As a seasoned crypto investor with a knack for spotting trends and a keen eye for technical analysis, I find the recent surge in Ethereum’s price against both USD and BTC quite intriguing. The insights from Benjamin Cowen, a respected analyst in our community, align with my own observations.

In the last 24 hours, the cost of Ethereum has surpassed $3,800 due to a 5% rise, an intriguing development given that this price hike coincides with improved performance for ETH when compared to Bitcoin over the past few weeks.

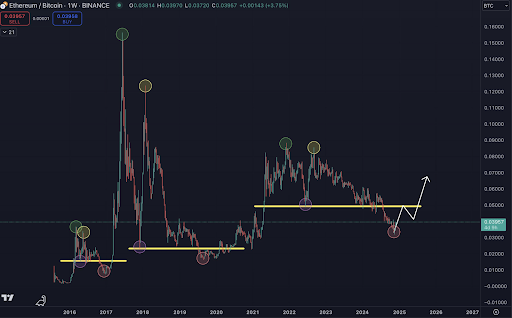

Based on cryptocurrency analyst Benjamin Cowen’s perspective, this current market behavior could potentially represent the early signs of an increase in Ethereum’s value relative to Bitcoin over the next six to twelve months.

Analysing The ETH/BTC Pair

Over the past fortnight, the Bitcoin price has been steadily holding below $99,000 while investors eagerly wait for a surge above $100,000. During this period of stagnation for Bitcoin, Ethereum started a significant surge from $3,340 on November 26, which in turn outperformed Bitcoin and many other altcoins. This rise has sparked discussions about the possibility that the crypto market might be initiating the long-anticipated altcoin season.

Based on technical analysis shared by well-known crypto expert Benjamin Cowen on social media platform X, it seems we might be experiencing the initial phase of recovery for the ETH/BTC pair. Notably, the recent low of the ETH/BTC pair at 0.03187 is quite near to his previously predicted worst-case scenario of 0.03.

In 2023, Cowen had foreseen a significant decrease in the ETH/BTC ratio. At that time, the ETH/BTC ratio was approximately 0.066, but he suggested it could drop by more than 45%. Remarkably, this forecast has come true as Ethereum’s value compared to Bitcoin has been decreasing since the last quarter of 2023 until very recently.

By December 2024, Ethereum has made a strong comeback and is holding its ground against Bitcoin. Notably, the ETH/BTC ratio stands at approximately 0.0396, marking a 24% increase from its 2024 low of 0.03187. This upturn has encouraged analyst Cowen to reconsider his perspective on the ETH/BTC pair, and he now holds an optimistic view.

Historical Trends Suggest A Seasonal Rebound

Cowen pointed out Ethereum’s past patterns, observing that the ETH/BTC ratio typically picks up speed around December or January. If this pattern persists and the ETH/BTC ratio strengthens in December, Ethereum could be entering its initial phase of recovery. On the other hand, if it delays until January, a revisit to previous lows at 0.03187 and potentially 0.03 might still occur, but it would become less probable as time goes on. He also mentioned that within a few months, determining the exact bottom could become inconsequential.

Moving forward, Cowen anticipates that substantial growth in the ETH/BTC pair could occur within the next 6 to 12 months. This development would be characterized by Ethereum’s price surpassing Bitcoin’s and marking the onset of a full altcoin season.

Currently, Ethereum’s price stands at $3,845 in the market. In contrast, Bitcoin has surpassed the $100,000 threshold and is now being traded at $103,000. At present, one Ether (ETH) amounts to approximately 0.03755 Bitcoins (BTC).

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-05 22:52