategic decisions yet.

In the process of taking over, HashPort Inc. plans to transfer the Pallete Chain and its affiliates’ software to the Aptos Network. Moreover, the Japanese chain will be granted entry into the Aptos Network’s ecosystem, benefiting from its robust security features, scalability, and developer resources.

The migration should be finished around early 2025, which coincides perfectly with the EXPO2025 DIGITAL WALLET launch. Additionally, Aptos Labs has teamed up with HashPort to empower local developers, NFT artists, and businesses by further developing blockchain solutions based on the Aptos Network’s infrastructure.

APT Leads The Crypto Market

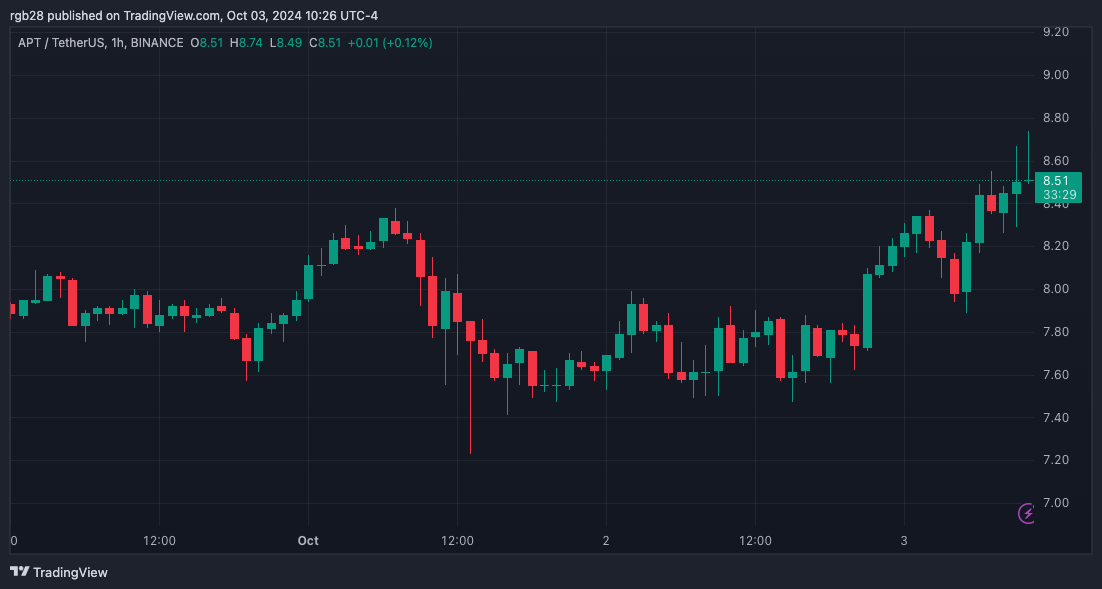

After the recent announcement, the value of APT increased by 11% over the course of a day, reaching the resistance level of $8.66. However, it subsequently pulled back to $8.51. Despite this retracement, APT’s exceptional performance placed it at the top among all cryptocurrencies during the market correction.

Among the many cryptocurrencies, APT stands out as one of the rare ones showing positive trends across various timeframes within the top 100 coins ranked by market capitalization. In the past week, this altcoin has risen by 7.5%, while over the past month, it’s seen a substantial increase of approximately 41%.

As a crypto investor, I’m excited to share that the daily market volume of my investment token, APT, skyrocketed an impressive 41.7%. This surge brought the trading volume up to a significant $769.6 million in just the last 24 hours. The attention-grabbing performance of APT has not gone unnoticed by crypto analysts, who have singled it out as having “the most intriguing chart” right now.

Based on Yuriy’s analysis at BikoTrading, the cryptocurrency appears robust given the increase in trading activity and its positive price trend, suggesting further growth potential. Notably, despite the market downturn, APT‘s price has managed to stay above a crucial resistance area, propelling it beyond the upper limits of Q3’s price range.

In a similar vein, crypto trader Osbrah noted that APT has been “quietly making its way up in the most intriguing altcoin rankings.” He highlighted that following the October 1 market sweep, the token underwent a “clear bullish retest” and surpassed the $8 level.

For the trader, the next significant barrier is at the $9 level, and if APT can’t surpass this, it might slide back towards the $7.95 support area. However, another market observer believes that APT’s behavior is nearing a potential breakout.

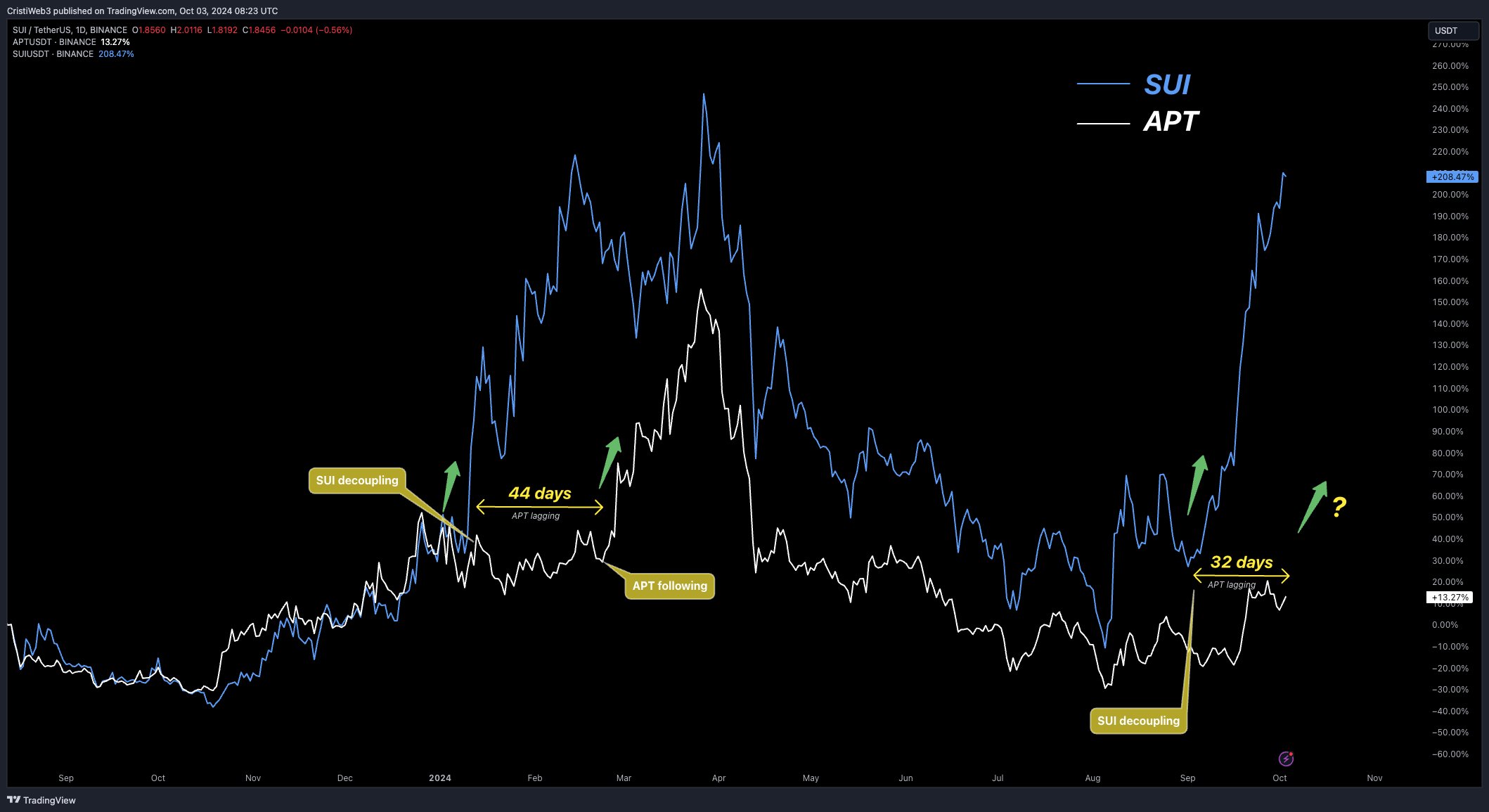

According to the article, SUI and APT have been following a “trade pattern” where they move together over the past year, until SUI separated in early 2024. This separation caused a 44-day delay for APT before it started mirroring SUI’s actions. Following this period, APT experienced a significant increase of 98% and reached its highest point of $18.8 in mid-March.

Currently, APT is displaying a 32-day delay following SUI’s recent separation in September, demonstrating “extraordinary resilience.” This trend, according to the analyst, could potentially mirror SUI’s path and initiate a significant surge within the next fortnight if past patterns persist.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-10-04 12:40