As a seasoned analyst with over two decades of experience in the financial markets under my belt, I find myself intrigued by the insights presented by Crypto Rover. His analysis of Bitcoin’s market dynamics is not only insightful but also backed by robust evidence. The consistent decline in exchange reserves and the bull flag pattern he has identified are strong indicators that suggest a potential price surge towards $200,000.

According to well-known cryptocurrency expert, Crypto Rover, there are notable signs in the current market trends of Bitcoin. These include reduced reserves on exchanges and an optimistic chart configuration that could potentially lead to a predicted value of $200,000.

His findings align well with Bernstein’s long-term forecast, providing support for the idea that Bitcoin could see significant expansion in the coming years.

As an analyst, I’m eagerly waiting for Bitcoin’s next major shift, given the volatile state of the market at present. Investors and I are keeping a close eye on its movements, hoping to make informed decisions.

Decreasing Exchange Reserves May Indicate A Supply Shock

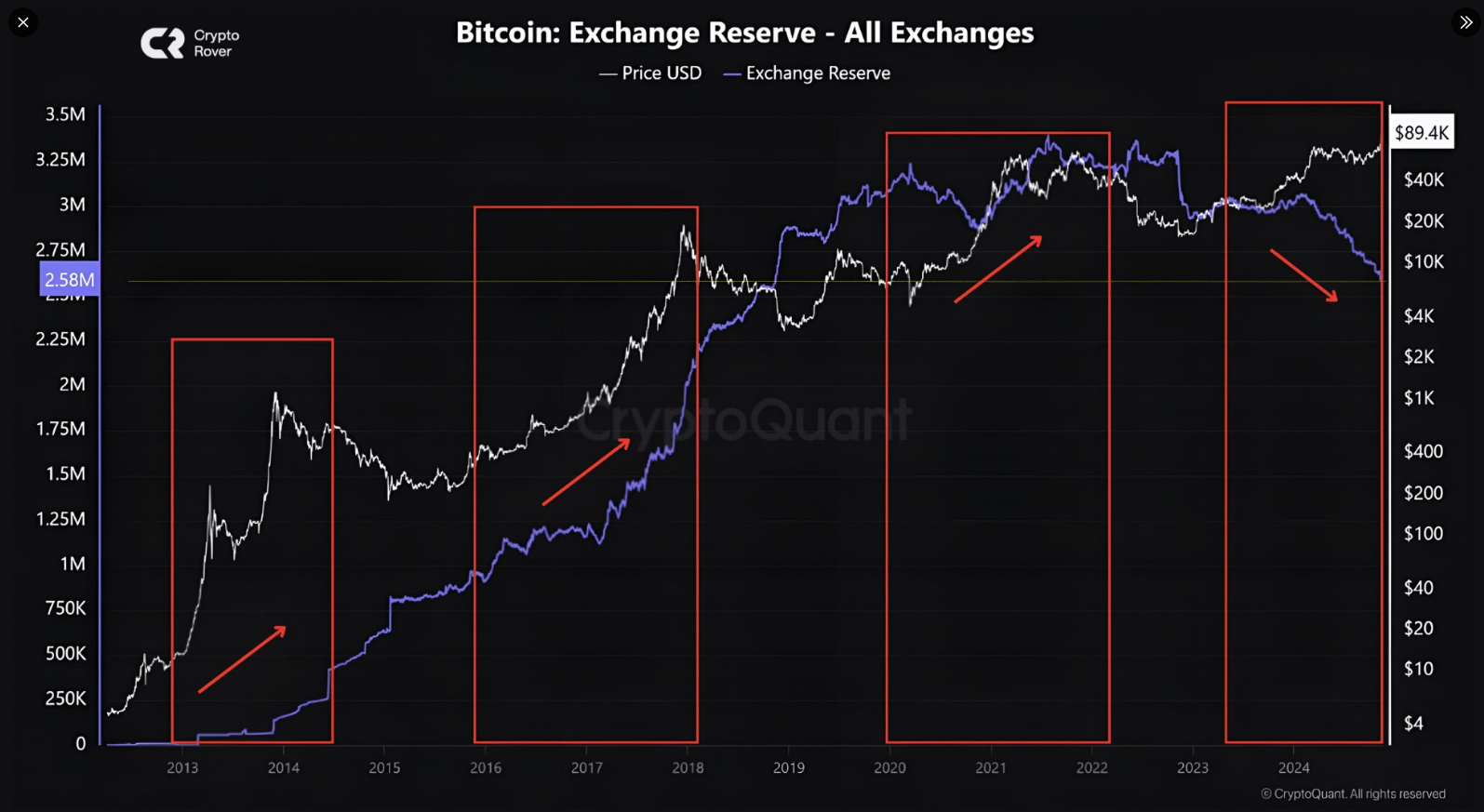

One significant pattern observed by Crypto Rover is the continuous decrease in Bitcoins kept on exchanges. In contrast to the rising value of Bitcoin, a growing number of investors are shifting their assets from exchange accounts to personal wallets.

For the initial occasion in Bitcoin’s past, the Bitcoin held on trading platforms is decreasing amidst a market uptrend.

This cycle is different.

A MASSIVE SUPPLY SHOCK IS COMING.

— Crypto Rover (@rovercrc) November 18, 2024

As an analyst, I’m noticing a growing trend that prioritizes security over liquidity. This shift is evident given the ongoing worries about cyber threats such as attacks and data breaches.

From my perspective as an analyst, the diminishing amount of Bitcoin held on exchanges hints at a potential disruption. With fewer coins available for trading, it suggests that demand may soon outstrip supply, leading to a substantial increase in prices. This trend challenges traditional market dynamics where reserves often increase during bull markets.

Bernstein’s $200K Target And Rover’s Bull Flag

The Bitcoin price charts are showing a bull flag pattern according to Rover’s technical analysis. This pattern usually signals the prolongation of an uptrend. Rover anticipates that if Bitcoin breaks through key resistance levels, as suggested by this pattern, it could potentially reach prices above $200,000 in the near future.

Bernstein analysts continue to share a favorable outlook for Bitcoin, as they maintain their prediction that its price could reach $200,000 by the year 2025. Their current forecast of Bitcoin hitting $100,000 becomes more feasible, and the possibility of it reaching $200,000 is gaining traction considering that Bitcoin’s current value is around $92,000.

Daily Crypto Movers Nov. 19

Bitcoin predicted to reach $200,000 by 2025 according to Bernstein’s forecast for a bull run.

Learn more#Bitcoin #CryptoNews #KuCoin

— KuCoin (@kucoincom) November 19, 2024

They believe this possible rise is due to several reasons, including the advantageous political and legal circumstances for Bitcoin, which are particularly prominent under a pro-cryptocurrency American government.

Market Outlook And Investor Strategy

Powerful technical signals coupled with decreasing Bitcoin reserves hint at an imminent substantial recovery, benefiting investors. Minor shifts in demand might lead to dramatic price fluctuations due to reduced liquidity, making it both risky and potentially profitable. Therefore, a well-thought-out strategy and precise timing are crucial.

Bernstein additionally highlights the broader political landscape as a significant factor. With the arrival of President Donald Trump, they anticipate a more favorable environment could propel Bitcoin’s development even more significantly.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2024-11-20 22:35