As a seasoned researcher with a background in financial markets and a keen interest in digital currencies, I find the recent Bitcoin price action particularly intriguing. Having closely followed the gold market for years, I can’t help but draw parallels between its historical patterns and that of Bitcoin.

Over the past week, the price of Bitcoin has dipped back towards the $67,000 mark following a drop of roughly 8.9%. This decline occurred between October 29, where it was at $73,464, and November 4, where it settled at $66,895. This drop can be attributed to a number of short-term traders selling off their positions, as well as some long-term investors who may have chosen to cash out their Bitcoins in order to secure profits.

As a researcher delving into the world of cryptocurrencies, I’ve found that the ongoing correction in Bitcoin’s price is perfectly normal and expected according to technical analysis. Intriguingly, this assessment stems from the observation that the $100,000 target for Bitcoin seems very much within reach based on the same analytical methods. Remarkably, these findings are substantiated by drawing similarities with the historical price trends of gold.

Analyst Reveals What The Gold Chart Says About The Bitcoin Price

Over the years, Bitcoin is often compared to digital gold due to its role as an investment safeguard against inflation. Yet, upon closer examination of their market behaviors, it appears that they share more commonalities in this aspect than most investors might initially think.

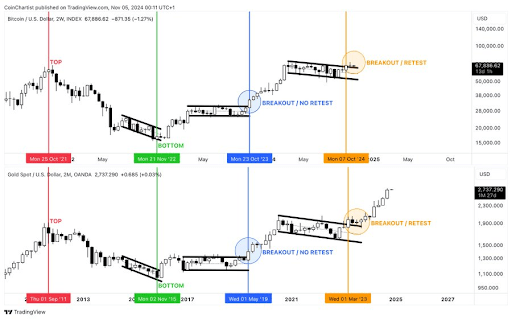

Crypto expert Tony ‘The Bull’ Severino recently posted on social media platform X about an interesting pattern he spotted in the Bitcoin price chart that suggests a positive outlook for its future growth path. According to Severino, Bitcoin’s price fluctuations seem to mirror historical trends observed in gold, with comparable peaks, troughs, breakthroughs, and retests.

Tony Severino pointed out striking resemblances between Bitcoin’s price movements over a two-week period and gold’s price fluctuations over a two-month period, as depicted on their respective candlestick charts. In various instances, Bitcoin’s price behavior has closely followed that of gold. Specifically, the current price trend in Bitcoin, particularly its breakout/retest phase, was compared to a similar breakout/retest pattern observed in gold during 2023 by the analyst.

In March 2023, gold demonstrated a breakout and retest pattern that paved the way for an extended rise lasting multiple months, as I write now. Severino posits that Bitcoin might mirror this trend, leading to a prolonged increase over several months.

What’s Next For The BTC Price?

Based on Tony Severino’s assessment, we can expect the downturn in Bitcoin prices to conclude swiftly and be followed by a significant upward trend throughout the remainder of this year. Looking further ahead, he predicts that a new record high will be reached by the end of 2024, with Bitcoin potentially reaching $100,000 as early as the first quarter of 2025.

Despite the analyst’s prediction being influenced by Bitcoin’s relationship with Gold, it aligns with other technical analysis forecasts. For example, a CryptoQuant analyst called CoinLupin pointed out a similar timeframe using the Bitcoin MVRV (Market Value to Realized Value) ratio. Employing this ratio, he suggested a price target range of between $95,000 and $120,000.

At the time of writing, Bitcoin is trading at $68,714 and is down by 3% in the past 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-06 01:16