As a seasoned crypto investor with a few battles under my belt, I can’t help but feel a sense of anticipation as I read these recent developments about Bitcoin (BTC). The predictions and bullish signals are reminiscent of the early days of 2017 when BTC was still just a whisper in the financial world.

This September has been an atypical one, and Bitcoin (BTC) has added another week to its list of positive performances, rising by 5.07% over the past seven days. As per CoinMarketCap’s data, this growth boosted Bitcoin’s total increase for the month up to 11.30%. Remarkably, following the Bitcoin halving event, financial experts are optimistic that the traditional market rally could soon be led by the largest digital currency.

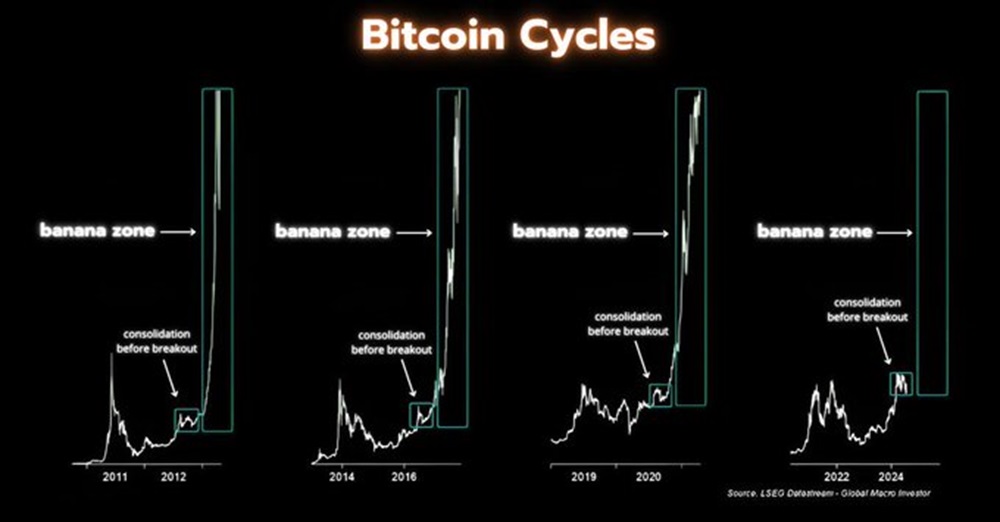

BTC In Consolidation As It Gathers Momentum For Breakout

On Friday, well-known cryptocurrency expert Crypto Rover foretold that Bitcoin could reach a value of around $290,000 during the next bull market cycle.

It’s worth noting that this predicted price aligns with earlier predictions by analysts, who anticipate a six-digit value for Bitcoin after the launch of Bitcoin spot ETFs. This could be due to an enhanced institutional interest in the leading cryptocurrency.

Significantly, Bitcoin (BTC) has been fluctuating between $55,000 and $70,000 for the past seven months, indicating a period of consolidation. As per Crypto Rover’s analysis, after breaking free from this recent price range, Bitcoin could potentially enter a phase of rapid and unusual price increase, similar to previous bull market trends, often referred to as the “banana zone”.

According to the crypto expert’s forecast, we might see Bitcoin prices soaring to approximately $290,000 over the next 12-18 months, which would equate to a substantial increase of 339.39% from its current value.

For numerous cryptocurrency enthusiasts, there’s a strong possibility that the long-awaited surge could happen in the upcoming weeks, given that Bitcoin has now developed an inverse head and shoulders pattern, as Crypto Rover pointed out in another post. To clarify, the inverse head and shoulders pattern is a commonly used bullish signal suggesting potential reversals from a downtrend. If the price breaches above the neckline with substantial volume, it suggests a transition to bullish dominance.

The optimistic outlook on Bitcoin’s price surge is reinforced by the approach of Q4, a historically strong and bullish quarter for Bitcoin, with an average increase of approximately 88% during the past eleven years.

Bitcoin Exchange Stablecoins Ratio Shows Bullish Signal

Good news for Bitcoin enthusiasts: The Bitcoin Exchange Stablecoin Ratio, a key indicator, is now showing a buy signal. As CryptoQuant analyst EgyHash explains, this metric compares Bitcoin reserves (in USD) to the total stablecoin reserves held on exchanges. At present, it’s at levels similar to those observed at the beginning of 2024, which could indicate a potential buying opportunity.

EgypHash states that when the Bitcoin Exchange Ratio is low, it suggests traders possess more purchasing power because they hold substantial stablecoin reserves. This increased buying potential could lead to investments in Bitcoin, potentially causing its price to increase. Consequently, this low ratio serves as another positive indicator for Bitcoin investors, pointing towards a bullish market trend.

Currently, as I’m typing this, the leading cryptocurrency is being traded at approximately $66,064. In the past 24 hours, its value has increased by 1.14%. On the other hand, Bitcoin’s daily trading volume has decreased by 12.92% and stands at around $32.01 billion.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

2024-09-28 22:16