A researcher has outlined that a confluence of these two Bitcoin indicators is necessary for the action to start being exciting regarding this asset.

Bitcoin Realized Price Is Yet To Flip 200-Week MA

In his latest article on X, analyst James Van Straten delves into the subject of Realized Price and the 200-week moving average for Bitcoin. The term “Realized Price” signifies an on-chain metric that essentially monitors the average cost basis or purchase price of the typical investor within the BTC network.

As an analyst, I find that when the current market value of my cryptocurrency holdings exceeds the original purchase price, it indicates collectively we are sitting on a net unrealized profit. Conversely, if the market value is less than what I initially paid, it seems the overall market is experiencing a collective loss.

The 200-week Moving Average (MA), another key measurement we’re focusing on, comes from technical analysis. In other words, an MA is a device used to determine the average value of a specific data point over a defined time frame. As its name suggests, this average value shifts or moves as time progresses.

MAs (Moving Averages) play a crucial role in analyzing long-term patterns as they smooth out temporary fluctuations or short-term irregularities from an asset’s price graph. Among various MAs, some are deemed more important than others, and the time frame of 200 weeks is one such significant period.

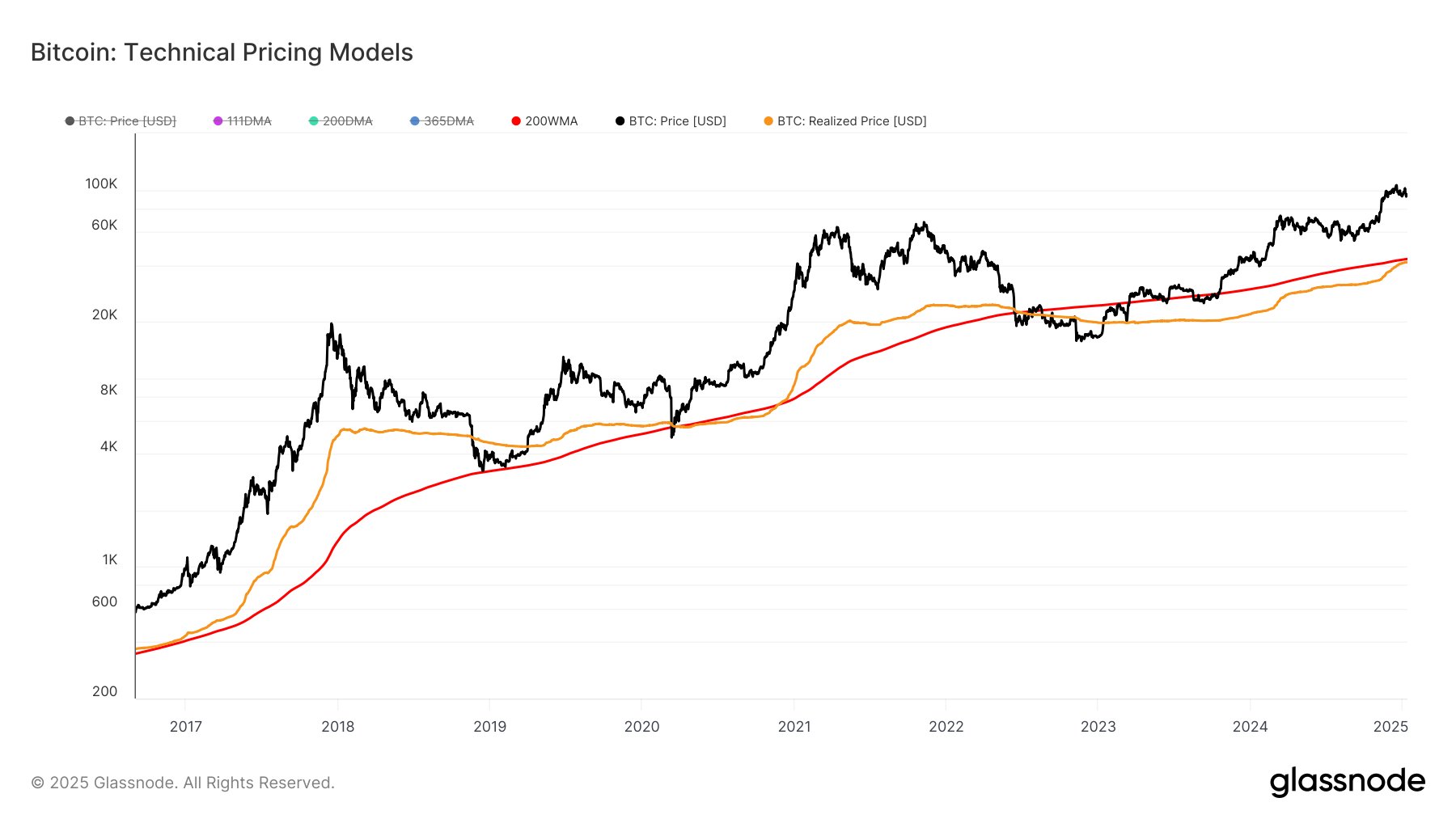

Here’s a chart provided by our analyst, displaying the evolution of Bitcoin’s Realized Price and its 200-week Moving Average during recent years.

This chart from our analyst illustrates the changing pattern of Bitcoin’s Realized Price and its 200-week Moving Average over the past few years.

Or simply:

Our analyst’s chart demonstrates the historical trend in Bitcoin’s Realized Price and the 200-week MA over the last several years.

It’s clear from the chart that the average price at which Bitcoin was last spent (Realized Price) dipped below its 200-week moving average during the 2022 market downturn. Since then, this metric has stayed beneath the line, but more recently, it has been rapidly closing in on a potential retest.

As a crypto investor, I’ve noticed an interesting pattern: when the realized price crosses over the 200-week moving average (MA), that’s often when things get exciting. Van Straten puts it well when he says, “When the realized price flips the 200WMA, the party starts.

In other words, it’s plausible that this combination might boost Bitcoin during the present phase too. However, it’s uncertain if the Realized Price will exceed its current level soon or if there’s resistance ahead.

In a different context, the Realized Price has often acted as a defining line for the lowest points in an asset’s price during bear markets. As previously discussed, when Bitcoin (BTC) drops below this measure, most investors find themselves in a losing position. With few sellers remaining to cash out their profits, the asset typically hits its bottom at such times.

BTC Price

In the last 24 hours, Bitcoin has experienced a significant surge in value and is currently back at approximately $96,600 following a decline that took it below $90,000 on the previous day.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-01-15 08:46