As a seasoned researcher with over two decades of experience in financial markets, I have seen bull runs and bear markets come and go. The current state of Bitcoin at $59,545, while showing signs of recovery, leaves me cautiously optimistic. The NUPL metric’s position near the 0.4 level serves as a critical juncture, hinting at potential turbulence ahead.

Currently, Bitcoin is being traded at approximately $59,545, marking a 0.5% rise in value over the past day. While this increase may seem small, it’s significant given that Bitcoin’s price had dropped to around $57,812 earlier today, making this surge noteworthy.

Despite this minor improvement, an examination conducted by an author at CryptoQuant, published on their QuickTake platform, suggests that Bitcoin could potentially find itself in a vulnerable state.

Bears At The Gates? Analyzing BTC’s Vulnerable Stance

Based on insights from analyst Grizzly at CryptoQuant, Bitcoin’s Net Unrealized Profit/Loss (NUPL) indicator – which helps determine the market’s profit or loss situation by considering both unrealized gains and losses – is close to a significant mark of 0.4.

As an analyst, I’ve noticed that this particular level in the market has traditionally played a pivotal role. It can serve as solid support, lifting market sentiment, or alternatively, it might function as resistance, signaling potential downturns.

Will the bears seize control of the market?

“Right now, the NUPL indicator finds itself close to a crucial threshold. In the past, the 0.4 mark has often acted as a key level offering both support and resistance.”

Read more

— CryptoQuant.com (@cryptoquant_com) August 15, 2024

Present evidence indicates that Bitcoin might be approaching a critical threshold. If it falls beneath this point, control may pass to the bears significantly, possibly causing a shift towards a bear market trend.

As suggested by the analyst Grizzly, if this action occurs, the value of Bitcoin might drop to around $40,000, marking a significant decrease from its present market values, he pointed out.

The data indicates that when the level falls below 0.4, it usually signals a significant decrease in trend. If the index keeps decreasing, it’s likely that bears might dominate the market. Under these conditions, the price might plummet towards approximately $40,000.

Simultaneously, although these warning signs are troubling, it’s important to maintain a balanced view when considering the data presented about Bitcoin. Grizzly noted that while Bitcoin’s current drop in value is worrying, it hasn’t reached a critical point yet that definitively suggests an end to its upward trend.

As a researcher examining historical trends of Bitcoin, I find myself holding a measured hopefulness. Previous occurrences suggest that Bitcoin has the resilience to bounce back from comparable situations, overturning pessimistic forecasts and continuing its trajectory of growth.

Bullish Take On Bitcoin

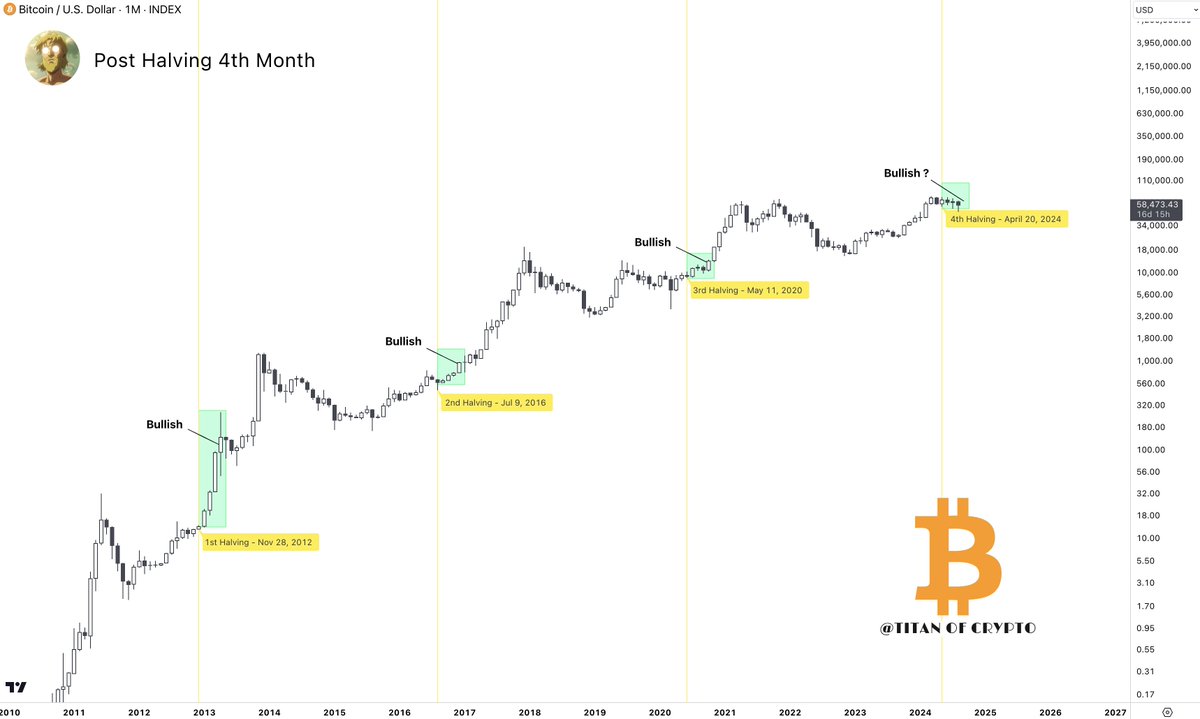

Meanwhile, historical trends could potentially indicate a recovery for Bitcoin. Notably, a well-known analyst within the cryptocurrency sphere, often referred to as the Titan of Crypto on X, has recently shared an intriguing pattern observed in Bitcoin.

As per the Crypto Titan’s analysis, historically, the fourth month following the Bitcoin halving has typically seen a bullish trend, closing above the price at which it was halved. If this pattern persists, September might show a bullish movement exceeding $66,000.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-16 07:37