As a seasoned crypto investor with several years of experience in the market, I find Willy Woo’s analysis on Bitcoin’s recent inventory trend both intriguing and potentially bullish. The decline in available Bitcoin supply on centralized exchanges during consolidation phases has historically been a constructive sign for the cryptocurrency.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development regarding Bitcoin‘s liquidity during its recent consolidation period. Specifically, I’ve found that the number of coins available for trading has been gradually decreasing.

Bitcoin May Be In A Good Position To Set New All-Time Highs

As a crypto investor, I’ve been following the insights of analyst Willy Woo on his latest post over at X. He sheds light on an intriguing trend concerning the amount of Bitcoin held in inventory on centralized exchange platforms recently.

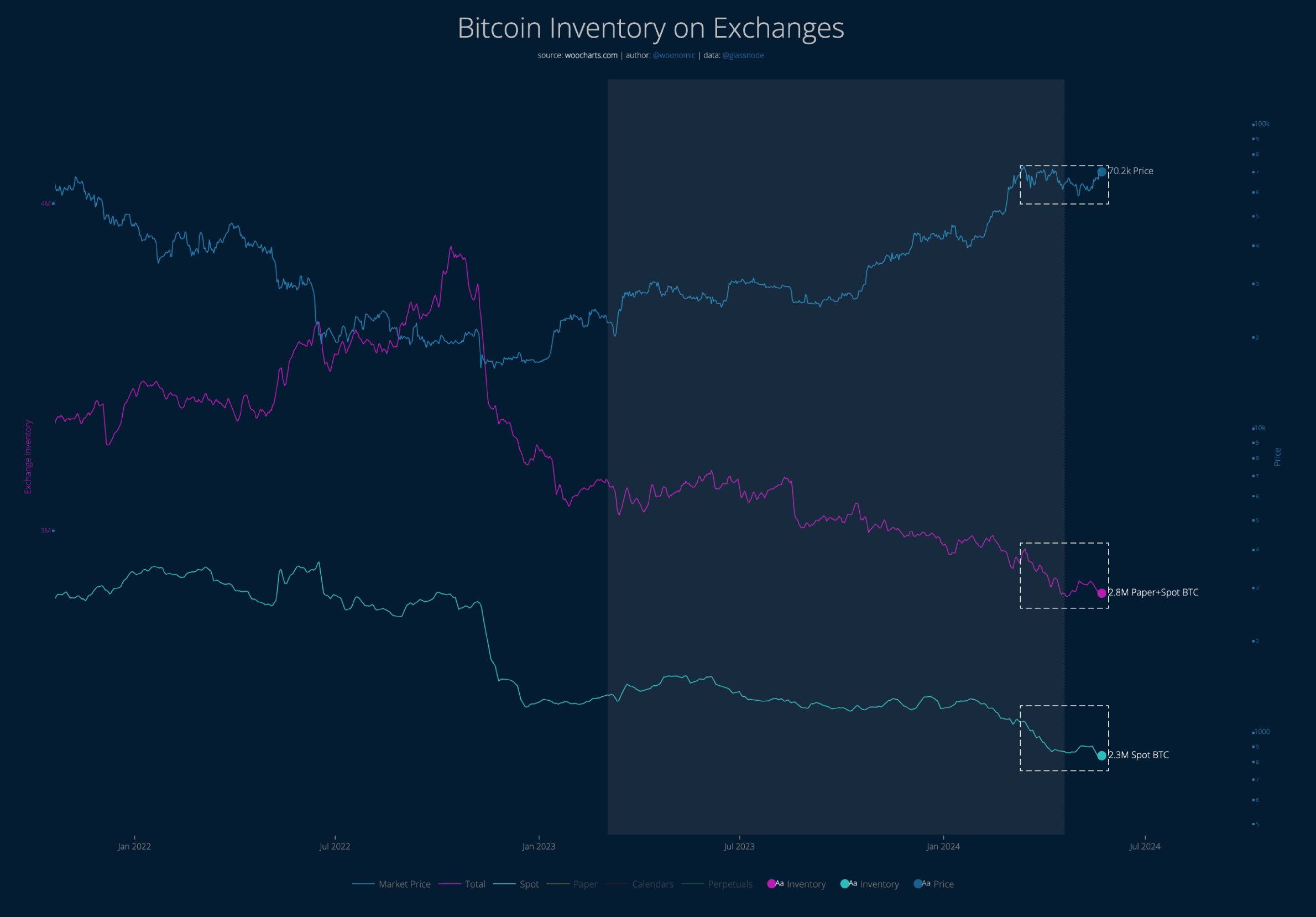

The chart below shows how the spot and paper BTC reserves have changed over the past few years.

I’ve observed a downward trend in the Bitcoins held in spot wallets as depicted on the graph over the past few months. The current figure stands at approximately 2.3 million Bitcoins, which is now under the control of central entities.

It’s clear that both the on-screen Bitcoin (indicated in purple) and its associated derivatives, referred to as “paper Bitcoin,” have experienced a decrease in total value simultaneously. “Paper Bitcoin” denotes financial instruments linked to cryptocurrencies without requiring investors to hold the underlying asset itself.

As a researcher examining the current state of cryptocurrency markets, I’ve noticed that the total amount of Bitcoin held in exchanges has decreased. This observation suggests that the drop in the spot price of Bitcoin isn’t due to an increase in paper Bitcoin replacing it. Instead, other factors may be at play in shaping the market dynamics.

In simple terms, the amount of Bitcoin that can be traded on exchanges is often viewed as part of the total Bitcoin supply. According to the principles of supply and demand, a smaller quantity of this exchange-tradable Bitcoin could be a positive indication for the value of Bitcoin.

I’ve noticed from the chart that the decrease in the exchange stockpile occurred during a timeframe when the cryptocurrency’s price faced challenges following its establishment of a new record high (ATH). According to Woo’s analysis.

During the past two months when the price of Bitcoin seemed stagnant and caused concern for many, a significant amount of Bitcoin was being acquired steadily without the creation of new paper Bitcoins to correspond with it.

As a crypto investor, I’ve noticed an intriguing development: the shrinking supply of a particular coin during this period. This reduction in availability could be a promising indicator, suggesting that demand is outpacing supply and potentially leading to price increases – perhaps even surpassing previous all-time highs. So, one might say, “It’s just a matter of time before this coin breaks through its all-time highs.”

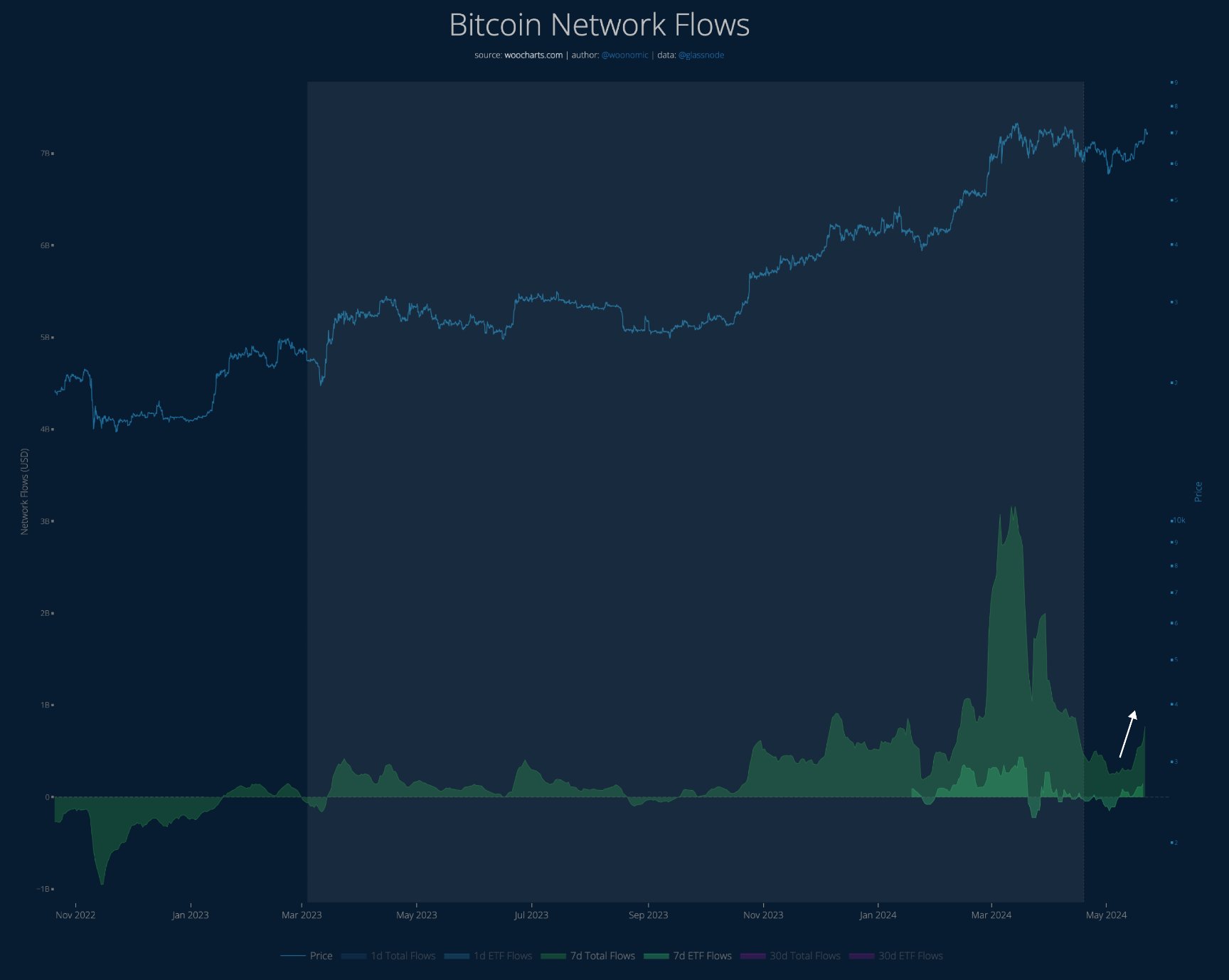

As a researcher studying cryptocurrencies, I’ve observed that in one of Woo’s previous posts, they noted the recent resurgence of capital flowing into Bitcoin. Earlier, there was a significant decrease in this influx.

According to the graph, there was a significant increase in network inflows coinciding with the record-breaking peak. However, there was a notable decrease in these inflows during the subsequent consolidation period.

As a crypto investor, I’ve noticed that the once absent inflows into spot exchange-traded funds (ETFs), represented by the light green bars, have recently returned in tandem with this new wave of capital influxes.

BTC Price

Bitcoin reached a peak of $71,000 previously, but it has since retreated and is currently trading below the $68,000 mark again.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-24 07:16