As a seasoned crypto investor with over a decade of experience under my belt, I’ve witnessed countless market fluctuations and learned to read between the lines when it comes to price predictions. While I don’t blindly follow analysts’ opinions, their insights can be valuable when combined with my own research and understanding of the market trends.

Recently, Solana (SOL), one of the major cryptocurrencies based on market capitalization, appears to be indicating a possible price rebound following a downtrend in August.

The asset that dropped by almost 10% over the past week is gaining traction once September began. Solana, which had recently dipped to $124, has climbed back up to above $134 in early trading today, indicating a 2.7% growth over the last day and currently trading at around $132.

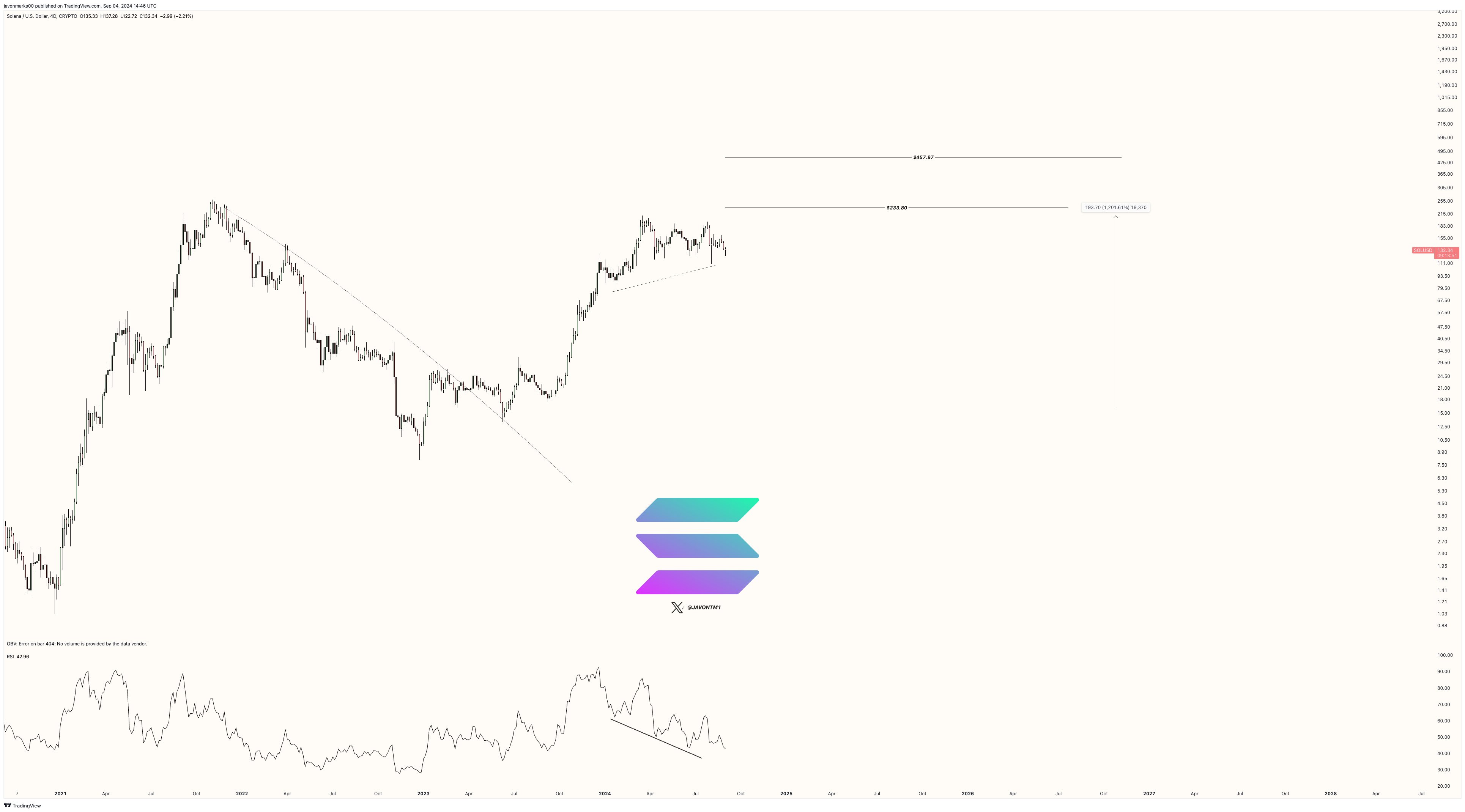

In the midst of the current market rebound, well-known cryptocurrency expert Javon Marks continues to express optimism towards Solana. His prediction sets a price goal of around $233.8 for this digital asset.

Why Is A $233 Target in Sight For Solana?

Based on Mark’s analysis, it appears that the value of Solana could keep climbing, possibly reaching $233.8 or even more if the current positive momentum persists.

According to the analyst’s forecast, Solana (SOL) surpassing this particular level is expected due to a concealed uptrend pattern it has been following for some time, known as a ‘hidden bullish divergence’.

Marks particularly noted in the prediction post on X:

Since mid-2023, our projected price for Solana (SOL) has remained steady at around $16.12. After this, we saw a significant increase of approximately 1,203%, leading us towards reaching this target. Now, as a slight pullback occurs, this target remains the same due to the ongoing breakout that makes it relevant. As long as the breakout holds and bullish indicators persist, there could be an additional climb of nearly +72% to complete the process of meeting our $233.8 target.

Based on the analyst’s recommendation, if Solana surpasses the $233.8 mark, it may potentially soar higher to reach around $457, which represents a potential growth of approximately 93%.

SOL Breakpoint Approaches

Besides Javon Marks’ predictions, other experts have also shared their insights regarding possible price fluctuations for Solana. Notably, they’ve focused on Solana’s potential price changes leading up to the SOL Breakpoint event.

In response to a comment from analyst Sai about topic X, crypto expert Marty Party highlighted the fact that traditionally, the price of Solana tends to surge prior to such events.

Marty Party pointed out: “The typical boost during the Solana Breakpoint is 62%. Given that Solana (SOL) is now valued at $133, if we see a 62% rise, it might climb up to approximately $215.46.”

Sai’s article pointed out that Solana’s price history has shown significant growth prior to Solana Breakpoint conferences. For instance, in 2021, the price of Solana jumped by approximately 68%, before the event, and then rose further by 42% in 2022, while a notable increase of around 58% was observed in 2023.

As a researcher, I’ve observed that the Breakpoint event, a platform for demonstrating the groundbreaking innovations and advancements within the Solana ecosystem, consistently garners significant interest from investors. This interest often precedes the event, leading to price surges in the pre-event market.

#Solana Breakpoint in 16 days. Do you know how the Solana price behaves before the breakpoint?

2021 saw a 68% increase in prices prior to the Breakpoint, followed by a 42% rise in 2022 and another 58% jump in 2023, all occurring before reaching the Breakpoint.

Follow the Thread to make sure you don’t miss 2024…

— Sai (@SaiPrathap846) September 4, 2024

In September this year, the Breakpoint event will unfold in Singapore, and there’s already a buzz among Solana enthusiasts!

As we count down the remaining 16 days, I find myself echoing the sentiments of analysts like Sai. There’s a strong possibility that Solana might experience a rally reminiscent of past years. However, whether it can match its historic price surges is yet to be determined. Nonetheless, an analysis of historical data and bullish technical signals hints at a potential for substantial upward movement in the coming days.

Read More

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-06 03:05