As a seasoned analyst with over a decade of experience in the financial markets, I find EGRAG Crypto’s analysis particularly intriguing. His use of the VRVP tool to predict Bitcoin Dominance’s decline and potential altcoin inflow is an innovative approach that aligns with my own market observations.

As a crypto investor, I’ve noticed a surge in bullish performances by various altcoins lately, which has led many analysts to suggest that we might be in the midst of an altseason. This trend seems to be gathering momentum, hinting at a significant price surge in the upcoming weeks. Notably, renowned analyst EGRAG Crypto has added his voice to the conversation about this highly anticipated altseason, predicting a potential influx of $627 billion into the market.

Bitcoin Dominance To Crash By 33% As Altcoins Fly – Analyst

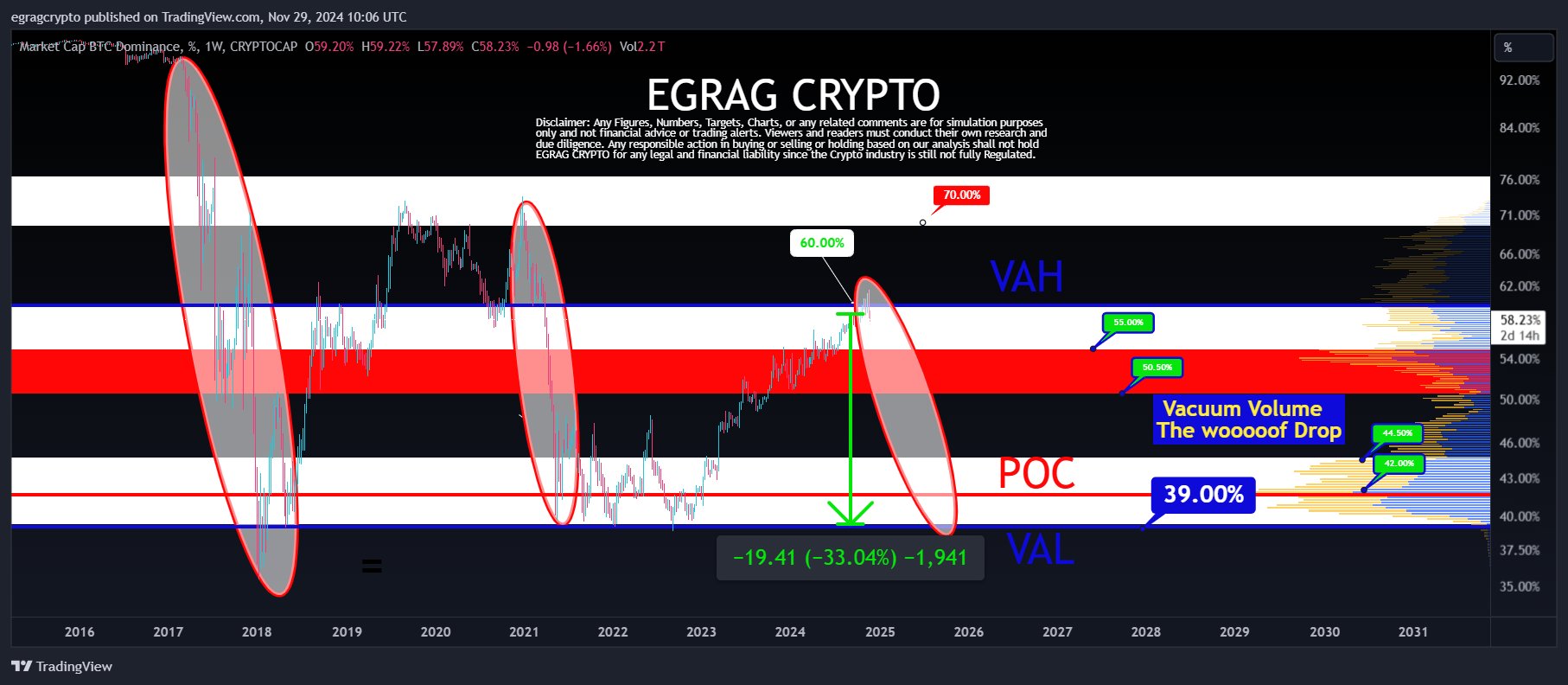

Last Friday’s post by EGRAG Crypto offered insightful predictions about the growth potential of altcoins during the upcoming altseason. The analyst used the Volume Range Visible Profile (VRVP), a tool that analyzes trading volume, to examine Bitcoin’s trading activity across various dominance levels and identify crucial support and resistance points.

In simpler terms, an alt season refers to a time when alternative coins (altcoins) experience substantial growth in value compared to Bitcoin. This period is marked by a decrease in Bitcoin’s dominance in the market as investors shift their focus and resources towards other digital currencies.

According to the weekly chart displayed, EGRAG Crypto indicates that Bitcoin’s influence is trending beneath its Value Area High (VAH), representing the upper limit where significant trading occurs and now serving as a potential resistance area.

This advancement is particularly advantageous for altcoins because it indicates growing selling activity on Bitcoin, potentially lessening its influence over other investments. Notably, EGRAG Crypto also emphasizes the Value Area Low (VAL) – the lower boundary of intense trading activity. This area could function as a support level and potential target point for Bitcoin’s dominance during this altcoin season.

Based on the analyst’s findings, a 33.04% decrease in Bitcoin Dominance is expected if it hits its Value Area Low. Given that Bitcoin’s current market cap stands at around $1.91 trillion, this could potentially lead to an influx of approximately $627 billion towards altcoins in the coming weeks.

Furthermore, EGRAG Crypto predicts that the dominance of Bitcoin will reach a significant control point (POC) of 42% during this altseason. This POC is an important price/dominance level with the highest trading activity. A drop below this level suggests a clear change in market focus from Bitcoin to other cryptocurrencies.

Ethereum Remains Key To Altseason Charge

According to analyst Michael van de Poppe’s analysis, the impressive price gains of alternative cryptocurrencies over the past month have been noted. Furthermore, if Ethereum (ETH), the largest altcoin by market cap, manages to close above 0.035 on its ETH/BTC chart for November, it could indicate a robust bullish trend for alternative coins in December.

Currently, as I’m typing this, the overall value of altcoins stands at approximately $1.39 trillion, making up about 41.4% of the entire cryptocurrency market capitalization.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-30 21:04