As a seasoned crypto investor with a decade of market insights under my belt, I have weathered multiple Bitcoin storms and witnessed its incredible resilience and growth. The current dip, although concerning for some, doesn’t faze me.

Bitcoin (BTC) faced a challenging start to August, experiencing a significant drop of over 13% that pushed its value down to approximately $50,000 within the initial days. This steep decrease can be attributed to multiple factors such as the unraveling of yen carry trades, economic worries about the United States, and other related issues.

Despite this, two key indicators suggest BTC could be strong in the long run.

Positive Outlook from Long-Term Options

A notable indication of optimism is the persistent bullishness in Bitcoin’s long-term options market, as shown by data from cryptocurrency platform Amberdata. This data suggests that Bitcoin’s 180-day call-put skew remains elevated, signifying faith in its price growth over the next six months. The skew compares the demand for ‘call options’ (which allow for buying Bitcoin at a future date) versus ‘put options’ (which permit selling it). A favorable skew implies investors are willing to pay more for call options, indicating they believe Bitcoin’s price will increase.

Investing in call options gives you the opportunity to purchase Bitcoin at a predetermined cost in the future, whereas put options enable you to sell it at a fixed price. The current positive skew implies that investors foresee Bitcoin’s price increasing, which is a promising indicator for its long-term success.

Buying Pressure on US Exchanges

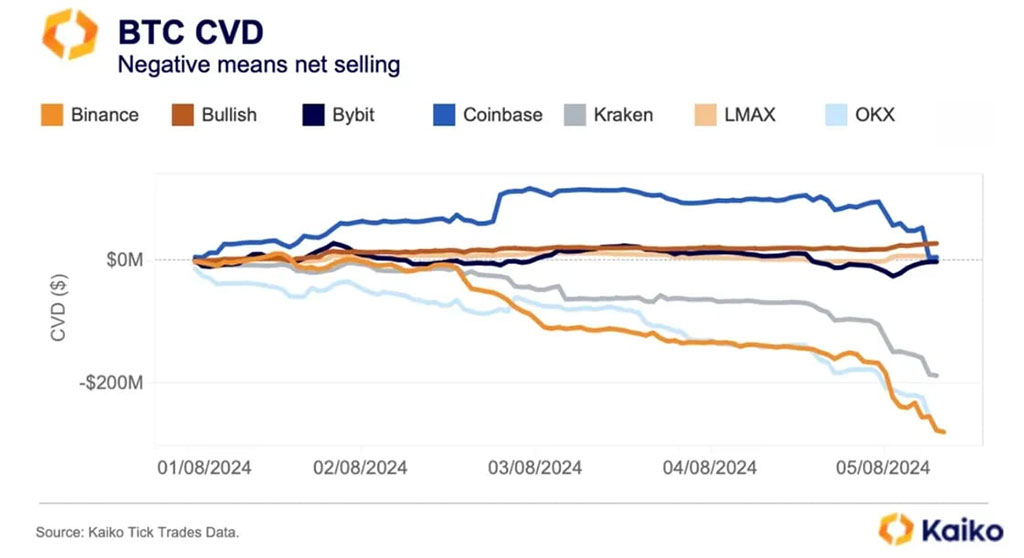

An additional factor that remains optimistic is the trading activity on American stock markets, particularly on platforms such as Coinbase, Gemini, and Kraken. Although there have been recent price decreases, data from Kaiko reveals that these platforms have seen robust buying activity. This strength is quantified through a metric called cumulative volume delta (CVD), which monitors the gap between buying and selling volumes. A positive CVD signifies more purchases than sales, implying that traders are capitalizing on reduced prices.

Photo: Kaiko

On U.S. exchanges with abundant liquidity, such as Coinbase and Gemini, there’s been a notable increase in Bitcoin buying by individual traders and institutional ETF providers, even as offshore platforms like Binance and OKX experience more selling. This buying activity during the dip could potentially bolster Bitcoin’s price.

Other Technical Indicators and Historical Trends

For now, Bitcoin’s sudden significant decrease and RSI (Relative Strength Index) being below 30 may indicate it is overbought, potentially setting up for a quick recovery. Historically, these circumstances have frequently been followed by temporary recoveries, hinting that Bitcoin could find stability or even improve in the upcoming days.

Over a prolonged period, Bitcoin appears to be moving upwards within a trend channel. Notable support can be found near the $45,000 mark, while resistance is present around $70,000. This uptrend indicates that although there have been temporary drops, the general path of Bitcoin’s price has been on an upward slope.

The current trend seems reminiscent of Bitcoin’s response during the market crash in March 2020. After a substantial decline, Bitcoin bounced back strongly as the economy started to recover. If the present economic problems get resolved and stability returns, there’s a possibility that Bitcoin might undergo a similar recovery.

Essentially, Bitcoin may experience fluctuations in the short run, yet its future prospects appear optimistic. It’s recommended that investors and speculators exercise caution during these volatile periods, but they should also be mindful of Bitcoin’s potential growth over the long term.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-08-06 15:00