As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of political and economic cycles. The upcoming US presidential elections certainly seem to be stirring the pot for Bitcoin and other cryptocurrencies, making it an interesting time for us market enthusiasts.

Another factor contributing significantly to Bitcoin‘s rising cost is the upcoming U.S. presidential elections. Many financial experts are closely watching to see if political events might impact the cryptocurrency in the coming days, as the election day draws closer.

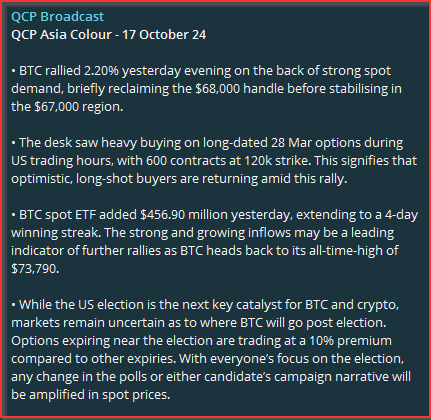

As a crypto investor, I’m closely watching the upcoming presidential election, given QCP Capital’s belief that its outcome could significantly impact Bitcoin’s trajectory. The heightened sensitivity of the market is evident in the surging price of options contracts linked to the election, which are currently trading at a 10% premium. This premium suggests that traders are keenly attuned to political developments and their potential effects on our digital currency investments.

Who Is More Advantageous For Bitcoin: Trump Or Harris?

Previously elected President Donald Trump recently declared his newfound endorsement for digital currencies like Bitcoin and others. This shift in stance is noteworthy since he previously criticized cryptocurrencies strongly. In his recent address, he emphasized the importance of adopting these digital assets, expressing concern that they are leaving the United States due to a lack of appreciation for them.

He advises the creation of a national Bitcoin stockpile and prevent the Federal Reserve from launching a digital currency. This approach aims to attract supporters and contributors of cryptocurrencies, hence maybe raising the value of Bitcoin should he be successful.

Regarding Vice President Kamala Harris, she hasn’t made many comments about it so far, but she has been engaging with individuals from the cryptocurrency sector. The fact that her campaign is looking to gather crypto votes suggests that she may be open to re-evaluating her views on digital currencies.

While she might not be as enthusiastic about cryptocurrency as Trump, her openness to discussing it suggests a potentially friendlier regulatory landscape if she were elected.

Market Predictions And Reactions

At present, Bitcoin is hovering around $67,685, and certain experts predict it could soon break its previous record high of about $74,000. The rise in Bitcoin’s price over the past few weeks might be due in part to increased investment in Bitcoin ETFs.

On October 16th, Bitcoin ETFs recorded an influx of approximately $457 million, marking four straight days of progress. This continuous uptrend suggests that institutional investors are growing increasingly optimistic regarding Bitcoin’s potential.

Despite some clarity, there remains a level of doubt about the direction of the cryptocurrency market in the future. The policies of both candidates could lead to different results, with Harris’s shifting stance creating speculation about potential regulations, and Trump’s pro-crypto stance being viewed as beneficial for Bitcoin.

The Bitcoin market capitalization, which is still a figure of $1.3 trillion, according to some analysts, may make it less susceptible to high volatility by any verdict.

Currently, QCP Capital anticipates that the outcome of the upcoming U.S. presidential election could shape Bitcoin’s future. Already, political shifts have impacted the prices of election options contracts, which are currently trading at a 10% premium. As traders watch for policy changes from each candidate, QCP predicts that these developments will affect Bitcoin’s trajectory.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-10-18 10:16