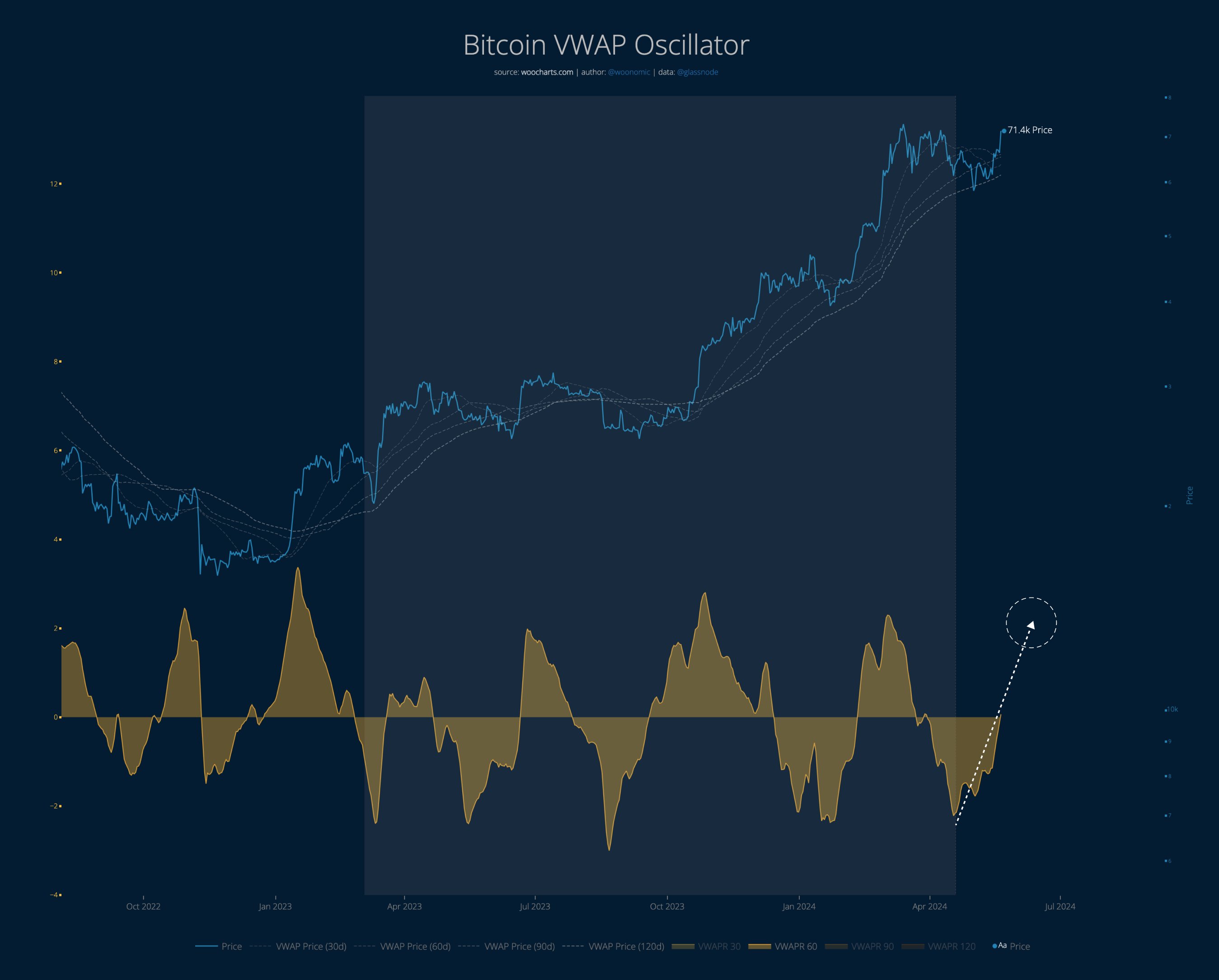

As a researcher with a background in cryptocurrency analysis, I find Willy Woo’s latest insights on the Bitcoin VWAP Oscillator intriguing. Based on my understanding of technical analysis and this specific indicator, his interpretation seems plausible.

As a researcher studying the Bitcoin market, I’ve come across an interesting analysis suggesting that we may have reached the midpoint of the current price surge based on a particular indicator.

Bitcoin VWAP Oscillator Suggests BTC Rally Only Halfway Done

Analyst Willy Woo has shared a fresh insight on X regarding the Bitcoin Volume Weighted Average Price (VWAP) Oscillator following the recent market surge.

As a cryptocurrency market analyst, I would explain that the Volume-Weighted Average Price (VWAP) is a valuable metric I use to gain insights into the behavior of the market. Unlike simple average price calculations, VWAP goes beyond merely considering price changes during the day; it also takes volume into account. Ess effect, each price point is weighted by the trading volume at that specific price level, providing a more comprehensive and accurate representation of the market’s trend.

In the typical scenario, the volume of a financial asset like a stock is determined using data from central exchanges. However, when it comes to Bitcoin, its decentralized nature allows for on-chain data to be utilized in calculating the Volume Weighted Average Price (VWAP) instead. This approach takes advantage of the transparency and accessibility of the Bitcoin blockchain.

The VWAP Oscillator, which is the key measure in this context, calculates the ratio of a cryptocurrency’s current market price to its volume-weighted average price (VWAP), and then displays this ratio as an oscillating graph around zero.

Previously this month, Woo noted that the Bitcoin Value Weighted Average Price (VWAP) Oscillator was displaying a bullish discrepancy for the cryptocurrency.

In the chart, the Bitcoin Volume-Weighted Average Price (VWAP) oscillator noticeably dipped into the negative zone following its previous apparent low point. Meanwhile, the value of Bitcoin itself continued to decline.

Previously, this particular configuration has shown strong upward momentum for the cryptocurrency, which persisted until the VWAP Oscillator reached positive values. Given my research findings, I believed the coin held significant potential for further gains at that time.

After that point, the price has bounced back, indicating a possibility that the bullish divergence will be profitable according to Woo’s observation. Notably, the indicator has regained its neutral stance following this upward trend.

Using a conversational tone,

As for how things could play out next, the analyst says,

To reach new record highs, it’s essential first to consolidate our gains at current peak levels. Once this is achieved, we can assess if there’s enough momentum for a further advance that propels us beyond these highs, opening up the opportunity for even more significant growth.

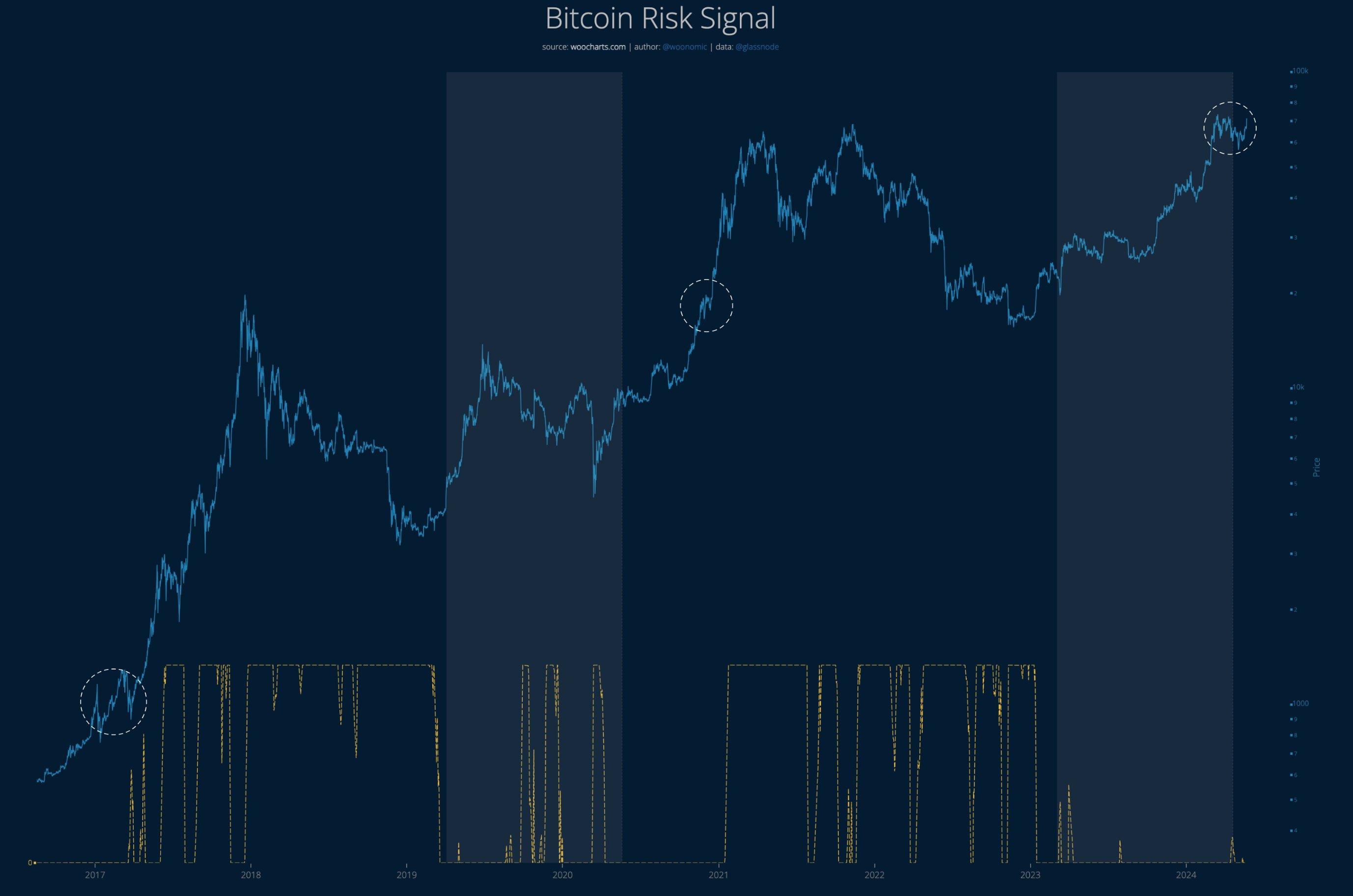

As a crypto investor, I’ve noticed that Woo has provided a “warning sign” regarding Bitcoin’s position in the broader market context.

As a researcher studying the Bitcoin market, I’ve observed that we might be approaching a stage where risk becomes more pronounced and prices become volatile in response to substantial capital inflows. It is during this phase that significant gains often occur.

BTC Price

I’m glad I invested in Bitcoin today when it surged past $71,000. However, my excitement was short-lived as the cryptocurrency has experienced a setback and is currently trading below $70,000 once again.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-05-22 00:04