As a researcher with a background in cryptocurrency and data analysis, I find Martinez’s UTXO Realized Price Distribution (URPD) chart analysis on Bitcoin intriguing. The potential support levels identified based on past investor behavior can provide valuable insights into the market sentiment and price movements.

Based on information from CoinMarketCap, Bitcoin experienced a lackluster week as its market value decreased by 4.65% in the past seven days. Nevertheless, noteworthy crypto analyst Ali Martinez has issued a warning: if Bitcoin fails to hold onto a specific support level, further price declines could ensue.

Bitcoin URPD Chart Shows Potential Correction – Analyst

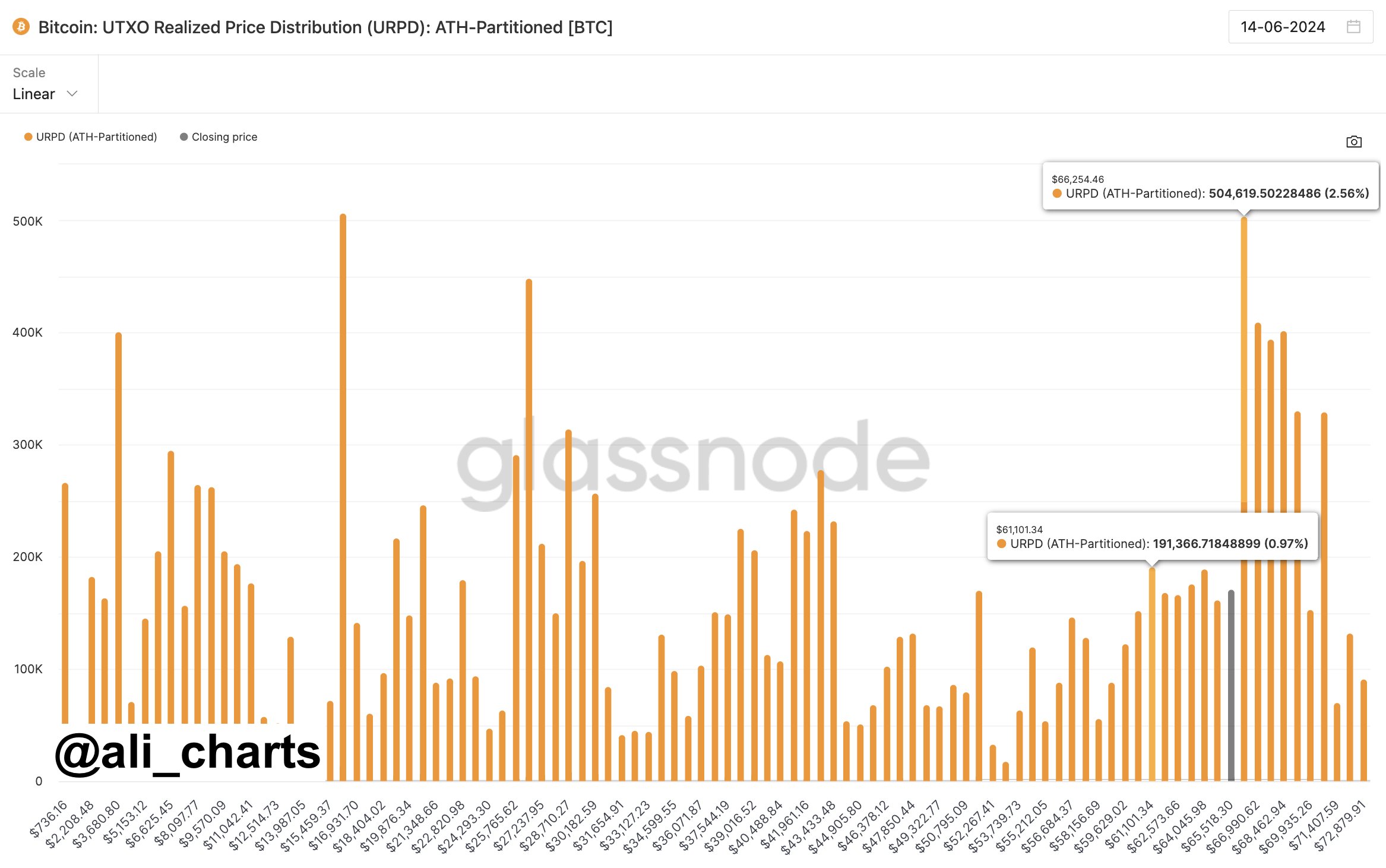

According to a post on Glassnode’s X forum on June 15th, I, as a crypto investor, have taken note of the analysis shared by Martinez. He argues that for Bitcoin to avoid a potential price decline, it must surge past the $66,254 mark. This assessment is derived from the UTXO Realized Price Distribution (URPD) chart provided by Glassnode’s data analytics platform.

Bitcoin should regain the $66,254 mark promptly to prevent a possible price drop towards $61,100.

— Ali (@ali_charts) June 14, 2024

Unspent Bitcoin outputs, or UTXOs for short, represent portions of the digital currency that have not been utilized in a transaction yet. Each UTXO carries a “realized price,” which is the market value at the time when the associated Bitcoin was transferred. By examining the UTXO Realized Price Distribution chart, we can observe how the overall Bitcoin supply has been accumulated at various price levels over time.

This data is valuable for conducting market analysis, including sentiment assessment, distribution studies, and identification of key support and resistance points. Furthermore, it provides insights into investor behavior, as clusters of Unspent Outputs (UTXOs) may signify locations where many investors purchased Bitcoin, potentially indicating future resistance or support levels.

As a crypto investor, I’ve taken note of the URPD chart presented by Martinez, which reveals that approximately 504,619 Bitcoins were bought at a price of $66,254. This significant purchase volume suggests that this level could potentially act as a strong support for Bitcoin during its current downtrend. Moreover, the next most prominent realized price (at which 191,366 Bitcoins were bought) is $61,101. Should Bitcoin fail to regain the $66,254 mark, this level could serve as the next support level for the premier cryptocurrency.

Bitcoin Price Overview

As I pen down this analysis, Bitcoin presently exchanges hands at a price of $66,151, marking a 1.15% decrease in value over the past day. Simultaneously, Bitcoin’s daily trading volume has witnessed a decline of 5.54%, currently standing at $25.4 billion. Despite this recent dip, Bitcoin continues to display a monthly growth rate of 5.80%, an encouraging sign for long-term investors.

Based on Coincodex’s analysis, although the overall attitude is pessimistic, the fear and greed index reading of 74 reflects investor enthusiasm and a willingness to take risks. This situation could lead to significant market fluctuations.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-06-15 21:04