As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless market cycles and trends. The surge of Ethereum past $4,000, coupled with its strength against Bitcoin, is reminiscent of the early days of Bitcoin itself back in 2013.

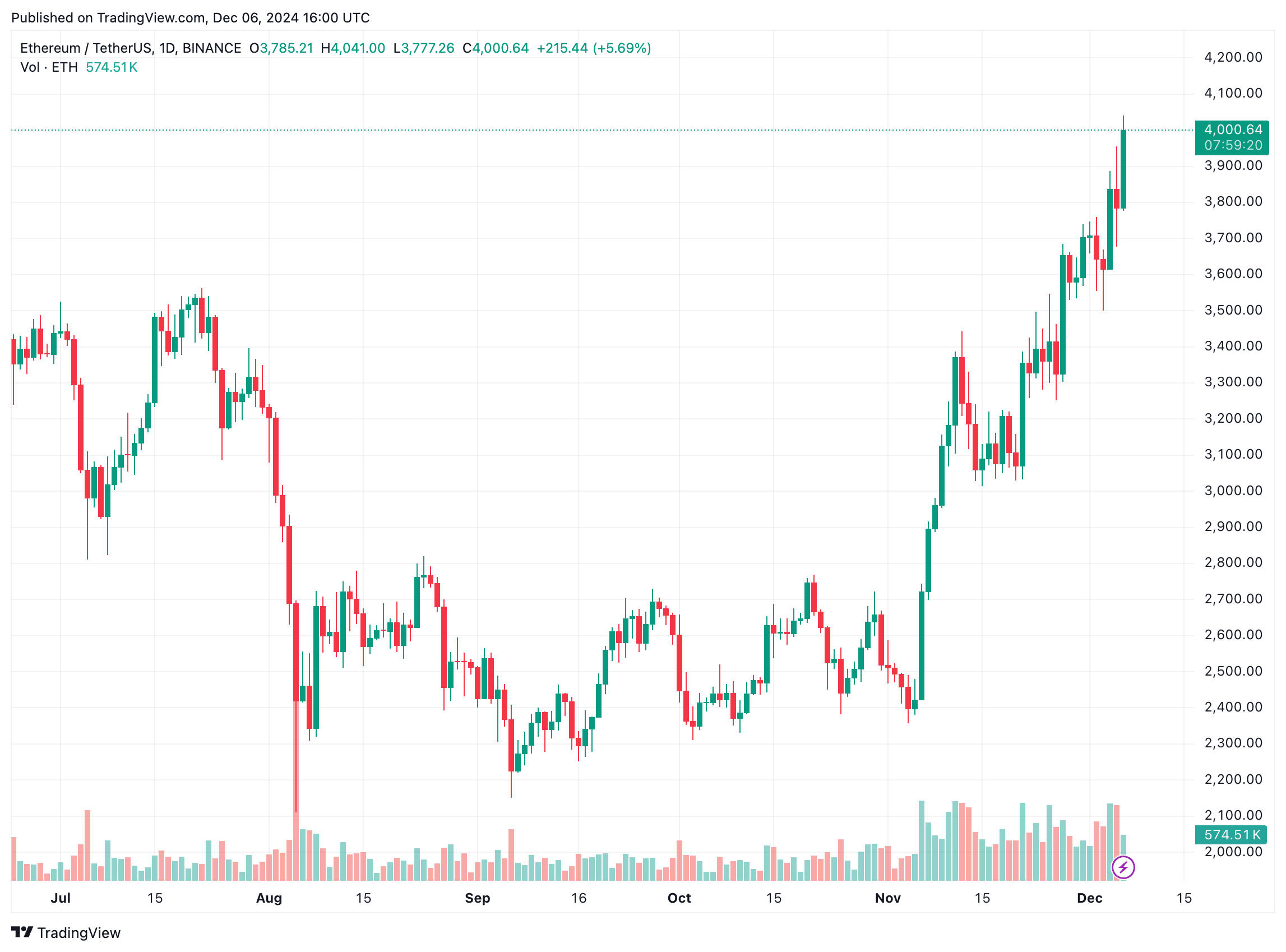

Today, the value of Ethereum (ETH) climbed above $4,000 for the first time since March 2024, marking a significant milestone. With the formation of a golden cross, financial experts believe that this could be an early sign of the much-talked-about “altcoin season” starting up.

How Far Can The Golden Cross Push Ethereum?

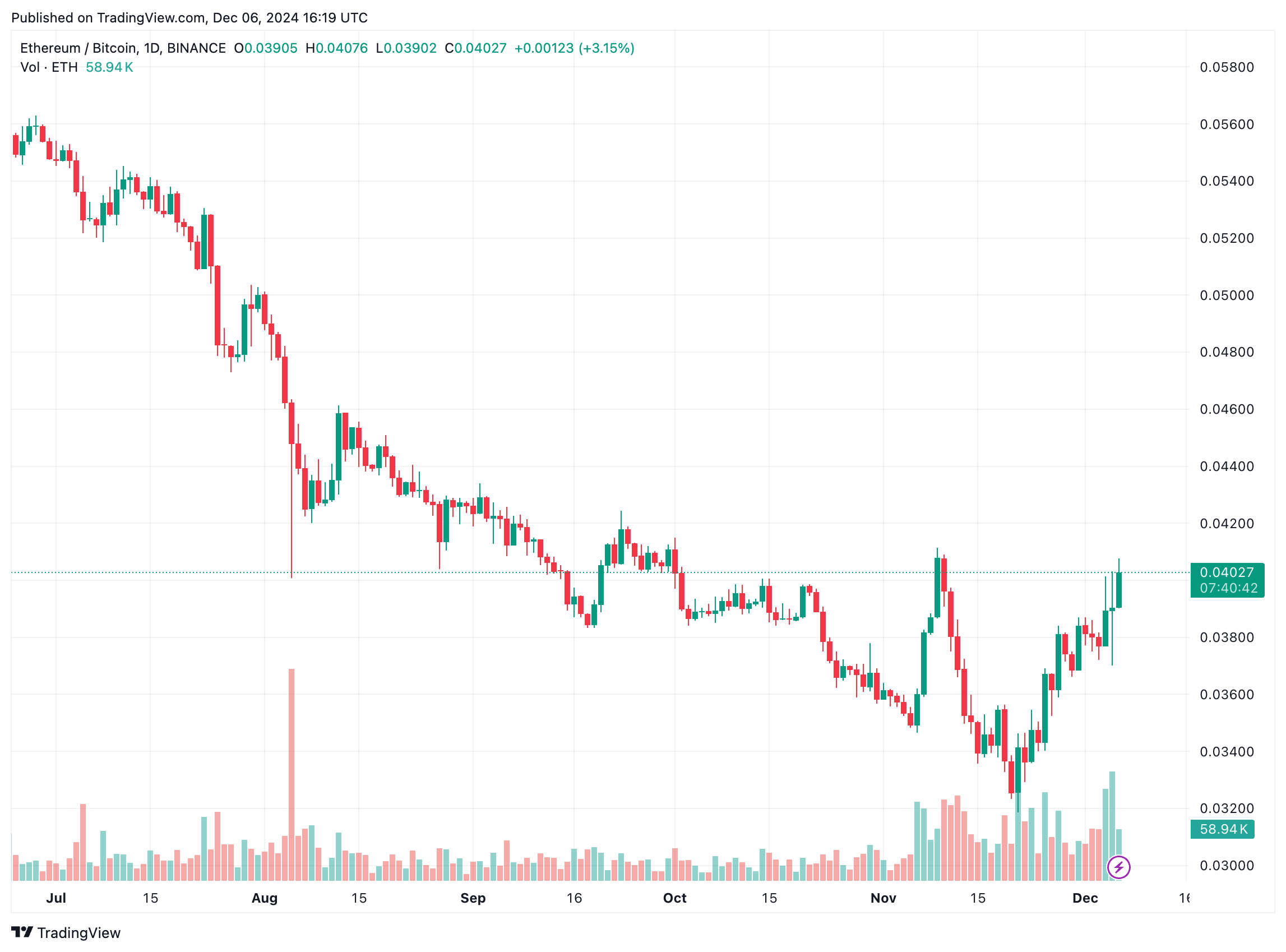

Today, Ethereum, the dominant platform for smart contracts, witnessed its own Ether (ETH) token surpassing $4,000. Notably, Ether’s value isn’t just growing compared to Tether’s USD equivalent (USDT), but it’s also demonstrating strength against Bitcoin (BTC).

On the graph showing daily trades for ETH and BTC, you’ll notice that Ethereum has been increasing in value compared to Bitcoin. Specifically, the value of the ETH/BTC trading pair has risen significantly from 0.032 on November 21st to currently 0.04 as we speak.

As an analyst, I prioritize maintaining Bitcoin’s dominance as it lays the groundwork for a promising altcoin season ahead. This phase, often referred to as ‘altseason’, typically sees altcoins gaining more value relative to Bitcoin, which tends to trade within a narrow range.

A crypto expert at venturefounder utilized platform X to verify that Ethereum (ETH) has successfully achieved its initial golden cross this year on the daily graph. This analyst emphasized the potentially positive impact a golden cross could have on Ethereum’s pricing, explaining:

Previously, when a similar occurrence took place, Ethereum was moving through the accumulation phase within a bear market; however, it still experienced a significant surge of approximately +129%. In contrast, during the 2021 bull market, the last golden cross propelled ETH to an impressive gain of around 2,323%.

For those who are new to trading jargon, a “golden cross” is an optimistic technical signal that takes place when a short-term average moving line surpasses a long-term average moving line. In the context of ETH, this has recently happened as the 50-day Moving Average (MA) moved above the 200-day MA. This could be an indication of a robust rally or possibly a change in the current trend’s direction.

If Ethereum (ETH) surpasses the $4,000 mark convincingly, it might encounter resistance at a price range of approximately $4,800 to $5,000, which was previously ETH’s all-time high (ATH) in November 2021, as recorded by CoinGecko.

It’s noteworthy that there’s growing interest among institutional investors in Ethereum exchange-traded funds (ETFs). As per data from SoSoValue, US-based spot ETH ETFs saw a significant increase of $428 million in daily net inflows on December 5.

Altseason On The Horizon?

Over the last three weeks, Bitcoin Dominance (BTC.D), a commonly used benchmark for predicting an altcoin season, has been consistently decreasing. Currently, BTC.D stands at 55%, having dropped from around 61%. This suggests that alternative coins have been performing exceptionally well relative to Bitcoin recently.

Yesterday’s plunge of Bitcoin to $90,500 didn’t seem to faze altcoins much, which I believe is a promising sign indicating an imminent altcoin surge in the coming days. Moreover, as per Crypto Amsterdam’s analysis, it appears that mid-tier altcoins might be on the brink of initiating their parabolic growth phase.

Looking forward to a potential ‘giant candle’ on Ethereum that could potentially push its price to $5,000, the upcoming days are expected to be thrilling for altcoin enthusiasts. As we speak, Ethereum is trading at approximately $4,000, representing a 2.5% increase over the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-12-07 14:10